Region:Middle East

Author(s):Dev

Product Code:KRAB7399

Pages:87

Published On:October 2025

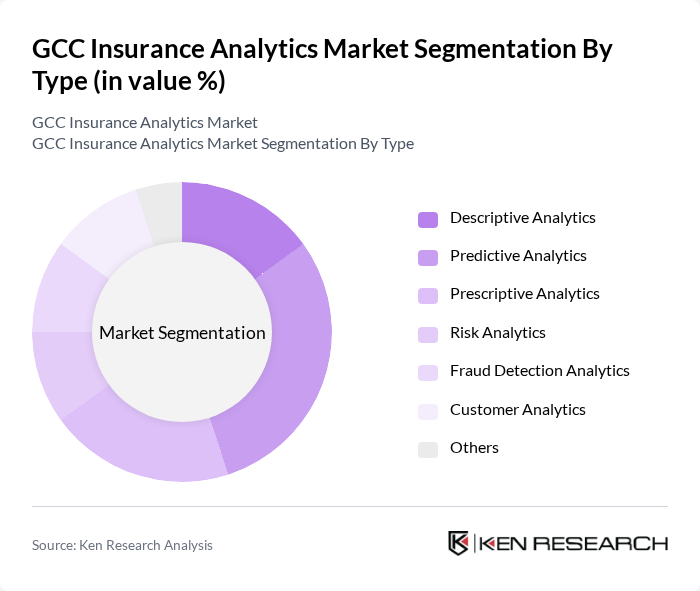

By Type:The market is segmented into various types of analytics, including Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, Risk Analytics, Fraud Detection Analytics, Customer Analytics, and Others. Among these, Predictive Analytics is currently the leading sub-segment, driven by its ability to forecast trends and behaviors, which is crucial for risk management and customer retention strategies in the insurance industry.

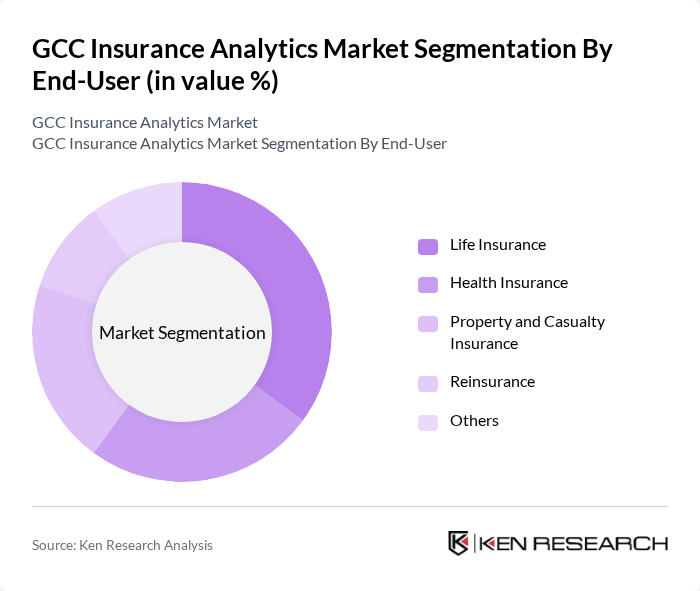

By End-User:The end-user segmentation includes Life Insurance, Health Insurance, Property and Casualty Insurance, Reinsurance, and Others. The Life Insurance segment is currently the most significant contributor to the market, as it increasingly adopts analytics to enhance underwriting processes and improve customer engagement through personalized offerings.

The GCC Insurance Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aon plc, Allianz SE, Munich Re, Swiss Re, AXA Group, Zurich Insurance Group, Chubb Limited, Berkshire Hathaway Inc., MetLife, Inc., Prudential Financial, Inc., Generali Group, Tokio Marine Holdings, Inc., Liberty Mutual Insurance, Travelers Companies, Inc., Aviva plc contribute to innovation, geographic expansion, and service delivery in this space.

The GCC insurance analytics market is poised for significant transformation, driven by technological advancements and evolving consumer expectations. In the future, the integration of artificial intelligence and machine learning is expected to enhance predictive analytics capabilities, allowing insurers to better assess risks and tailor products. Additionally, the rise of insurtech startups is fostering innovation, creating a more competitive landscape that encourages traditional insurers to adopt agile practices and improve customer engagement strategies.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Risk Analytics Fraud Detection Analytics Customer Analytics Others |

| By End-User | Life Insurance Health Insurance Property and Casualty Insurance Reinsurance Others |

| By Application | Underwriting Claims Management Customer Retention Risk Management Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Sales Channel | Direct Sales Online Sales Brokers and Agents Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain Others |

| By Customer Segment | Individual Customers Small and Medium Enterprises Large Corporations Government Entities Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Life Insurance Market Insights | 150 | Product Managers, Actuaries |

| Health Insurance Trends | 120 | Underwriters, Claims Adjusters |

| Property and Casualty Insurance Analysis | 100 | Risk Managers, Compliance Officers |

| Insurance Technology Adoption | 80 | IT Managers, Digital Transformation Leads |

| Market Regulation Impact Assessment | 90 | Regulatory Affairs Specialists, Legal Advisors |

The GCC Insurance Analytics Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by the adoption of advanced analytics technologies and the demand for data-driven decision-making in the insurance sector.