Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4853

Pages:87

Published On:December 2025

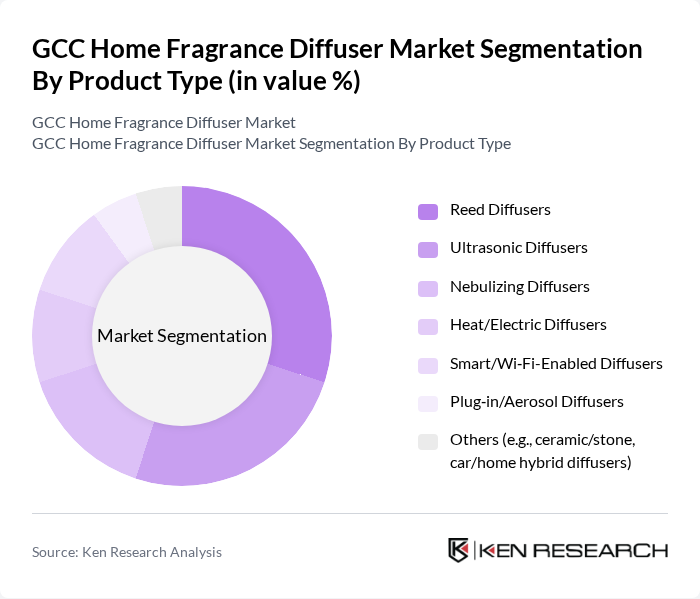

By Product Type:The product type segmentation includes various categories such as Reed Diffusers, Ultrasonic Diffusers, Nebulizing Diffusers, Heat/Electric Diffusers, Smart/Wi-Fi-Enabled Diffusers, Plug-in/Aerosol Diffusers, and Others (e.g., ceramic/stone, car/home hybrid diffusers). Among these, Reed Diffusers are particularly popular due to their simplicity, decorative appeal, flameless operation, and ability to provide continuous, low-maintenance scenting, reflecting global patterns where reed diffusers hold the largest share within home fragrance diffusers. Smart/Wi-Fi-Enabled Diffusers are gaining traction due to the increasing integration of technology in home products, rising use of mobile apps and smart speakers, and a preference for programmable, personalized scenting schedules in premium GCC households and hospitality environments.

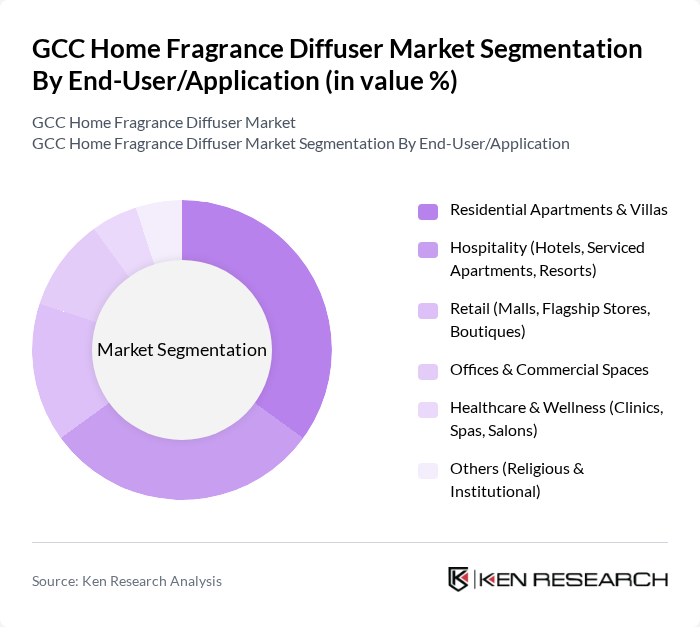

By End-User/Application:This segmentation includes Residential Apartments & Villas, Hospitality (Hotels, Serviced Apartments, Resorts), Retail (Malls, Flagship Stores, Boutiques), Offices & Commercial Spaces, Healthcare & Wellness (Clinics, Spas, Salons), and Others (Religious & Institutional). The Hospitality sector is a significant contributor to the market, driven by the need for creating pleasant and differentiated ambient experiences in hotels, serviced apartments, and resorts, where branded signature scents and professional ambient scenting solutions are increasingly deployed in lobbies, corridors, and guest rooms. Residential applications are also growing as consumers seek to enhance their living spaces with premium lifestyle fragrances, aromatherapy benefits, and wellness-oriented products that align with broader trends in self-care and home-centered lifestyles.

The GCC Home Fragrance Diffuser Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jo Malone London, Diptyque, Yankee Candle, Nest New York (NEST Fragrances), Pura, Air Wick (Reckitt Benckiser), Glade (SC Johnson), Aera, ScentAir, AromaTech, Scentys, Votivo, L’Occitane en Provence, The White Company, Bath & Body Works contribute to innovation, geographic expansion, and service delivery in this space, leveraging premium fragrance portfolios, branded shop-in-shops, e-commerce, and partnerships with leading retailers and hospitality groups in the GCC.

The GCC home fragrance diffuser market is poised for significant evolution, driven by technological advancements and changing consumer preferences. The integration of smart technology into fragrance diffusers is expected to enhance user experience, while the growing emphasis on sustainability will likely lead to increased demand for eco-friendly products. Additionally, as consumers seek personalized experiences, brands that offer customizable fragrance solutions will find new avenues for growth, positioning themselves favorably in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Reed Diffusers Ultrasonic Diffusers Nebulizing Diffusers Heat/Electric Diffusers Smart/Wi?Fi-Enabled Diffusers Plug?in/Aerosol Diffusers Others (e.g., ceramic/stone, car/home hybrid diffusers) |

| By End-User/Application | Residential Apartments & Villas Hospitality (Hotels, Serviced Apartments, Resorts) Retail (Malls, Flagship Stores, Boutiques) Offices & Commercial Spaces Healthcare & Wellness (Clinics, Spas, Salons) Others (Religious & Institutional) |

| By Distribution Channel | Supermarkets/Hypermarkets Specialty Home & Fragrance Stores Brand Boutiques & Department Stores Online Marketplaces (e.g., Amazon, Noon) Direct-to-Consumer E?commerce (Brand Webstores) B2B/Project Sales (Hospitality & Corporate) |

| By Fragrance Family | Oud & Oriental Floral Citrus & Fresh Woody & Amber Gourmand & Spicy Others (Seasonal & Limited Editions) |

| By Price Tier | Mass/Budget Mid-Range Premium Luxury/Ultra?Luxury Private Label/White Label |

| By Packaging Format | Glass Bottles & Vessels Plastic Cartridges & Refills Metal/Aluminum Canisters Refillable & Recyclable Systems Gift Sets & Multi?Pack Formats |

| By Brand Positioning | International Luxury & Prestige Brands Regional GCC/Arabian Fragrance Brands Mass Market & Private Label Brands Clean, Natural & Eco?Friendly Brands Smart/Tech-Enabled Home Fragrance Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Distribution of Home Fragrance Diffusers | 120 | Store Managers, Category Buyers |

| Consumer Preferences for Home Fragrance Products | 150 | Homeowners, Renters, Interior Designers |

| Market Trends in E-commerce for Home Fragrance | 100 | E-commerce Managers, Digital Marketing Specialists |

| Insights from Home Fragrance Manufacturers | 80 | Product Development Managers, Sales Directors |

| Consumer Feedback on Scent Preferences | 120 | General Consumers, Lifestyle Bloggers |

The GCC Home Fragrance Diffuser Market is valued at approximately USD 320 million, reflecting a growing consumer interest in home aesthetics, wellness, and aromatherapy trends within premium residential and hospitality spaces across the region.