Region:Middle East

Author(s):Rebecca

Product Code:KRAB7782

Pages:81

Published On:October 2025

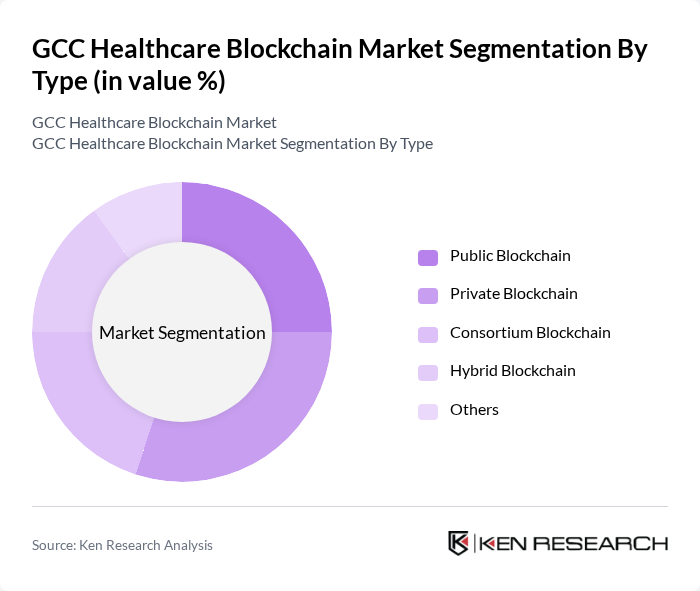

By Type:The market is segmented into various types of blockchain technologies, including Public Blockchain, Private Blockchain, Consortium Blockchain, Hybrid Blockchain, and Others. Each type serves different purposes and offers unique advantages, catering to the diverse needs of healthcare stakeholders.

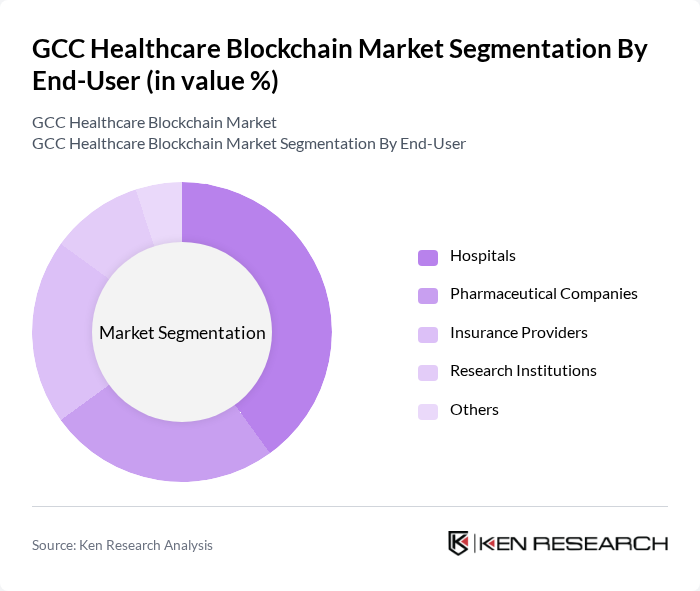

By End-User:The end-user segmentation includes Hospitals, Pharmaceutical Companies, Insurance Providers, Research Institutions, and Others. Each segment plays a crucial role in the adoption and implementation of blockchain technology in healthcare, driven by specific needs and operational requirements.

The GCC Healthcare Blockchain Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Microsoft Corporation, Chronicled, Inc., Guardtime, Gem Health, Hashed Health, Solve.Care, Ripe Technology, Medicalchain, Factom, BurstIQ, SimplyVital Health, Chronicled, Akiri, Healthereum contribute to innovation, geographic expansion, and service delivery in this space.

The GCC healthcare blockchain market is poised for significant transformation as technological advancements and regulatory frameworks evolve. With increasing investments in digital health and a focus on patient-centric care, blockchain solutions are expected to gain traction. The integration of artificial intelligence with blockchain will enhance data analytics capabilities, while government initiatives will further support the adoption of innovative healthcare technologies. As the market matures, collaboration between healthcare providers and technology firms will be crucial for overcoming existing challenges and unlocking new opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Public Blockchain Private Blockchain Consortium Blockchain Hybrid Blockchain Others |

| By End-User | Hospitals Pharmaceutical Companies Insurance Providers Research Institutions Others |

| By Application | Supply Chain Management Patient Data Management Clinical Trials Billing and Payments Others |

| By Component | Software Hardware Services |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Deployment Mode | On-Premises Cloud-Based |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Blockchain Integration | 100 | IT Directors, Chief Information Officers |

| Insurance Claims Processing | 80 | Claims Managers, Underwriting Officers |

| Pharmaceutical Supply Chain | 70 | Supply Chain Managers, Compliance Officers |

| Patient Data Management | 90 | Data Protection Officers, Healthcare Administrators |

| Telemedicine Solutions | 75 | Telehealth Coordinators, IT Support Staff |

The GCC Healthcare Blockchain Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the need for secure patient data management, interoperability among healthcare systems, and transparency in healthcare transactions.