Region:Middle East

Author(s):Rebecca

Product Code:KRAD1337

Pages:82

Published On:November 2025

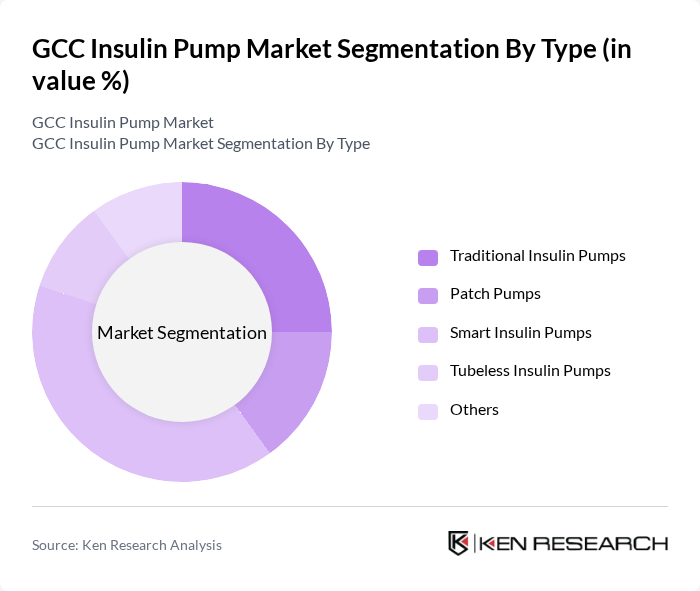

By Type:

The segmentation by type includesTraditional Insulin Pumps,Patch Pumps,Smart Insulin Pumps,Tubeless Insulin Pumps, andOthers. Among these,Smart Insulin Pumpsare leading the market due to their advanced features such as integration with continuous glucose monitoring, automated insulin delivery, and remote monitoring capabilities. The growing trend toward digital health solutions and the increasing demand for user-friendly, connected devices have made Smart Insulin Pumps particularly appealing to consumers. Traditional Insulin Pumps still hold a significant share, but the shift toward more innovative and wearable solutions is accelerating.

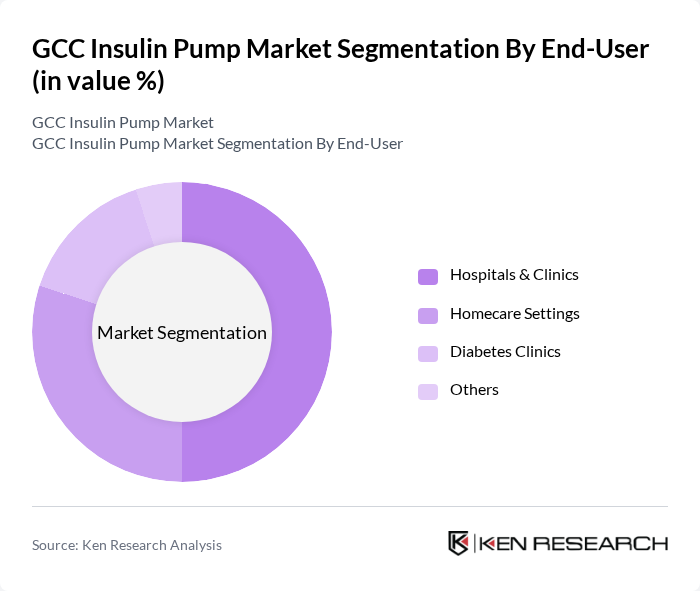

By End-User:

The end-user segmentation includesHospitals & Clinics,Homecare Settings,Diabetes Clinics, andOthers. Hospitals & Clinics dominate the market due to their ability to provide comprehensive diabetes care and access to advanced medical devices. The increasing number of diabetes patients seeking specialized treatment in these facilities drives demand for insulin pumps. Homecare settings are also gaining traction as patients increasingly prefer managing diabetes at home, supported by telemedicine and remote monitoring technologies.

The GCC Insulin Pump Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Insulet Corporation, Tandem Diabetes Care, Inc., Roche Diabetes Care (F. Hoffmann-La Roche AG), Abbott Laboratories, B. Braun Melsungen AG, Ypsomed AG, Ascensia Diabetes Care, Dexcom, Inc., Eli Lilly and Company, Novo Nordisk A/S, Sanofi S.A., Johnson & Johnson (LifeScan, Inc.), A. Menarini Diagnostics S.r.l., SOOIL Development Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC insulin pump market appears promising, driven by ongoing technological advancements and increasing healthcare investments. As telehealth services expand, patients will have greater access to diabetes management resources, enhancing the adoption of insulin pumps. Additionally, the development of hybrid closed-loop systems is expected to revolutionize insulin delivery, providing patients with more effective and user-friendly options. These trends indicate a positive trajectory for the market, with improved patient outcomes and increased demand for innovative solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Traditional Insulin Pumps Patch Pumps Smart Insulin Pumps Tubeless Insulin Pumps Others |

| By End-User | Hospitals & Clinics Homecare Settings Diabetes Clinics Others |

| By Distribution Channel | Direct Sales Online Retail Pharmacies Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain |

| By Age Group | Pediatric Adult Geriatric Others |

| By Technology | Continuous Glucose Monitoring (CGM) Integrated Pumps Automated Insulin Delivery Systems Bluetooth-Enabled/Connected Pumps Others |

| By Insurance Coverage | Private Insurance Public Insurance Out-of-Pocket Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 120 | Endocrinologists, Diabetes Educators |

| Patients Using Insulin Pumps | 100 | Diabetes Patients, Caregivers |

| Hospital Administrators | 80 | Healthcare Facility Managers, Procurement Officers |

| Insurance Providers | 60 | Health Insurance Underwriters, Policy Analysts |

| Diabetes Advocacy Groups | 50 | Non-profit Leaders, Community Health Workers |

The GCC Insulin Pump Market is valued at approximately USD 250 million, driven by the rising prevalence of diabetes, advancements in insulin delivery technologies, and increased awareness of diabetes management in the region.