Region:Middle East

Author(s):Dev

Product Code:KRAC8874

Pages:100

Published On:November 2025

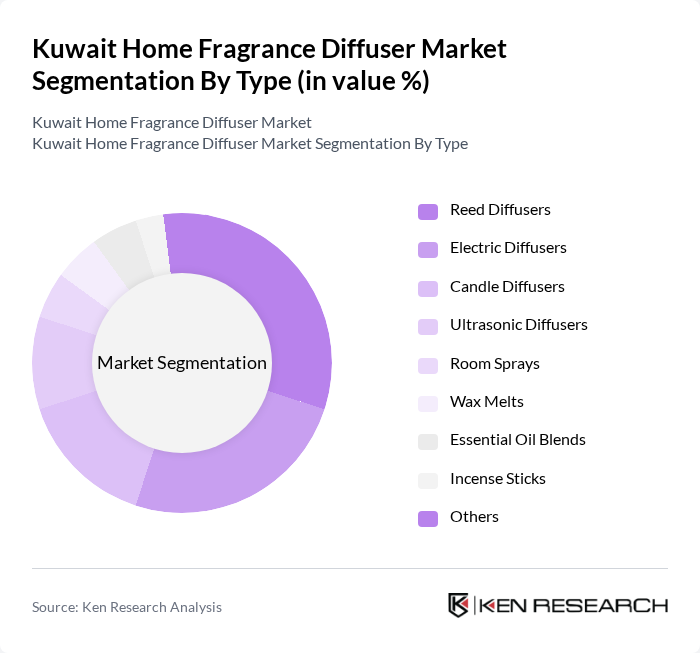

By Type:The market is segmented into various types of home fragrance diffusers, including Reed Diffusers, Electric Diffusers, Candle Diffusers, Ultrasonic Diffusers, Room Sprays, Wax Melts, Essential Oil Blends, Incense Sticks, and Others. Among these,Reed DiffusersandScented Candlesare particularly popular due to their ease of use, aesthetic appeal, and versatility in home decor.Electric Diffusersare gaining traction for their convenience and modern design, whileRoom SpraysandWax Meltsare favored for quick and customizable scent experiences. The market reflects a growing preference for premium, unique scents and eco-friendly product options .

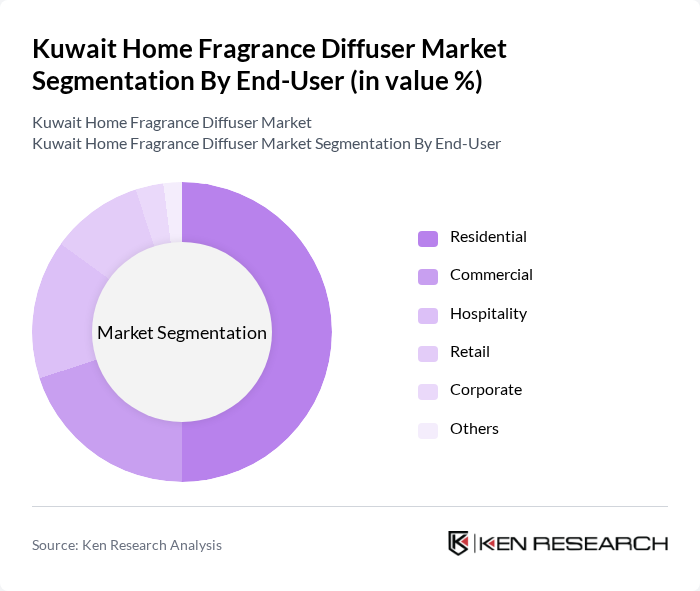

By End-User:The end-user segmentation includes Residential, Commercial, Hospitality, Retail, Corporate, and Others. TheResidentialsegment dominates the market, driven by increasing consumer awareness of home wellness, the desire for personalized living spaces, and a trend toward home personalization. TheHospitalitysector is also significant, as hotels and restaurants seek to create inviting atmospheres for guests. Commercial and retail environments are increasingly adopting fragrance solutions to enhance customer experience and brand differentiation .

The Kuwait Home Fragrance Diffuser Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Haramain Perfumes, Ajmal Perfumes, Al Rehab, Scents of Arabia, The Body Shop, Bath & Body Works, Yankee Candle, Glade (SC Johnson), Air Wick (Reckitt Benckiser), Jo Malone London, Diptyque, Nest Fragrances, Maison Margiela, Voluspa, Baobab Collection, Cire Trudon, Rituals, The White Company, L'Occitane, Byredo, Le Labo, Aesop, and Pura contribute to innovation, geographic expansion, and service delivery in this space. The market is witnessing increased product diversification, with brands focusing on unique scent profiles, eco-friendly packaging, and technology integration to enhance customer engagement .

The future of the Kuwait home fragrance diffuser market appears promising, driven by evolving consumer preferences and technological advancements. As smart home technology gains traction, the integration of smart diffusers is expected to enhance user experience. Additionally, the growing trend of eco-consciousness will likely push brands to adopt sustainable practices, including biodegradable packaging. These developments, combined with a robust retail landscape, will create a dynamic environment for growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Reed Diffusers Electric Diffusers Candle Diffusers Ultrasonic Diffusers Room Sprays Wax Melts Essential Oil Blends Incense Sticks Others |

| By End-User | Residential Commercial Hospitality Retail Corporate Others |

| By Distribution Channel | Online Retail Specialty Stores Supermarkets/Hypermarkets Department Stores Direct Sales Others |

| By Fragrance Type | Floral Woody Fresh Spicy Fruity Others |

| By Packaging Type | Glass Containers Metal Containers Plastic Containers Eco-Friendly Packaging Others |

| By Price Range | Premium Mid-Range Budget Luxury Others |

| By Brand Positioning | Established Brands Emerging Brands Private Labels Artisan Brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Outlets for Home Fragrance | 60 | Store Managers, Sales Representatives |

| Manufacturers of Home Fragrance Products | 40 | Product Development Managers, Marketing Managers |

| Distributors and Wholesalers | 40 | Supply Chain Managers, Business Development Executives |

| Consumers of Home Fragrance Products | 100 | General Consumers, Home Decor Enthusiasts |

| Online Retailers of Home Fragrance | 40 | E-commerce Managers, Digital Marketing Specialists |

The Kuwait Home Fragrance Diffuser Market is valued at approximately USD 150 million, reflecting a growing consumer interest in home aesthetics, wellness, and aromatherapy trends. This market has expanded significantly due to the demand for unique and premium fragrance products.