Region:Middle East

Author(s):Dev

Product Code:KRAC4049

Pages:91

Published On:October 2025

By Type:The market is segmented into Life Insurance Brokerage, Health Insurance Brokerage, Property and Casualty Insurance Brokerage, Liability Insurance Brokerage, Marine Insurance Brokerage, Reinsurance Brokerage, Cyber Insurance Brokerage, Professional Indemnity Insurance Brokerage, and Others. Each segment addresses distinct risk profiles and regulatory requirements, with health and life insurance brokerage experiencing the highest demand due to mandatory health coverage and growing awareness of personal financial security.

By End-User:End-user segments include Individual Clients, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Individual clients drive demand for health and life insurance brokerage, while SMEs and large corporations increasingly seek comprehensive risk solutions, including cyber and professional indemnity coverage, to address evolving operational and regulatory risks.

The GCC Insurance Brokerage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Marsh & McLennan Companies, Aon plc, Willis Towers Watson, Arthur J. Gallagher & Co., Al-Futtaim Willis, Gulf Insurance Group, Qatar Insurance Company, Oman Insurance Company, Abu Dhabi National Insurance Company, Saudi Arabian Cooperative Insurance Company (SAICO), Emirates Insurance Company, National General Insurance Company, Bahrain National Holding Company, AXA Gulf, Daman National Health Insurance Company, Takaful Emarat Insurance, Zurich Insurance Group, Tokio Marine & Nichido Fire Insurance Co. contribute to innovation, geographic expansion, and service delivery in this space.

The GCC insurance brokerage market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As InsurTech solutions gain traction, brokers will increasingly leverage data analytics to enhance underwriting processes and personalize offerings. Additionally, the focus on customer experience will intensify, prompting firms to adopt innovative engagement strategies. This shift will likely lead to a more dynamic market, where agility and responsiveness to consumer needs become critical for success in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Life Insurance Brokerage Health Insurance Brokerage Property and Casualty Insurance Brokerage Liability Insurance Brokerage Marine Insurance Brokerage Reinsurance Brokerage Cyber Insurance Brokerage Professional Indemnity Insurance Brokerage Others |

| By End-User | Individual Clients Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Distribution Channel | Direct Sales Online Platforms Brokers and Agents Partnerships with Financial Institutions |

| By Service Model | Full-Service Brokerage Discount Brokerage Specialized Brokerage |

| By Geographic Presence | UAE Saudi Arabia Qatar Kuwait Oman Bahrain Others |

| By Customer Segment | Retail Customers Corporate Clients Institutional Clients |

| By Policy Type | Short-Term Policies Long-Term Policies Custom Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Life Insurance Brokerage | 100 | Insurance Brokers, Financial Advisors |

| Health Insurance Brokerage | 90 | Healthcare Consultants, Insurance Agents |

| Property & Casualty Insurance Brokerage | 80 | Risk Managers, Underwriters |

| Commercial Insurance Brokerage | 70 | Business Owners, Corporate Insurance Managers |

| Insurance Technology Solutions | 50 | IT Managers, Digital Transformation Leads |

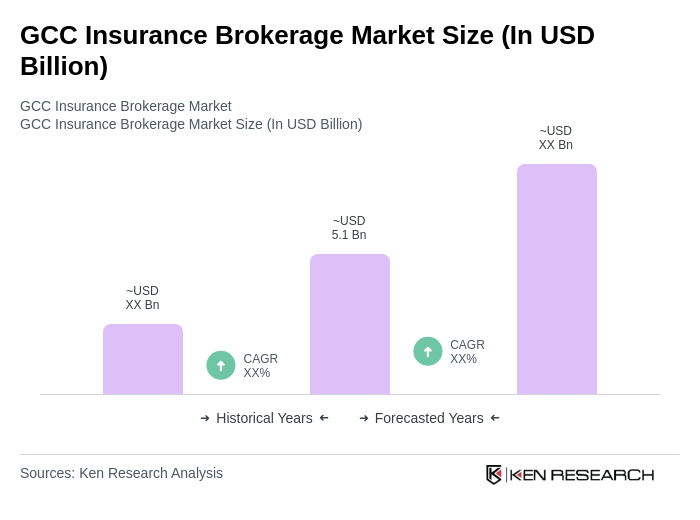

The GCC Insurance Brokerage Market is valued at approximately USD 5.1 billion, reflecting revenues from health, life, and non-life insurance segments. This growth is driven by increased insurance penetration and demand for risk management solutions.