Region:Middle East

Author(s):Shubham

Product Code:KRAD5448

Pages:95

Published On:December 2025

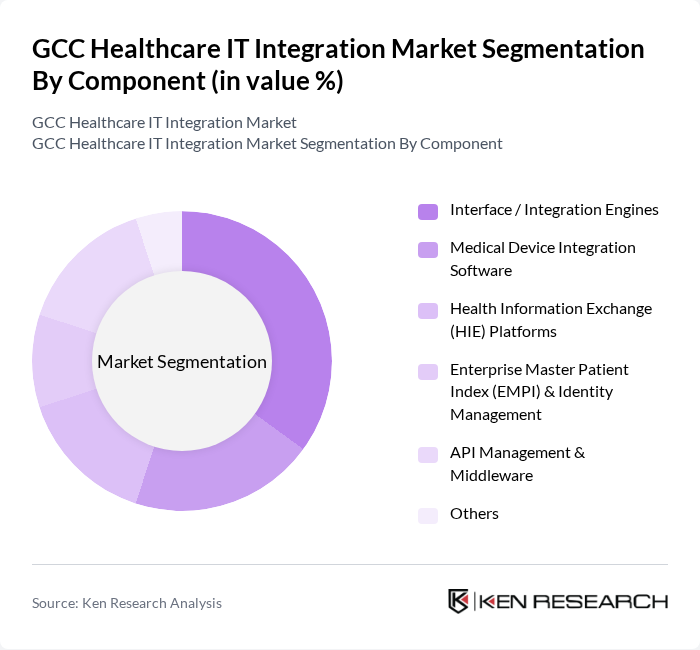

By Component:The components of the market include various technologies and software solutions that facilitate healthcare IT integration. The subsegments are Interface / Integration Engines, Medical Device Integration Software, Health Information Exchange (HIE) Platforms, Enterprise Master Patient Index (EMPI) & Identity Management, API Management & Middleware, and Others. Among these, Interface / Integration Engines are leading due to their critical role in enabling seamless communication between disparate healthcare systems, which is essential for effective patient care and operational efficiency.

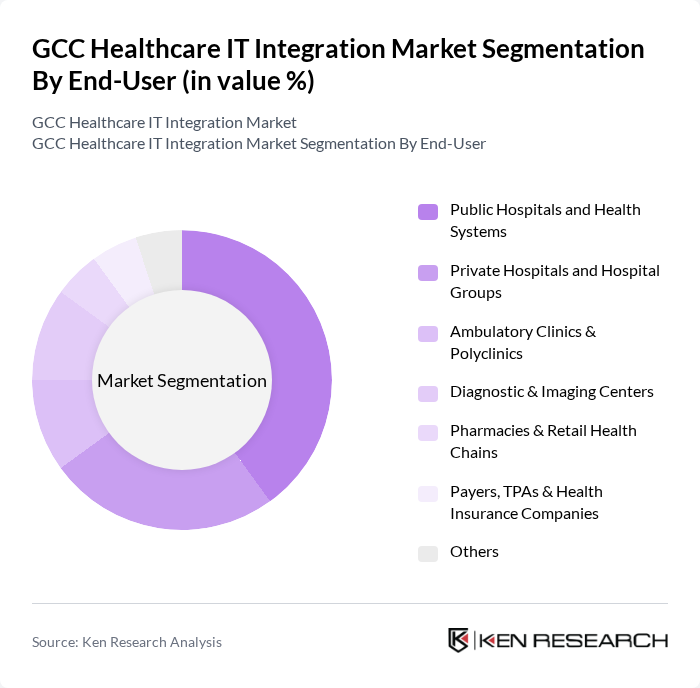

By End-User:The end-users of the market include various healthcare providers and organizations that utilize IT integration solutions. The subsegments are Public Hospitals and Health Systems, Private Hospitals and Hospital Groups, Ambulatory Clinics & Polyclinics, Diagnostic & Imaging Centers, Pharmacies & Retail Health Chains, Payers, TPAs & Health Insurance Companies, and Others. Public Hospitals and Health Systems dominate the market due to their large-scale operations and the necessity for integrated systems to manage patient data effectively across multiple departments.

The GCC Healthcare IT Integration Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oracle Health (including former Cerner), InterSystems Corporation, Philips Healthcare, Siemens Healthineers, GE HealthCare, IBM (including IBM Watson Health legacy solutions), Infosys Limited, Tata Consultancy Services (TCS), Wipro Limited, Cognizant Technology Solutions, DXC Technology, Dedalus Group, Orion Health, Cerner Middle East (Oracle Health Middle East), Etisalat Digital (UAE) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC healthcare IT integration market appears promising, driven by technological advancements and increasing healthcare demands. The integration of AI and machine learning is expected to enhance data analytics capabilities, leading to more informed decision-making. Additionally, the expansion of telehealth services will further necessitate robust IT integration, allowing for improved patient access and care continuity. As these trends evolve, the market is likely to witness significant growth and innovation in future.

| Segment | Sub-Segments |

|---|---|

| By Component | Interface / Integration Engines Medical Device Integration Software Health Information Exchange (HIE) Platforms Enterprise Master Patient Index (EMPI) & Identity Management API Management & Middleware Others |

| By End-User | Public Hospitals and Health Systems Private Hospitals and Hospital Groups Ambulatory Clinics & Polyclinics Diagnostic & Imaging Centers Pharmacies & Retail Health Chains Payers, TPAs & Health Insurance Companies Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Hosted / Managed Services |

| By Application | EHR / EMR Integration Health Information Exchange & Regional Connectivity Revenue Cycle & Claims Management Integration Population Health Management & Analytics Clinical Decision Support & Care Coordination Telehealth & Remote Patient Monitoring Integration Others |

| By Country | Saudi Arabia UAE Qatar Kuwait Oman Bahrain |

| By Integration Technology | HL7 v2 / v3 FHIR (Fast Healthcare Interoperability Resources) DICOM & Imaging Integration Standards API-Based & Microservices Integration Others |

| By Service Type | Consulting & Integration Design Services Implementation & Interface Development Services Managed Services & 24/7 Monitoring Support, Training & Maintenance Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital IT Infrastructure | 120 | IT Directors, Chief Information Officers |

| Telehealth Solutions Adoption | 100 | Telehealth Coordinators, Healthcare Administrators |

| Healthcare Data Analytics | 80 | Data Analysts, Health Informatics Specialists |

| Electronic Health Records Implementation | 100 | Clinical Managers, IT Project Managers |

| Healthcare IT Vendor Partnerships | 90 | Procurement Officers, Vendor Relationship Managers |

The GCC Healthcare IT Integration Market is valued at approximately USD 2.3 billion, reflecting significant growth driven by the adoption of digital health solutions, interoperability needs, and government initiatives aimed at enhancing healthcare delivery through technology.