Region:Middle East

Author(s):Rebecca

Product Code:KRAB7371

Pages:87

Published On:October 2025

Market.png)

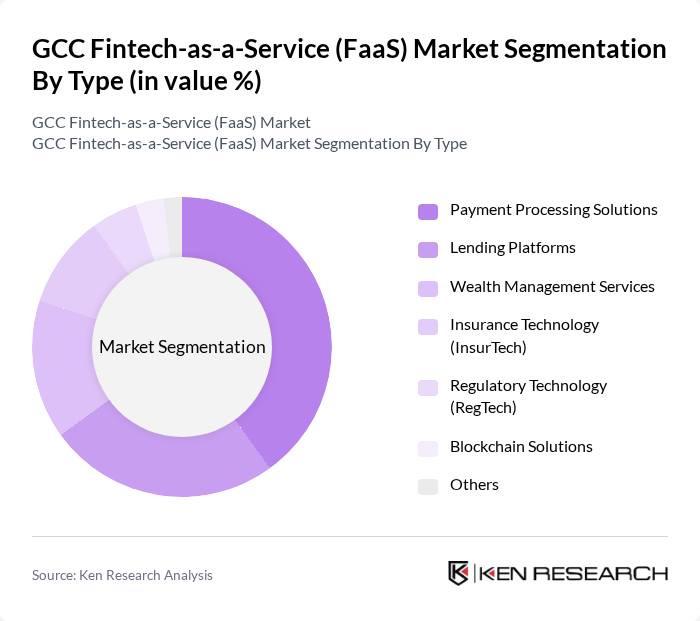

By Type:The FaaS market is segmented into various types, including Payment Processing Solutions, Lending Platforms, Wealth Management Services, Insurance Technology (InsurTech), Regulatory Technology (RegTech), Blockchain Solutions, and Others. Among these, Payment Processing Solutions are leading the market due to the increasing demand for seamless and secure transaction methods. The rise of e-commerce and digital wallets has significantly contributed to the growth of this segment, as businesses seek efficient payment solutions to enhance customer experience.

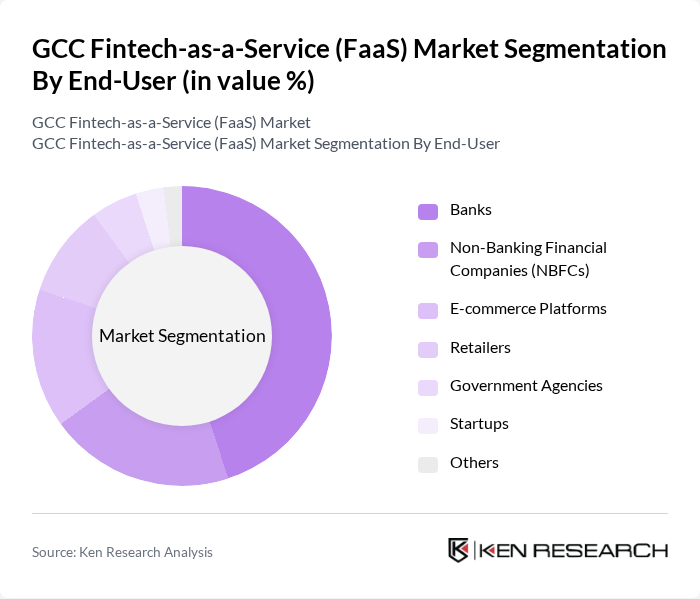

By End-User:The end-user segmentation includes Banks, Non-Banking Financial Companies (NBFCs), E-commerce Platforms, Retailers, Government Agencies, Startups, and Others. Banks are the leading end-users of FaaS solutions, as they increasingly adopt fintech services to enhance operational efficiency and customer engagement. The growing trend of digital banking and the need for innovative financial products are driving banks to leverage FaaS offerings.

The GCC Fintech-as-a-Service (FaaS) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fawry for Banking and Payment Technology, PayTabs, Tabby, Souqalmal, NymCard, YAP, Raseed, ZoodPay, Fintech Galaxy, Qpay, Mamo Pay, Sarwa, Raqamyah, Bitoasis, Deriv contribute to innovation, geographic expansion, and service delivery in this space.

The GCC Fintech-as-a-Service market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As digital payment solutions become increasingly integrated into daily life, the demand for innovative fintech services will rise. Additionally, the ongoing collaboration between fintech firms and traditional banks is expected to enhance service offerings. With a focus on regulatory compliance and cybersecurity, the market is likely to witness a shift towards more secure and user-friendly solutions, fostering greater consumer trust and adoption.

| Segment | Sub-Segments |

|---|---|

| By Type | Payment Processing Solutions Lending Platforms Wealth Management Services Insurance Technology (InsurTech) Regulatory Technology (RegTech) Blockchain Solutions Others |

| By End-User | Banks Non-Banking Financial Companies (NBFCs) E-commerce Platforms Retailers Government Agencies Startups Others |

| By Business Model | Subscription-Based Models Transaction-Based Models Freemium Models Commission-Based Models Others |

| By Service Type | API Services White-Label Solutions Custom Development Services Consulting Services Others |

| By Deployment Model | Cloud-Based Solutions On-Premises Solutions Hybrid Solutions Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Individual Consumers Others |

| By Geographic Focus | GCC Countries International Markets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector FaaS Adoption | 150 | Chief Technology Officers, Digital Transformation Leads |

| Insurance Industry FaaS Solutions | 100 | Product Managers, Compliance Officers |

| Payment Processing Services | 120 | Operations Managers, Financial Analysts |

| Regulatory Compliance Tools | 80 | Risk Management Officers, Legal Advisors |

| Data Analytics in Fintech | 90 | Data Scientists, Business Intelligence Managers |

The GCC Fintech-as-a-Service (FaaS) market is valued at approximately USD 7.5 billion, driven by the increasing adoption of digital payment solutions and the rise of e-commerce, alongside supportive regulatory frameworks and technological investments.