Region:Middle East

Author(s):Dev

Product Code:KRAB8193

Pages:95

Published On:October 2025

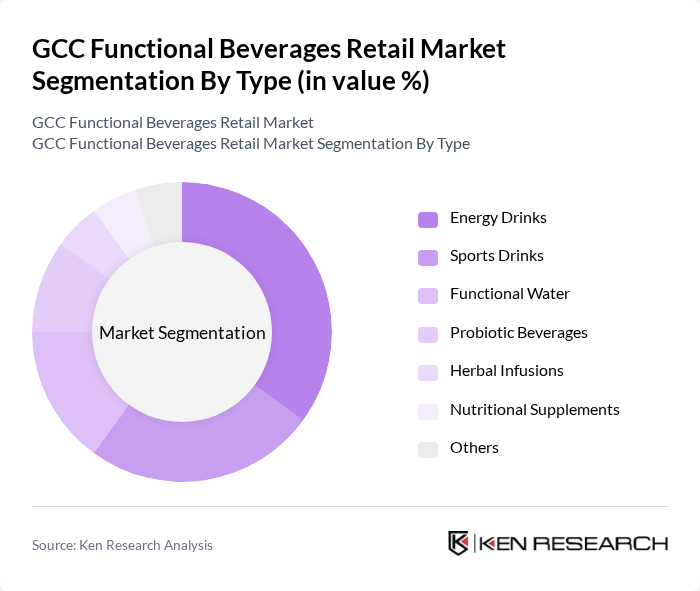

By Type:The market is segmented into various types of functional beverages, including energy drinks, sports drinks, functional water, probiotic beverages, herbal infusions, nutritional supplements, and others. Among these, energy drinks have emerged as a leading segment due to their popularity among young adults and athletes seeking quick energy boosts. The increasing trend of fitness and active lifestyles has further propelled the demand for energy drinks, making them a dominant force in the market.

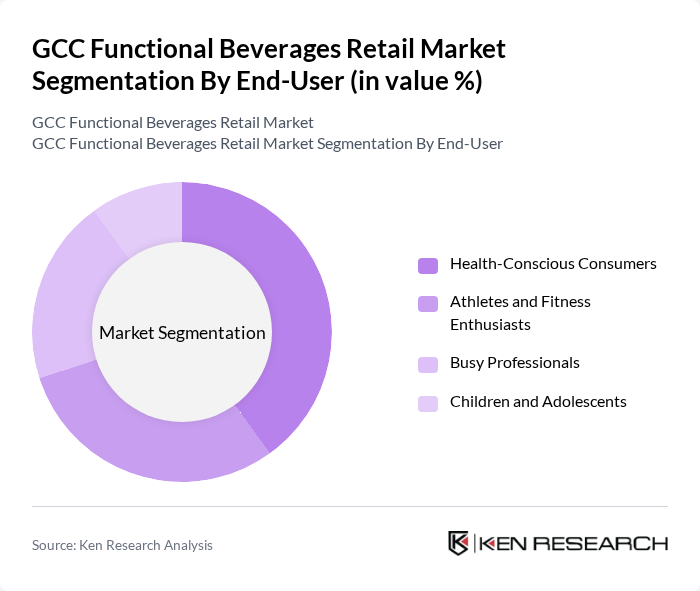

By End-User:The end-user segmentation includes health-conscious consumers, athletes and fitness enthusiasts, busy professionals, and children and adolescents. Health-conscious consumers are driving the market as they increasingly seek beverages that offer health benefits, such as improved hydration and energy. This segment's growth is fueled by rising awareness of health and wellness, leading to a higher demand for functional beverages tailored to their needs.

The GCC Functional Beverages Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A., PepsiCo, Inc., The Coca-Cola Company, Red Bull GmbH, Danone S.A., Monster Beverage Corporation, Suntory Holdings Limited, Keurig Dr Pepper Inc., Unilever PLC, FrieslandCampina, The Kraft Heinz Company, Glanbia PLC, Herbalife Nutrition Ltd., Otsuka Pharmaceutical Co., Ltd., Amway Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC functional beverages market appears promising, driven by ongoing trends in health and wellness. As consumers increasingly seek products that align with their health goals, the market is likely to see a surge in innovative offerings. Additionally, the integration of technology in product development, such as personalized nutrition solutions, will further enhance consumer engagement and satisfaction, fostering a dynamic market environment that adapts to evolving consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Energy Drinks Sports Drinks Functional Water Probiotic Beverages Herbal Infusions Nutritional Supplements Others |

| By End-User | Health-Conscious Consumers Athletes and Fitness Enthusiasts Busy Professionals Children and Adolescents |

| By Distribution Channel | Supermarkets and Hypermarkets Convenience Stores Online Retail Health and Wellness Stores |

| By Packaging Type | Bottles Cans Tetra Packs |

| By Price Range | Premium Mid-Range Budget |

| By Ingredient Type | Natural Ingredients Artificial Ingredients |

| By Region | UAE Saudi Arabia Qatar Kuwait Oman Bahrain Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Functional Beverage Retailers | 150 | Store Managers, Category Buyers |

| Health and Wellness Consumers | 200 | Health-Conscious Shoppers, Fitness Enthusiasts |

| Manufacturers of Functional Beverages | 100 | Product Development Leads, Marketing Managers |

| Nutritionists and Health Experts | 75 | Registered Dietitians, Health Coaches |

| Retail Market Analysts | 50 | Market Research Analysts, Business Development Managers |

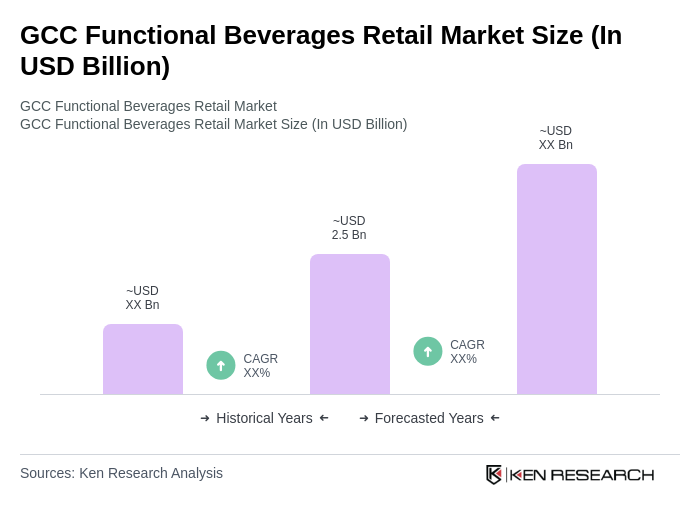

The GCC Functional Beverages Retail Market is valued at approximately USD 2.5 billion, reflecting a significant growth trend driven by increasing health consciousness, rising disposable incomes, and a growing interest in fitness and wellness among consumers.