Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7718

Pages:85

Published On:October 2025

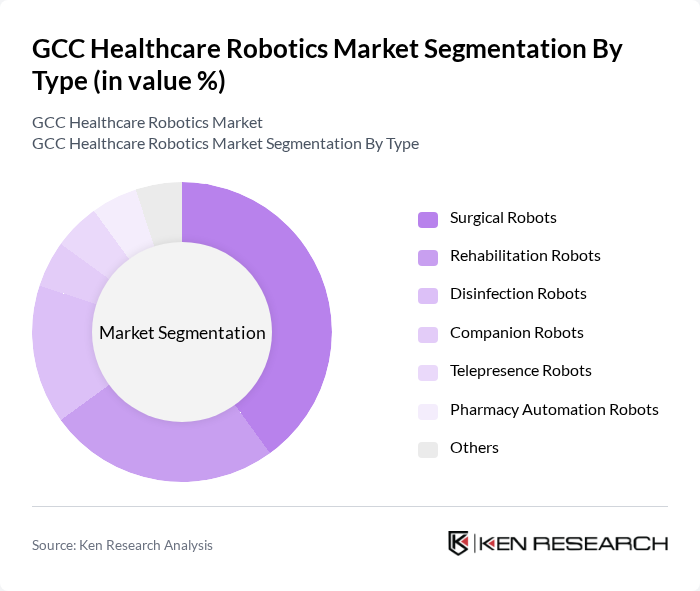

By Type:The market is segmented into various types of healthcare robotics, including Surgical Robots, Rehabilitation Robots, Disinfection Robots, Companion Robots, Telepresence Robots, Pharmacy Automation Robots, and Others. Among these, Surgical Robots are leading the market due to their precision and effectiveness in complex surgical procedures, which enhance patient safety and recovery times. Rehabilitation Robots are also gaining traction as they assist in patient recovery and mobility, reflecting a growing trend towards personalized healthcare solutions.

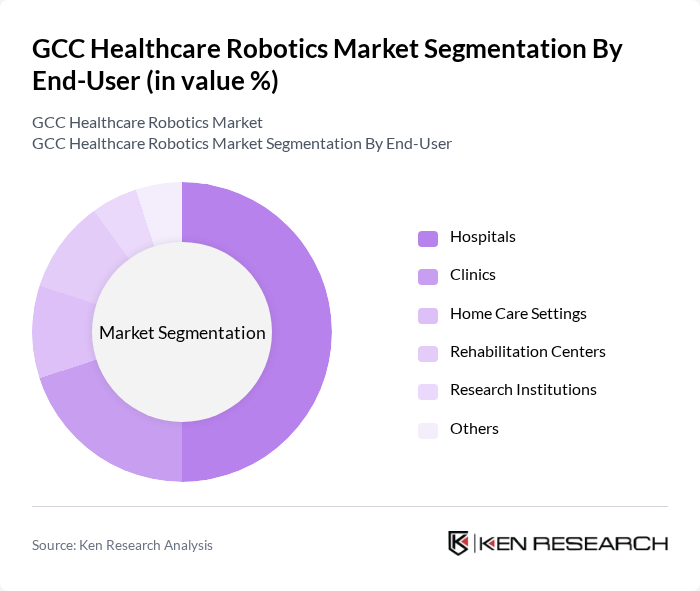

By End-User:The end-user segmentation includes Hospitals, Clinics, Home Care Settings, Rehabilitation Centers, Research Institutions, and Others. Hospitals are the dominant end-user segment, driven by the increasing adoption of robotic systems for surgical procedures and patient management. Clinics are also emerging as significant users of healthcare robotics, particularly for telehealth and rehabilitation applications, reflecting a shift towards more accessible healthcare solutions.

The GCC Healthcare Robotics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Intuitive Surgical, Inc., Stryker Corporation, Medtronic plc, Siemens Healthineers, Accuray Incorporated, Omnicare, Inc., KUKA AG, Cyberdyne, Inc., Aethon, Inc., Fetch Robotics, Inc., Diligent Robotics, Inc., Rethink Robotics, Inc., Blue Ocean Robotics, Airobotics Ltd., SoftBank Robotics Corp. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC healthcare robotics market appears promising, driven by ongoing technological advancements and increasing healthcare investments. As the region's healthcare systems continue to modernize, the integration of robotics is expected to enhance operational efficiency and patient care. Furthermore, the growing acceptance of telemedicine and remote surgical solutions will likely accelerate the adoption of robotics, positioning the GCC as a leader in healthcare innovation in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Surgical Robots Rehabilitation Robots Disinfection Robots Companion Robots Telepresence Robots Pharmacy Automation Robots Others |

| By End-User | Hospitals Clinics Home Care Settings Rehabilitation Centers Research Institutions Others |

| By Application | Surgery Patient Care Rehabilitation Disinfection Logistics Others |

| By Component | Hardware Software Services |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Retail Wholesale |

| By Price Range | Low-End Mid-Range High-End |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Surgical Robotics Adoption | 100 | Surgeons, Hospital Administrators |

| Rehabilitation Robotics Usage | 80 | Physical Therapists, Rehabilitation Center Managers |

| Telepresence Robotics in Healthcare | 70 | Healthcare IT Managers, Telemedicine Coordinators |

| Robotic Process Automation in Hospitals | 90 | Operations Managers, Healthcare Analysts |

| Market Trends and Future Outlook | 60 | Healthcare Consultants, Industry Experts |

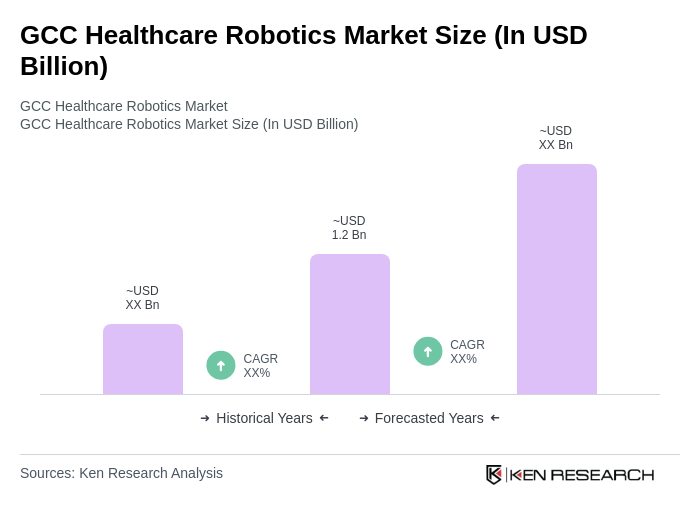

The GCC Healthcare Robotics Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by technological advancements, increased automation demand, and the rising prevalence of chronic diseases necessitating efficient healthcare solutions.