Region:Middle East

Author(s):Rebecca

Product Code:KRAD2728

Pages:95

Published On:November 2025

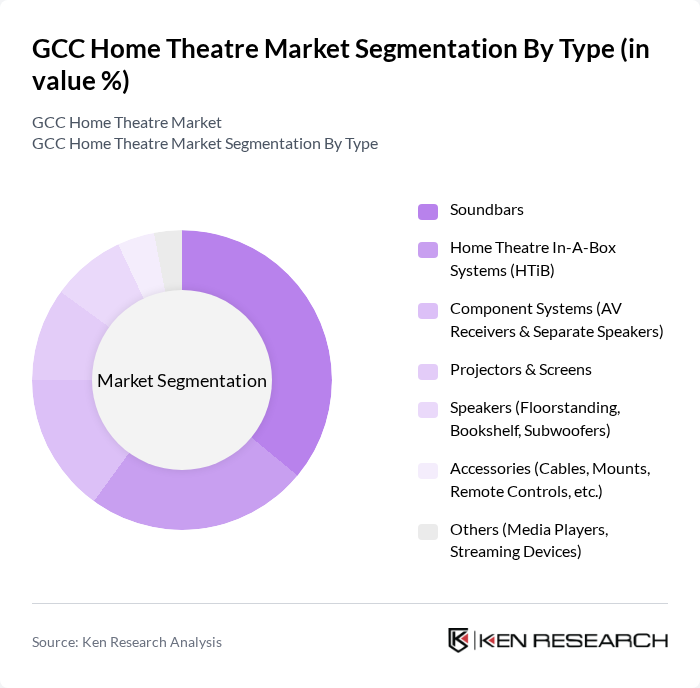

By Type:The market is segmented into Soundbars, Home Theatre In-A-Box Systems (HTiB), Component Systems (AV Receivers & Separate Speakers), Projectors & Screens, Speakers (Floorstanding, Bookshelf, Subwoofers), Accessories (Cables, Mounts, Remote Controls, etc.), and Others (Media Players, Streaming Devices). Among these, Soundbars hold the largest market share due to their compact design, ease of installation, and compatibility with smart devices. The growing demand for wireless and AI-enabled soundbars has made them the preferred choice for consumers seeking high-quality sound without the complexity of traditional multi-component systems.

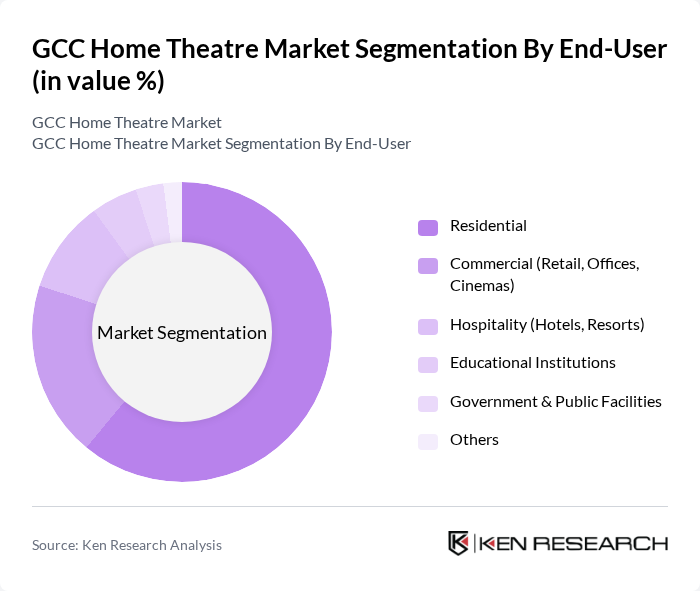

By End-User:The end-user segmentation includes Residential, Commercial (Retail, Offices, Cinemas), Hospitality (Hotels, Resorts), Educational Institutions, Government & Public Facilities, and Others. The Residential segment remains the largest, driven by the increasing trend of home entertainment, widespread adoption of streaming services, and the desire for high-quality audio-visual experiences. Enhanced smart home integration and the availability of bundled entertainment solutions have further boosted residential demand for home theatre systems.

The GCC Home Theatre Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics, LG Electronics, Sony Corporation, Bose Corporation, Panasonic Corporation, JBL (Harman International), Denon (Masimo Consumer), Yamaha Corporation, Philips Electronics, Vizio Inc., Hisense Group, TCL Technology, Klipsch Group, Inc., Sennheiser electronic GmbH & Co. KG, Onkyo Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The GCC home theatre market is poised for significant growth, driven by technological advancements and changing consumer preferences. As more households prioritize immersive entertainment experiences, the demand for high-quality audio-visual systems is expected to rise. Additionally, the integration of smart home technology will further enhance user experiences. Companies that focus on educating consumers about the benefits of home theatre systems and offer affordable solutions will likely capture a larger market share in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Soundbars Home Theatre In-A-Box Systems (HTiB) Component Systems (AV Receivers & Separate Speakers) Projectors & Screens Speakers (Floorstanding, Bookshelf, Subwoofers) Accessories (Cables, Mounts, Remote Controls, etc.) Others (Media Players, Streaming Devices) |

| By End-User | Residential Commercial (Retail, Offices, Cinemas) Hospitality (Hotels, Resorts) Educational Institutions Government & Public Facilities Others |

| By Region | United Arab Emirates Saudi Arabia Qatar Kuwait Oman Bahrain |

| By Technology | Wired Systems Wireless Systems Smart Home Integration Streaming Capabilities Voice Control & AI Features Others |

| By Application | Home Entertainment Gaming Professional Use (Studios, Content Creation) Events and Presentations Others |

| By Distribution Channel | Offline (Specialty Stores, Hypermarkets, Electronics Retailers) Online (E-commerce Platforms, Brand Websites) Others (Direct Sales, System Integrators) |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants Others |

| By Policy Support | Subsidies for Home Theatre Systems Tax Incentives for Manufacturers Grants for Research and Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Home Theatre Systems | 100 | Homeowners, Tech Enthusiasts |

| Retail Insights on Home Theatre Sales | 60 | Store Managers, Sales Associates |

| Market Trends in Audio-Visual Equipment | 50 | Product Managers, Marketing Managers |

| Consumer Electronics Purchase Behavior | 80 | General Consumers, Early Adopters |

| Technological Adoption in Home Entertainment | 40 | IT Specialists, Home Theatre Installers |

The GCC Home Theatre Market is valued at approximately USD 1.1 billion, driven by increasing consumer demand for high-quality audio-visual experiences and the integration of smart home technologies.