Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7200

Pages:88

Published On:December 2025

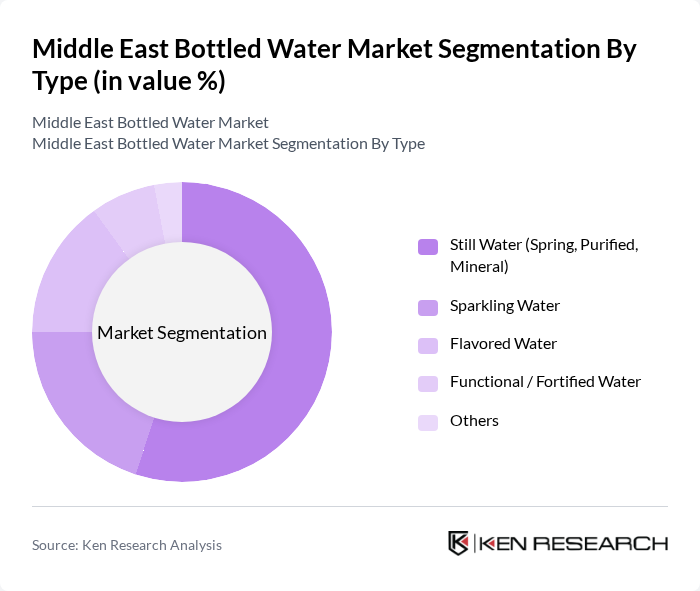

By Type:The bottled water market is segmented into various types, including Still Water (Spring, Purified, Mineral), Sparkling Water, Flavored Water, Functional / Fortified Water, and Others. Among these, Still Water, particularly purified and mineral varieties, dominates the market due to consumer preference for reliable, everyday hydration options and its wide availability across retail and home-delivery channels. The trend towards health and wellness has led to increased demand for functional and flavored waters, including products with added vitamins, minerals, and light flavors, appealing to younger demographics and active consumers seeking variety, low-calorie alternatives, and perceived added benefits.

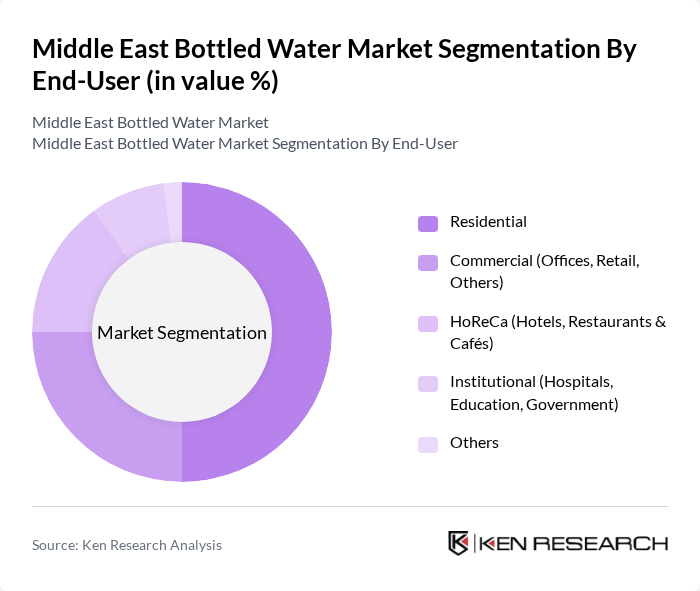

By End-User:The market is segmented by end-user into Residential, Commercial (Offices, Retail, Others), HoReCa (Hotels, Restaurants & Cafés), Institutional (Hospitals, Education, Government), and Others. The Residential segment leads the market, driven by the increasing trend of bulk and home delivery services, subscription-based water delivery models, and the growing awareness of health benefits associated with safe packaged drinking water. The HoReCa segment is also significant, fueled by the booming tourism industry, expanding hospitality infrastructure, and the rising number of dining establishments and cafés that rely on branded bottled water offerings to meet visitor expectations.

The Middle East Bottled Water Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé Waters (Nestlé Pure Life, Perrier, S.Pellegrino), The Coca-Cola Company (Aquafina, Arwa, Dasani), PepsiCo, Inc. (Aquafina, Ballygowan, Local Brands), Agthia Group PJSC (Al Ain Water), Masafi Co. LLC (Masafi), National Food Products Company LLC (Oasis Water), Almarai Company (Bottled Water & Beverages), Danone S.A. (Evian, Volvic, Local Joint Ventures), Health Water Bottling Co. Ltd. (Nova Water, Saudi Arabia), Mai Dubai LLC (Mai Dubai), Rayyan Mineral Water Company (Rayyan, Qatar), Hana Water Company (Hana Water, Saudi Arabia), Berain Water (Berain, Saudi Arabia), Maiyas Water (Regional Brand), Other Notable Regional and Private Label Bottled Water Brands contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East bottled water market is poised for continued growth, driven by evolving consumer preferences and increasing health awareness. As urbanization progresses, the demand for convenient hydration solutions will likely rise, further boosting sales. Additionally, the market is expected to adapt to environmental concerns by investing in sustainable practices and eco-friendly packaging. Companies that innovate and align with health trends will be well-positioned to capture emerging opportunities in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Still Water (Spring, Purified, Mineral) Sparkling Water Flavored Water Functional / Fortified Water Others |

| By End-User | Residential Commercial (Offices, Retail, Others) HoReCa (Hotels, Restaurants & Cafés) Institutional (Hospitals, Education, Government) Others |

| By Packaging Type | PET Plastic Bottles Glass Bottles Bulk Containers (5 Gallon / Large Refillable) Cans and Cartons (Tetra Packs & Others) Others |

| By Distribution Channel | Supermarkets / Hypermarkets Convenience & Grocery Stores On-Trade (HoReCa, Catering) Online Retail & Subscription Delivery Vending Machines Others |

| By Region | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain Egypt Jordan Other Middle East Countries |

| By Price Range | Economy / Mass Market Mid-Range Premium Ultra-Premium Others |

| By Brand Positioning | International Brands Regional / Local Brands Private Labels / Store Brands Niche & Premium Lifestyle Brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Bottled Water | 150 | General Consumers, Health-Conscious Individuals |

| Retail Distribution Insights | 100 | Retail Managers, Category Buyers |

| Manufacturing Process Feedback | 80 | Production Managers, Quality Control Experts |

| Environmental Impact Assessments | 70 | Sustainability Officers, Environmental Consultants |

| Market Entry Strategies | 60 | Business Development Managers, Market Analysts |

The Middle East Bottled Water Market is valued at approximately USD 12 billion, reflecting a significant increase in bottled water consumption driven by health consciousness, rising disposable incomes, and urbanization, particularly in countries like Saudi Arabia and the UAE.