Region:Middle East

Author(s):Rebecca

Product Code:KRAC8407

Pages:95

Published On:November 2025

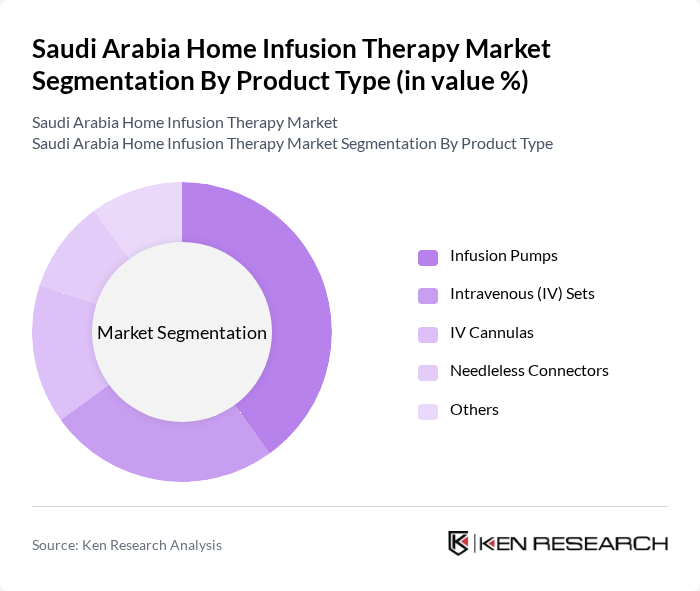

By Product Type:The product type segmentation includes devices and consumables essential for home infusion therapy: Infusion Pumps, Intravenous (IV) Sets, IV Cannulas, Needleless Connectors, and Others. Infusion Pumps are increasingly preferred due to their precision, portability, and ease of use, while IV Sets and Cannulas remain fundamental for therapy administration. The market is experiencing a shift toward advanced, user-friendly devices, including smart infusion pumps and needleless connectors, which are improving safety and patient outcomes.

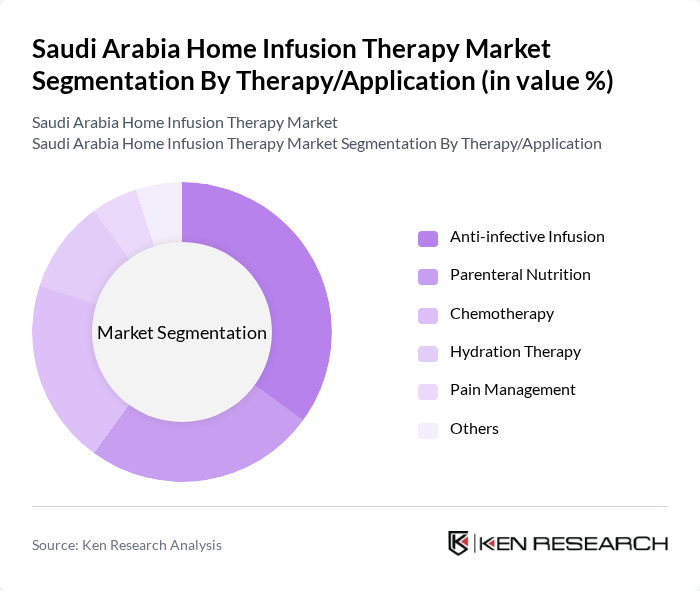

By Therapy/Application:This segmentation covers therapeutic applications including Anti-infective Infusion, Parenteral Nutrition, Chemotherapy, Hydration Therapy, Pain Management, and Others. Anti-infective Infusion leads demand due to high infection rates and the need for effective home-based treatment. Parenteral Nutrition and Chemotherapy are also significant, driven by the rising incidence of chronic illnesses and cancer. The market is further shaped by the adoption of home-based hydration and pain management therapies, reflecting a broader shift toward patient-centric, cost-effective care.

The Saudi Arabia Home Infusion Therapy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Baxter International Inc., B. Braun Melsungen AG, Fresenius Kabi AG, Terumo Corporation, Smiths Medical, Medtronic plc, ICU Medical, Inc., Halyard Health, Inc., Calea Ltd., Zyno Medical LLC, Amgen Inc., Pfizer Inc., Novartis AG, Roche Holding AG, Sanofi S.A., Al Faisaliah Medical Systems Co. (FMS), Gulf Medical Co. Ltd., Al-Jeel Medical & Trading Co., Tabuk Pharmaceuticals Manufacturing Co., Jamjoom Pharma contribute to innovation, geographic expansion, and service delivery in this space.

The future of the home infusion therapy market in Saudi Arabia appears promising, driven by ongoing advancements in technology and a growing emphasis on patient-centric care. As the healthcare system continues to evolve, the integration of telehealth services is expected to enhance patient monitoring and support. Additionally, the increasing investment in healthcare infrastructure will likely facilitate the expansion of home healthcare services, making home infusion therapy more accessible to a broader patient population.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Infusion Pumps Intravenous (IV) Sets IV Cannulas Needleless Connectors Others |

| By Therapy/Application | Anti-infective Infusion Parenteral Nutrition Chemotherapy Hydration Therapy Pain Management Others |

| By End-User | Homecare Patients Hospitals Long-term Care Facilities Ambulatory Infusion Centers Others |

| By Patient Demographics | Pediatric Patients Adult Patients Geriatric Patients Others |

| By Therapy Duration | Short-term Therapy Long-term Therapy Others |

| By Distribution Channel | Direct Sales Online Pharmacies Retail Pharmacies Home Healthcare Agencies Hospital Pharmacies Others |

| By Geographic Region | Northern and Central Region Western Region Eastern Region Southern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Home Infusion Therapy Providers | 60 | Healthcare Administrators, Infusion Therapy Specialists |

| Patients Receiving Home Infusion | 100 | Chronic Disease Patients, Caregivers |

| Pharmaceutical Suppliers | 40 | Sales Representatives, Product Managers |

| Healthcare Policy Makers | 40 | Health Economists, Regulatory Affairs Managers |

| Insurance Providers | 50 | Claims Analysts, Policy Underwriters |

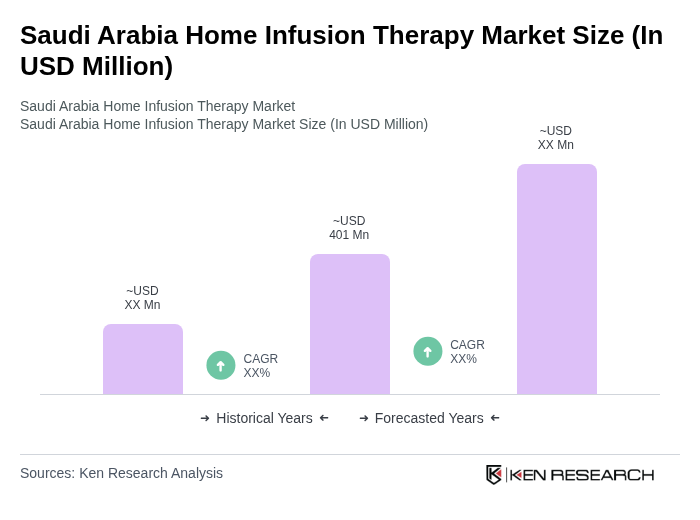

The Saudi Arabia Home Infusion Therapy Market is valued at approximately USD 401 million, reflecting a significant growth driven by the increasing prevalence of chronic diseases, an aging population, and advancements in home healthcare services.