Region:Middle East

Author(s):Shubham

Product Code:KRAD5359

Pages:93

Published On:December 2025

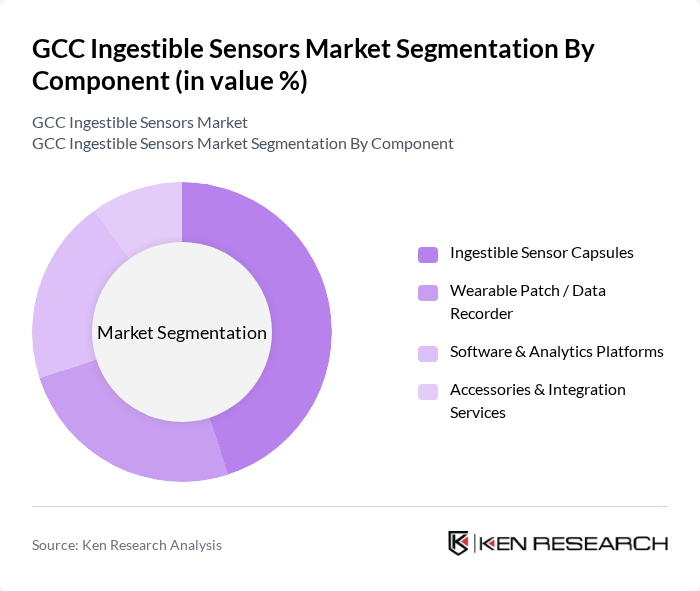

By Component:The components of the market include Ingestible Sensor Capsules, Wearable Patch / Data Recorder, Software & Analytics Platforms, and Accessories & Integration Services. Among these, Ingestible Sensor Capsules are leading the market due to their direct application in gastrointestinal diagnostics and their ability to provide real-time data. The increasing demand for non-invasive diagnostic tools and the growing trend of personalized medicine are driving the adoption of these capsules. The software and analytics platforms are also gaining traction as they enable healthcare providers to analyze data effectively, enhancing patient care.

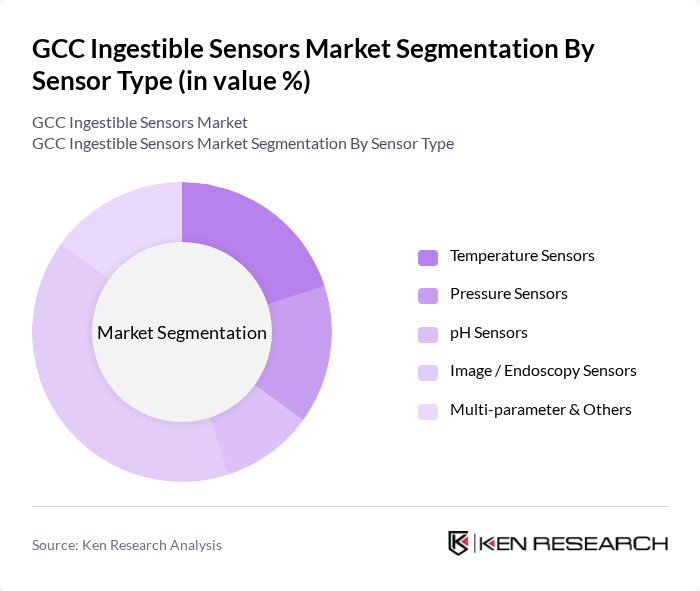

By Sensor Type:The market is segmented into Temperature Sensors, Pressure Sensors, pH Sensors, Image / Endoscopy Sensors, and Multi-parameter & Others. The Image / Endoscopy Sensors segment is currently dominating the market due to their critical role in visualizing internal organs and diagnosing gastrointestinal disorders. The increasing prevalence of gastrointestinal diseases and the demand for minimally invasive procedures are propelling the growth of this segment. Additionally, temperature and pressure sensors are gaining importance in monitoring patient health metrics, further diversifying the market.

