Region:Middle East

Author(s):Dev

Product Code:KRAC3478

Pages:91

Published On:October 2025

By Type:The market is segmented into various types of therapies, including Intravenous (IV) Therapy, Enteral Nutrition, Total Parenteral Nutrition (TPN), Antibiotic Infusion, Chemotherapy Infusion, Pain Management Infusion, Immunoglobulin Infusion, Hydration Therapy, Specialty Biologic Infusion, and Others. Among these, Intravenous (IV) Therapy is the most dominant segment due to its widespread application in treating various medical conditions, including dehydration, infections, and chronic diseases. The increasing preference for outpatient care and home-based treatments has further propelled the demand for IV therapy, making it a critical component of the home infusion therapy market. The segment’s dominance is reinforced by the broad clinical applications and the need for frequent administration of medications and fluids in chronic disease management .

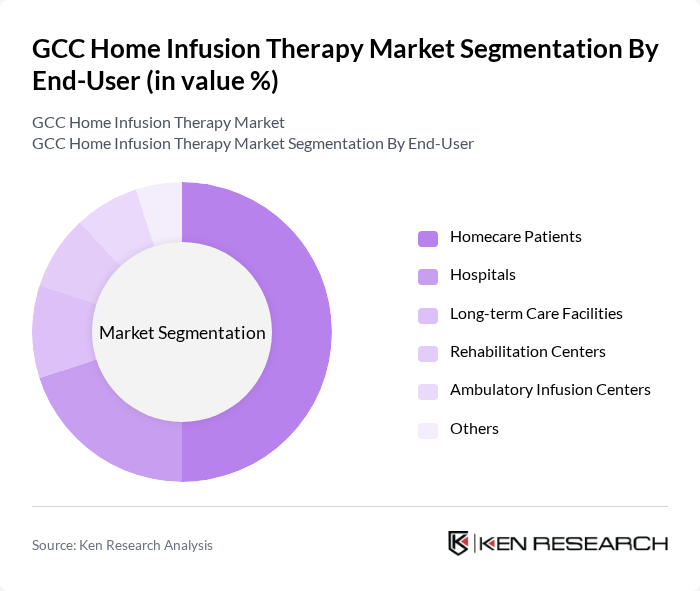

By End-User:The end-user segmentation includes Homecare Patients, Hospitals, Long-term Care Facilities, Rehabilitation Centers, Ambulatory Infusion Centers, and Others. Homecare Patients represent the largest segment, driven by the growing trend of patients preferring to receive care at home rather than in traditional healthcare settings. This shift is influenced by factors such as convenience, cost-effectiveness, and the desire for personalized care, making homecare patients a pivotal focus for the home infusion therapy market. The segment’s growth is supported by the increasing availability of home infusion services, improved patient outcomes, and the expansion of reimbursement policies for home-based care .

The GCC Home Infusion Therapy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Baxter International Inc., B. Braun Melsungen AG, Fresenius Kabi AG, Terumo Corporation, Smiths Medical, Moog Inc., ICU Medical, Inc., Calea Ltd., Medtronic plc, Halyard Health, Inc., Zyno Medical, Amsino International, Inc., Vygon S.A., Becton, Dickinson and Company, Gulf Drug LLC, Al Zahrawi Medical Supplies LLC, Pharmax Pharmaceuticals FZ LLC, United Medical Supplies (UMS), Al Maqam Medical Supplies LLC, Al Faisaliah Medical Systems Co. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC home infusion therapy market appears promising, driven by an increasing emphasis on patient-centric care and technological integration. As healthcare systems evolve, the focus will shift towards enhancing home-based therapies, supported by investments in digital health solutions. Furthermore, the expansion of telehealth services will facilitate better patient monitoring and engagement, ultimately improving treatment outcomes. These trends indicate a robust growth trajectory for home infusion therapy in the coming years, aligning with broader healthcare transformation initiatives.

| Segment | Sub-Segments |

|---|---|

| By Type | Intravenous (IV) Therapy Enteral Nutrition Total Parenteral Nutrition (TPN) Antibiotic Infusion Chemotherapy Infusion Pain Management Infusion Immunoglobulin Infusion Hydration Therapy Specialty Biologic Infusion Others |

| By End-User | Homecare Patients Hospitals Long-term Care Facilities Rehabilitation Centers Ambulatory Infusion Centers Others |

| By Distribution Channel | Direct Sales Online Pharmacies Retail Pharmacies Home Healthcare Agencies Hospital Pharmacies Others |

| By Region | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain Others |

| By Patient Demographics | Pediatric Patients Adult Patients Geriatric Patients Others |

| By Therapy Duration | Short-term Therapy Long-term Therapy Others |

| By Insurance Coverage | Private Insurance Public Insurance Out-of-Pocket Payments Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Home Infusion Therapy Patients | 120 | Patients currently receiving home infusion treatments |

| Healthcare Providers | 80 | Doctors, Nurses, and Home Healthcare Coordinators |

| Pharmaceutical Suppliers | 60 | Sales Representatives and Product Managers |

| Insurance Companies | 40 | Healthcare Policy Analysts and Claims Managers |

| Regulatory Bodies | 40 | Health Policy Makers and Regulatory Affairs Specialists |

The GCC Home Infusion Therapy Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the increasing prevalence of chronic diseases, advancements in infusion technology, and a rising geriatric population preferring home-based healthcare solutions.