Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4188

Pages:98

Published On:December 2025

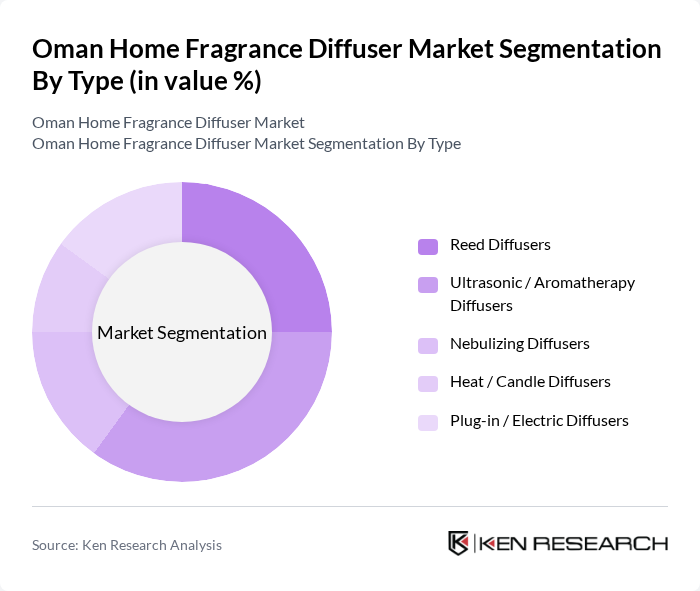

By Type:The market is segmented into various types of diffusers, including Reed Diffusers, Ultrasonic / Aromatherapy Diffusers, Nebulizing Diffusers, Heat / Candle Diffusers, and Plug-in / Electric Diffusers. Among these, Ultrasonic / Aromatherapy Diffusers are gaining popularity due to their ability to disperse essential oils effectively, appealing to wellness-focused consumers. Reed Diffusers also maintain a strong presence due to their aesthetic appeal and ease of use.

By End-User:The end-user segmentation includes Residential, Commercial Offices & Retail, Hospitality (Hotels & Resorts), Spa & Wellness Centers, and Government & Public Buildings. The Residential segment dominates the market, driven by increasing consumer spending on home decor and wellness products. The Hospitality sector is also significant, as hotels and resorts seek to enhance guest experiences through appealing fragrances.

The Oman Home Fragrance Diffuser Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amouage SAOC (Oman), Rasasi Perfumes Industry LLC, Ajmal Perfumes LLC, Al Haramain Perfumes LLC, Swiss Arabian Perfumes Group, NEST Fragrances (NEST New York), Bath & Body Works Inc., MUJI Co., Ltd. (Home Fragrance), IKEA Systems B.V. (Home Fragrance & Diffusers), Air Aroma International, ScentAir Technologies LLC, Al Halaby Perfumes LLC (Oman), The Body Shop International Limited, Diptyque Paris, Jo Malone London contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman home fragrance diffuser market appears promising, driven by evolving consumer preferences and technological advancements. As consumers increasingly seek personalized and eco-friendly products, manufacturers are likely to invest in innovative fragrance technologies and sustainable practices. Additionally, the expansion of e-commerce platforms will facilitate greater accessibility to a wider range of products, enhancing market penetration. Overall, these trends indicate a dynamic market landscape poised for growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Reed Diffusers Ultrasonic / Aromatherapy Diffusers Nebulizing Diffusers Heat / Candle Diffusers Plug?in / Electric Diffusers |

| By End-User | Residential Commercial Offices & Retail Hospitality (Hotels & Resorts) Spa & Wellness Centers Government & Public Buildings |

| By Distribution Channel | Online Retail & Marketplaces Supermarkets/Hypermarkets Specialty Perfume & Home Décor Stores Direct Sales & Corporate/B2B Channels Pharmacies & Convenience Stores |

| By Fragrance Type | Floral Fruity & Citrus Woody & Oud Amber, Musk & Spicy Herbal & Fresh |

| By Packaging Type | Glass Bottles & Jars Plastic Bottles & Cartridges Metal & Aluminum Containers Refill Packs & Pouches |

| By Price Range | Mass / Budget Mid-Range Premium Luxury & Niche Private Label / In?House Brands |

| By Consumer Profile | Brand-Loyal Fragrance Enthusiasts Price-Sensitive Value Seekers Quality- and Ingredient-Conscious Consumers Wellness & Aromatherapy-Focused Users |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Outlets for Home Fragrance | 80 | Store Managers, Sales Representatives |

| Manufacturers of Home Fragrance Products | 60 | Product Development Managers, Marketing Directors |

| Consumers of Home Fragrance Products | 120 | Regular Users, Occasional Buyers |

| Distributors and Wholesalers | 50 | Distribution Managers, Supply Chain Coordinators |

| Online Retail Platforms | 40 | E-commerce Managers, Digital Marketing Specialists |

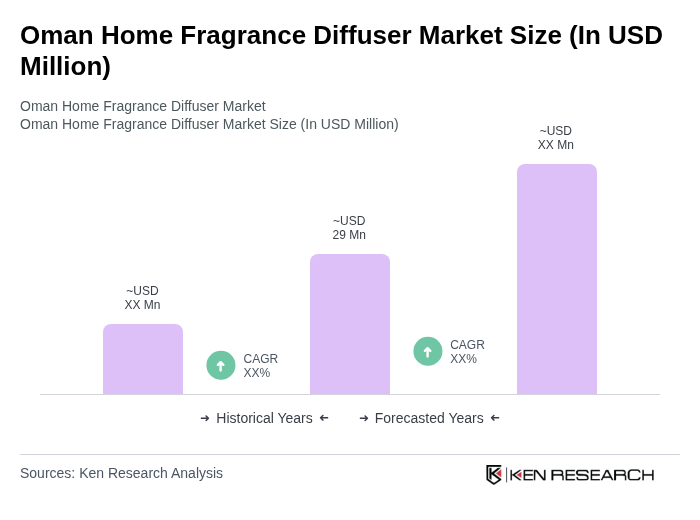

The Oman Home Fragrance Diffuser Market is valued at approximately USD 29 million, reflecting a growing consumer interest in home aesthetics, wellness, and aromatherapy, alongside rising disposable incomes and urbanization trends.