Region:Middle East

Author(s):Rebecca

Product Code:KRAD2703

Pages:90

Published On:November 2025

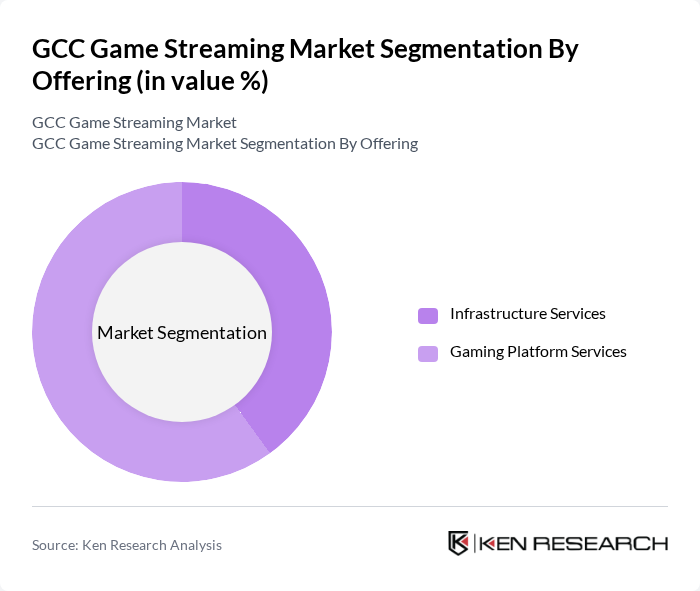

By Offering:This segmentation includes Infrastructure Services and Gaming Platform Services. Infrastructure Services encompass the underlying technology and support systems that enable game streaming, such as cloud servers, edge computing, and network management. Gaming Platform Services refer to the platforms that host and deliver games to users, including content delivery, user interface, and community features.

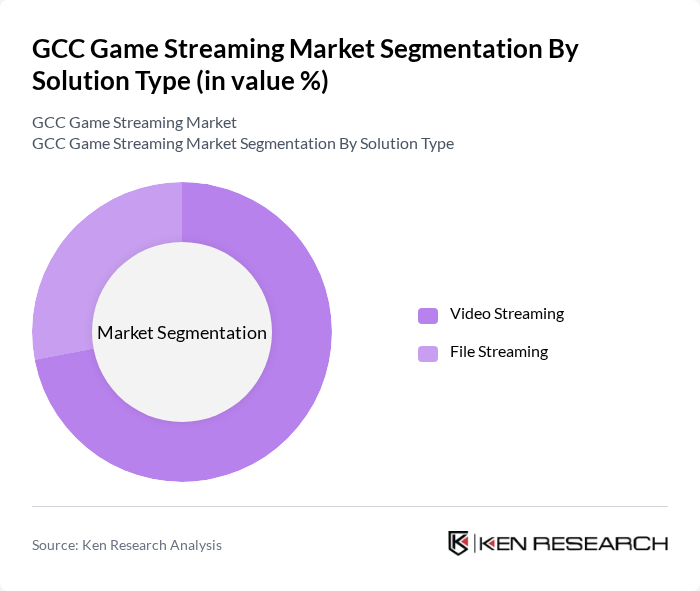

By Solution Type:This segmentation includes Video Streaming and File Streaming. Video Streaming is the primary method for delivering games in real-time, allowing users to play instantly without downloads, while File Streaming involves downloading game files for local play, supporting hybrid access models.

The GCC Game Streaming Market is characterized by a dynamic mix of regional and international players. Leading participants such as Twitch, YouTube Gaming, Facebook Gaming, Microsoft (Xbox Cloud Gaming), Sony (PlayStation Plus Premium), NVIDIA (GeForce NOW), Google (Stadia), Discord, Steam (Valve Corporation), Starzplay (MENA Cloud Gaming), Etisalat (Arena Esports, UAE), STC Play (Saudi Telecom Company), Vortex, Rainway, Shadow contribute to innovation, geographic expansion, and service delivery in this space.

The GCC game streaming market is poised for substantial growth, driven by technological advancements and evolving consumer preferences. As internet infrastructure improves and mobile gaming continues to rise, platforms will increasingly focus on enhancing user experiences through innovative features. The integration of social elements and cross-platform capabilities will further engage users. Additionally, the growing interest in esports will likely lead to more partnerships and content creation, positioning the region as a key player in the global gaming landscape.

| Segment | Sub-Segments |

|---|---|

| By Offering | Infrastructure Services Gaming Platform Services |

| By Solution Type | Video Streaming File Streaming |

| By Gamer Type | Casual Gamers Avid Gamers Hard-Core/Professional Gamers Lifestyle Gamers |

| By Device | Smartphones Tablets Gaming Consoles Personal Computers and Laptops Smart Televisions Head-Mounted Displays |

| By Deployment | Public Cloud Hybrid Cloud Private Cloud |

| By Revenue Model | Subscription-Based Ad-Supported Pay-Per-View Others |

| By Region | UAE Saudi Arabia Qatar Kuwait Bahrain Oman |

| By User Demographics | Age Group Gender Income Level Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Casual Gamers | 100 | Individuals aged 18-35, frequent mobile game users |

| Professional Streamers | 60 | Content creators with established streaming channels |

| Game Developers | 40 | Founders and lead developers from indie and established studios |

| Streaming Platform Users | 80 | Subscribers of major game streaming services in the GCC |

| Gaming Community Leaders | 40 | Moderators and influencers from online gaming forums and communities |

The GCC Game Streaming Market is valued at approximately USD 135 million, driven by factors such as high-speed internet penetration, mobile gaming growth, and the increasing popularity of esports in the region.