Region:Asia

Author(s):Dev

Product Code:KRAC2696

Pages:93

Published On:October 2025

By Type:The flavored water market can be segmented into various types, including Still Flavored Water, Sparkling Flavored Water, Functional Flavored Water (e.g., vitamin, mineral, alkaline), Organic Flavored Water, Sugar-free Flavored Water, and Others (e.g., oxygenated, herbal-infused). Each type caters to different consumer preferences and health trends, with functional and organic segments gaining traction due to rising demand for added health benefits and natural ingredients. Sparkling and sugar-free options are also expanding rapidly, reflecting consumer interest in low-calorie and refreshing alternatives .

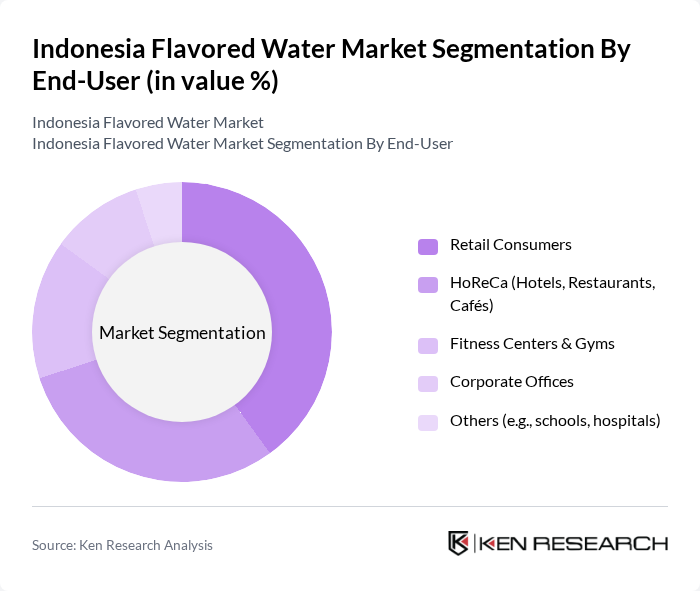

By End-User:The market can also be segmented based on end-users, which include Retail Consumers, HoReCa (Hotels, Restaurants, Cafés), Fitness Centers & Gyms, Corporate Offices, and Others (e.g., schools, hospitals). Each segment reflects different consumption patterns and preferences. Retail consumers represent the largest share, driven by individual purchases in supermarkets and convenience stores. HoReCa and fitness centers are rapidly expanding segments, as flavored water is increasingly offered as a premium hydration option in hospitality and wellness venues .

The Indonesia Flavored Water Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aqua (Danone Indonesia), Le Minerale (PT Tirta Fresindo Jaya), Nestlé Waters Indonesia, Coca-Cola Europacific Partners Indonesia (formerly Coca-Cola Amatil Indonesia), Sinar Sosro (PT Sinar Sosro), Ades (Coca-Cola Indonesia), Pristine 8.6+ (PT Super Wahana Tehno), VIT (PT Varia Industri Tirta), Nestlé Pure Life Indonesia, SuperO2 (PT Sariguna Primatirta), Tropicana Slim (PT Nutrifood Indonesia), Cleo Pure Water (PT Sariguna Primatirta), Mizu (PT Mizu Resources International), Waterplus (PT Waterplus Indonesia), Flavoured Water Co. (PT Flavoured Water Indonesia) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the flavored water market in Indonesia appears promising, driven by evolving consumer preferences and innovative product offerings. As health consciousness continues to rise, brands are likely to introduce more functional beverages that cater to specific health needs. Additionally, the growth of e-commerce platforms is expected to enhance distribution channels, making flavored water more accessible. Companies that adapt to these trends and invest in marketing strategies will likely capture a larger share of the expanding market in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Still Flavored Water Sparkling Flavored Water Functional Flavored Water (e.g., vitamin, mineral, alkaline) Organic Flavored Water Sugar-free Flavored Water Others (e.g., oxygenated, herbal-infused) |

| By End-User | Retail Consumers HoReCa (Hotels, Restaurants, Cafés) Fitness Centers & Gyms Corporate Offices Others (e.g., schools, hospitals) |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Health Food Stores Others (e.g., direct sales, vending machines) |

| By Flavor Profile | Citrus (lemon, lime, orange) Berry (strawberry, blueberry, raspberry) Tropical (mango, pineapple, coconut) Herbal (mint, lemongrass, basil) Others (e.g., mixed fruit, floral) |

| By Packaging Type | Plastic Bottles (PET) Glass Bottles Cans Tetra Packs Others (e.g., pouches) |

| By Price Range | Premium Mid-range Economy |

| By Region | Java Sumatra Bali Kalimantan Sulawesi Others (e.g., Papua, Nusa Tenggara) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Flavored Water | 120 | Health-conscious Consumers, Young Adults |

| Retail Distribution Insights | 90 | Retail Managers, Beverage Category Buyers |

| Manufacturing and Supply Chain Perspectives | 60 | Production Managers, Supply Chain Analysts |

| Market Trends and Innovations | 50 | Product Development Managers, Marketing Executives |

| Health and Wellness Influencers | 40 | Nutritionists, Fitness Trainers |

The Indonesia Flavored Water Market is valued at approximately USD 320 million, reflecting a growing trend towards healthier beverage options and increased health consciousness among consumers.