The GCC Ingestible Sensors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Olympus Corporation, CapsoVision, Inc., BodyCap Medical, Otsuka Pharmaceutical Co., Ltd. (including Otsuka’s Digital Medicine / ABILIFY MYCITE), etectRx, Inc., Check?Cap Ltd., Jinshan Science & Technology (Chongqing Jinshan Science & Technology Group Co., Ltd.), IntroMedic Co., Ltd., RF Co., Ltd. (Sayaka Capsule Endoscopy), Philips Healthcare (Philips Respironics & Digital Health Solutions), Siemens Healthineers AG, GE HealthCare Technologies Inc., Abbott Laboratories, Local GCC Distributors & Integrators (e.g., Gulf Drug LLC, Al Faisaliah Medical Systems, and others) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC ingestible sensors market appears promising, driven by increasing healthcare investments and a growing emphasis on digital health solutions. As the region's healthcare infrastructure evolves, the integration of ingestible sensors with telemedicine and mobile health applications is expected to enhance patient engagement and monitoring. Furthermore, collaborations between technology firms and healthcare providers will likely accelerate innovation, leading to more personalized and efficient healthcare delivery systems that cater to the unique needs of the GCC population.

| Segment | Sub-Segments |

|---|---|

| By Component | Ingestible Sensor Capsules Wearable Patch / Data Recorder Software & Analytics Platforms Accessories & Integration Services |

| By Sensor Type | Temperature Sensors Pressure Sensors pH Sensors Image / Endoscopy Sensors Multi?parameter & Others |

| By Clinical Application | Gastrointestinal Diagnostics (e.g., capsule endoscopy) Core Body Temperature & Heat Stress Monitoring Drug Adherence & Dose Monitoring Bariatric & Metabolic Disorder Management Sports & Fitness Performance Monitoring Others |

| By End-User | Hospitals Specialized Endoscopy & Gastroenterology Centers Ambulatory Surgical Centers Home Healthcare & Remote Monitoring Programs Sports Academies, Military & Occupational Health Centers Others |

| By Distribution Channel | Direct Tenders to Hospitals & Ministries Regional Medical Device Distributors Online / E?procurement Portals Retail & Hospital Pharmacies Others |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain |

| By Regulatory & Standards Status | US FDA?Cleared / Approved Devices CE?Marked Devices Saudi Food and Drug Authority (SFDA) Approved UAE Ministry of Health & Prevention (MOHAP) / DHCR Approved Other GCC Regulatory Approvals ISO?Certified Supporting Systems & Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 120 | Doctors, Nurses, Healthcare Administrators |

| Medical Device Manufacturers | 60 | Product Managers, R&D Engineers |

| Patients Using Ingestible Sensors | 80 | Patients, Caregivers, Health Advocates |

| Regulatory Bodies | 40 | Regulatory Affairs Specialists, Compliance Officers |

| Health Insurance Providers | 70 | Underwriters, Claims Analysts, Policy Makers |

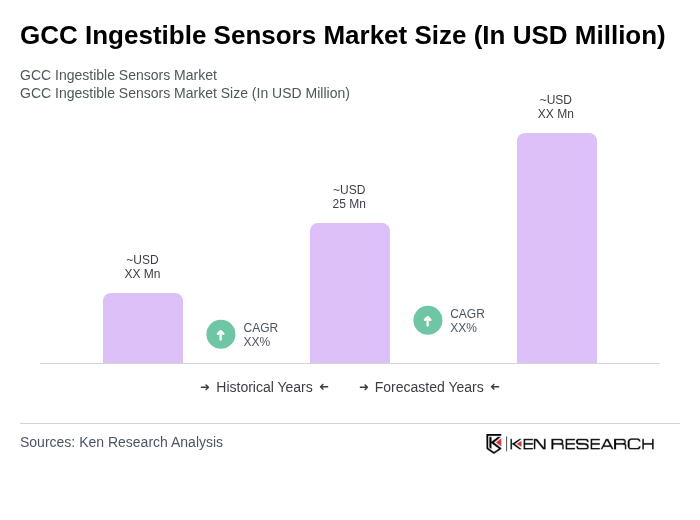

The GCC Ingestible Sensors Market is valued at approximately USD 25 million, reflecting a five-year historical analysis. This growth is attributed to advancements in medical technology and the increasing prevalence of chronic diseases in the region.