Region:Middle East

Author(s):Rebecca

Product Code:KRAD8204

Pages:96

Published On:December 2025

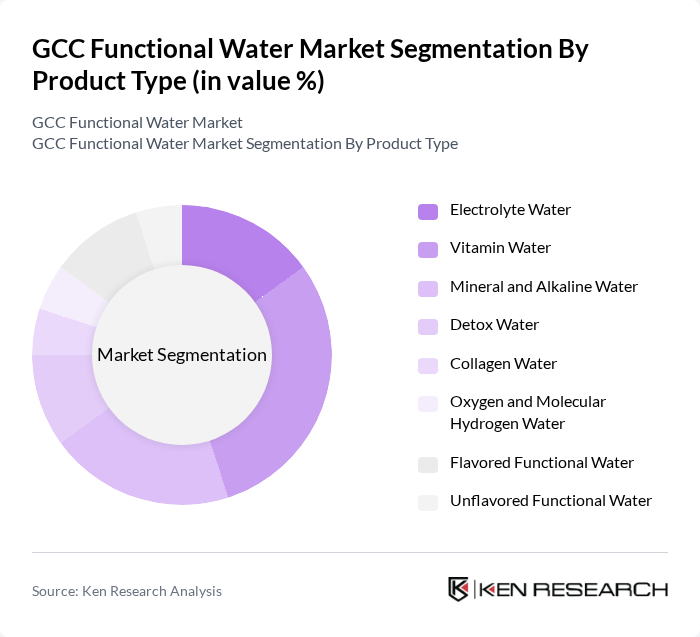

By Product Type:The product type segmentation includes various categories such as Electrolyte Water, Vitamin Water, Mineral and Alkaline Water, Detox Water, Collagen Water, Oxygen and Molecular Hydrogen Water, Flavored Functional Water, and Unflavored Functional Water. Among these, Vitamin Water has emerged as a leading sub-segment due to its appeal to health-conscious consumers seeking added nutritional benefits. The trend towards personalized nutrition and functional beverages has significantly boosted the demand for Vitamin Water, making it a preferred choice in the GCC region.

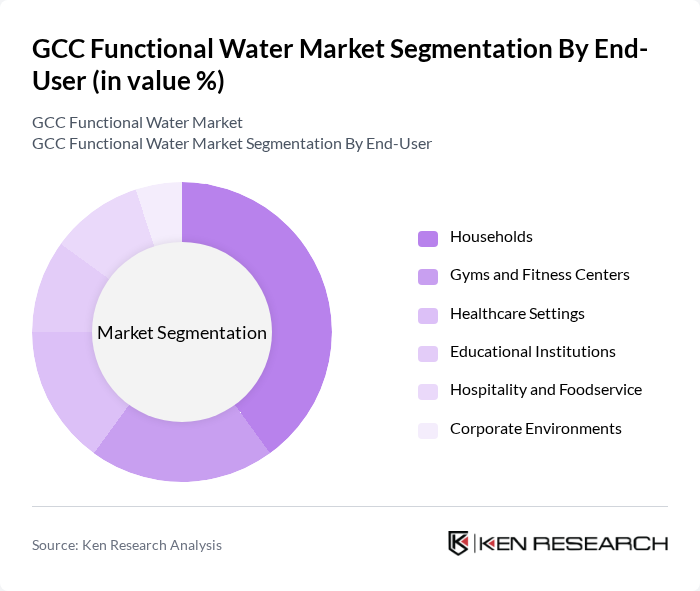

By End-User:The end-user segmentation encompasses various categories including Households, Gyms and Fitness Centers, Healthcare Settings, Educational Institutions, Hospitality and Foodservice, and Corporate Environments. Households represent the largest segment, driven by the increasing trend of health and wellness among families. The growing awareness of hydration's importance and the convenience of functional water products have made them a staple in many households across the GCC region.

The GCC Functional Water Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé Waters, PepsiCo (Aquafina, Tropicana), The Coca-Cola Company (Smartwater, Dasani), Danone (Evian, Volvic), Suntory Beverage & Food, Masafi (GCC-based), Nova Water (GCC-based), Essentia Water, Hint Water, Core Hydration, Fiji Water, Voss Water, LaCroix, Al Ain Water (GCC-based), Oasis Water (GCC-based) contribute to innovation, geographic expansion, and service delivery in this space.

The GCC functional water market is poised for continued growth, driven by evolving consumer preferences towards health and wellness. As more consumers prioritize hydration and functional benefits, brands are likely to innovate with new flavors and formulations. Additionally, the increasing integration of technology in marketing and distribution will enhance consumer engagement. Companies that adapt to these trends and invest in sustainable practices will likely capture a larger market share, positioning themselves favorably in the competitive landscape of functional beverages.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Electrolyte Water Vitamin Water Mineral and Alkaline Water Detox Water Collagen Water Oxygen and Molecular Hydrogen Water Flavored Functional Water Unflavored Functional Water |

| By End-User | Households Gyms and Fitness Centers Healthcare Settings Educational Institutions Hospitality and Foodservice Corporate Environments |

| By Distribution Channel | Supermarkets and Hypermarkets Specialty and Fitness Outlets E-commerce Platforms Convenience Stores Direct Procurement Home and Office Delivery |

| By Packaging Type | PET Bottles Cans Tetra Packs Pouches Glass Bottles |

| By Pack Size | Single Serve (250-500ml) Standard (500-750ml) Family Pack (1-2L) Bulk/Institutional (5L+) |

| By Region | Saudi Arabia United Arab Emirates Kuwait Qatar Oman Bahrain |

| By Consumer Demographics | Age Group (18-24, 25-34, 35-44, 45+) Gender Income Level (Low, Middle, High) Lifestyle Preferences (Active, Health-Conscious, Premium) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Water Management | 120 | Agronomists, Farm Managers |

| Industrial Water Treatment Solutions | 100 | Plant Managers, Environmental Compliance Officers |

| Residential Functional Water Products | 90 | Homeowners, Facility Managers |

| Healthcare Water Purification Systems | 80 | Healthcare Administrators, Facility Engineers |

| Water Quality Monitoring Technologies | 110 | Environmental Scientists, Quality Control Managers |

The GCC Functional Water Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing health consciousness, rising disposable incomes, and a shift towards functional beverages that offer health benefits beyond mere hydration.