Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8295

Pages:82

Published On:November 2025

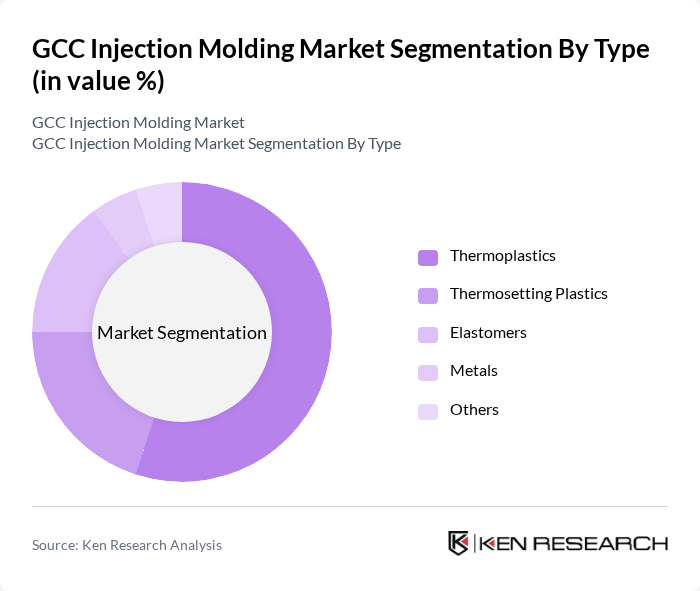

By Type:The injection molding market is segmented into thermoplastics, thermosetting plastics, elastomers, metals, and others. Thermoplastics remain the most widely used segment, favored for their versatility, recyclability, and ease of processing. Their dominance is driven by applications in automotive, consumer goods, and packaging, where lightweight and durable materials are essential. Thermosetting plastics and elastomers are also significant, particularly in applications requiring high thermal stability, chemical resistance, and flexibility. Metal injection molding is gaining traction in specialized industrial and electronics applications, while the “others” category includes composites and advanced engineering materials.

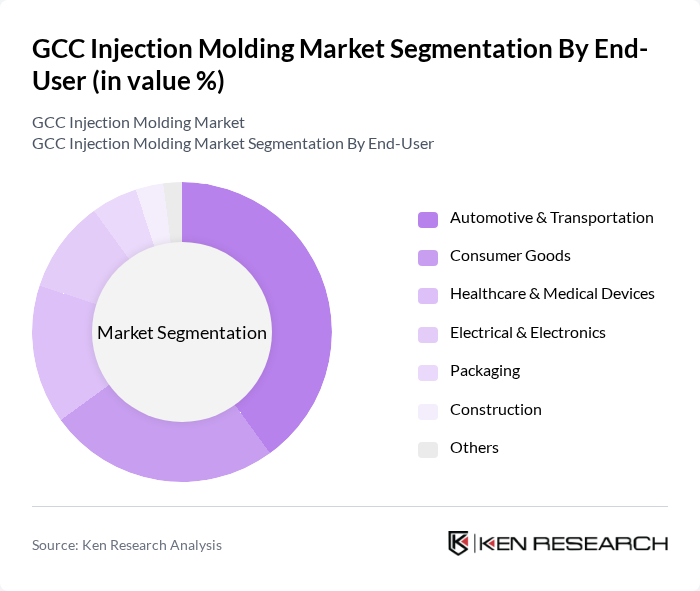

By End-User:The end-user segmentation of the injection molding market includes automotive & transportation, consumer goods, healthcare & medical devices, electrical & electronics, packaging, construction, and others. The automotive & transportation sector leads due to the demand for lightweight, fuel-efficient vehicles and the integration of high-performance plastics in automotive components. The healthcare sector is expanding rapidly, driven by the need for precision-molded medical devices and disposables. Consumer goods and packaging remain prominent segments, reflecting the region’s growing population and demand for convenience products. Electrical & electronics and construction sectors are also adopting injection-molded components for their reliability and design flexibility.

The GCC Injection Molding Market is characterized by a dynamic mix of regional and international players. Leading participants such as SABIC, Borouge, EQUATE Petrochemical Company, Tasnee (National Industrialization Company), Alpla, Napco National, Zamil Plastic Industries, Interplast Co. Ltd., Al Watania Plastics, Rowad National Plastic Company, Al Bayader International, Gulf Plastic Industries Co., Al Amir Plastic Industries, Cosmoplast (Harwal Group), Al Jabr Plastic Factory contribute to innovation, geographic expansion, and service delivery in this space.

The GCC injection molding market is poised for transformative growth, driven by technological innovations and evolving consumer preferences. As manufacturers increasingly adopt automation and smart technologies, production efficiency is expected to improve significantly. Additionally, the rising focus on sustainability will likely lead to greater adoption of biodegradable materials and eco-friendly practices. These trends, combined with the expansion of the automotive and consumer goods sectors, will create a dynamic landscape for the injection molding industry in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Thermoplastics Thermosetting Plastics Elastomers Metals Others |

| By End-User | Automotive & Transportation Consumer Goods Healthcare & Medical Devices Electrical & Electronics Packaging Construction Others |

| By Material | Polypropylene (PP) Polyethylene (PE) Polyvinyl Chloride (PVC) Polystyrene (PS) Acrylonitrile Butadiene Styrene (ABS) Polycarbonate (PC) Others |

| By Application | Packaging (Rigid & Flexible) Automotive Parts Medical Devices & Components Consumer Electronics Housings Construction Components Others |

| By Region | Saudi Arabia United Arab Emirates (UAE) Qatar Kuwait Oman Bahrain |

| By Production Process | Injection Molding Blow Molding Compression Molding Extrusion Molding Others |

| By Policy Support | Subsidies for Plastic Manufacturing Tax Incentives for Sustainable Practices Grants for Research and Development Import/Export Tariff Benefits Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Injection Molding | 100 | Production Managers, Quality Control Engineers |

| Consumer Goods Manufacturing | 70 | Product Development Managers, Supply Chain Analysts |

| Healthcare Product Manufacturing | 60 | Regulatory Affairs Specialists, Operations Managers |

| Industrial Equipment Components | 50 | Procurement Managers, Technical Directors |

| Packaging Solutions | 80 | Marketing Managers, Production Supervisors |

The GCC Injection Molding Market is valued at approximately USD 2.7 billion, driven by the increasing demand for plastic products across various sectors, including automotive, consumer goods, packaging, and healthcare.