Region:Middle East

Author(s):Dev

Product Code:KRAB7230

Pages:85

Published On:October 2025

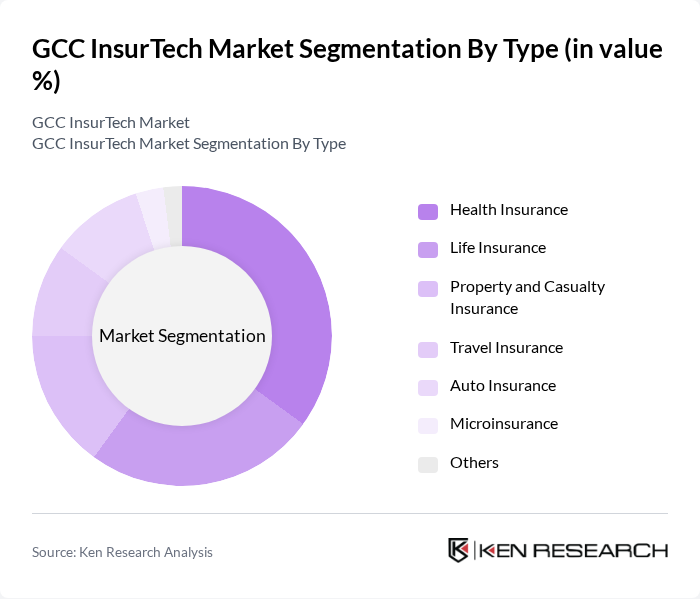

By Type:The InsurTech market can be segmented into various types, including Health Insurance, Life Insurance, Property and Casualty Insurance, Travel Insurance, Auto Insurance, Microinsurance, and Others. Among these, Health Insurance is currently the dominant segment due to the increasing healthcare costs and rising awareness about health-related issues. The demand for personalized health insurance products has surged, driven by a growing population and a shift towards preventive healthcare. Life Insurance also holds a significant share, as consumers seek financial security for their families. The other segments are growing steadily, with Auto Insurance and Property and Casualty Insurance gaining traction due to the increasing number of vehicles and property ownership in the region.

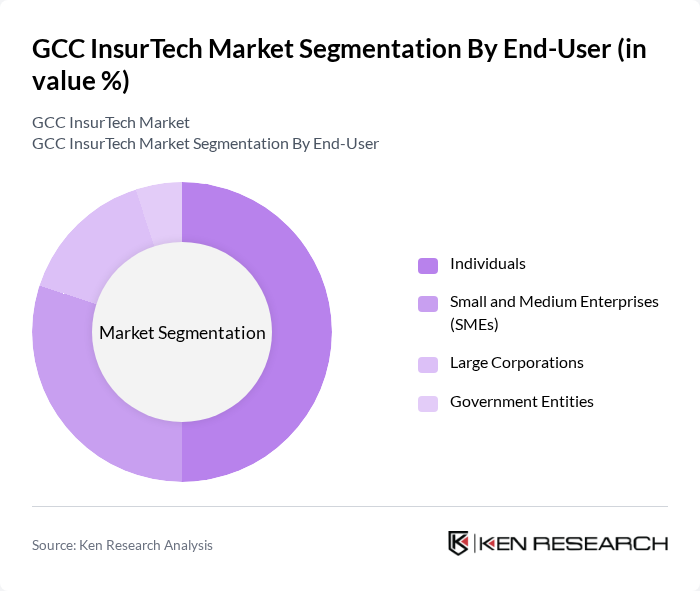

By End-User:The InsurTech market is segmented by end-user into Individuals, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Individuals represent the largest segment, driven by the increasing need for personal insurance products and the growing awareness of financial security. SMEs are also a significant segment, as they seek affordable insurance solutions to protect their businesses. Large Corporations and Government Entities are gradually adopting InsurTech solutions to enhance their risk management strategies and streamline operations, contributing to the overall growth of the market.

The GCC InsurTech Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bima, Takaful Emarat, Souqalmal, AXA Gulf, Oman Insurance Company, Dubai Insurance Company, Al Ain Ahlia Insurance, Noor Takaful, Qatar Insurance Company, Emirates Insurance Company, Al Hilal Takaful, Al Fujairah National Insurance Company, National General Insurance, Daman National Health Insurance, AXA Insurance contribute to innovation, geographic expansion, and service delivery in this space.

The GCC InsurTech market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As digital adoption continues to rise, InsurTech companies will increasingly leverage artificial intelligence and machine learning to enhance customer experiences and streamline operations. Furthermore, the regulatory landscape will likely evolve to support innovation while ensuring consumer protection, fostering a balanced environment for growth. Collaboration between InsurTech firms and traditional insurers will also become more prevalent, leading to innovative product offerings and improved market penetration.

| Segment | Sub-Segments |

|---|---|

| By Type | Health Insurance Life Insurance Property and Casualty Insurance Travel Insurance Auto Insurance Microinsurance Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Distribution Channel | Direct Sales Online Platforms Brokers and Agents Partnerships with Financial Institutions |

| By Application | Claims Processing Risk Assessment Customer Service Automation Fraud Detection |

| By Customer Segment | Retail Customers Corporate Clients High Net-Worth Individuals |

| By Pricing Model | Pay-Per-Use Subscription-Based One-Time Payment |

| By Policy Type | Standard Policies Customized Policies Bundled Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health Insurance Technology Adoption | 100 | Health Insurance Executives, IT Managers |

| Property Insurance Digital Solutions | 80 | Property Insurers, Claims Managers |

| Life Insurance Customer Engagement Tools | 70 | Life Insurance Agents, Marketing Directors |

| InsurTech Regulatory Compliance | 60 | Compliance Officers, Legal Advisors |

| Consumer Perception of InsurTech | 90 | Insurance Customers, Financial Advisors |

The GCC InsurTech market is valued at approximately USD 2.5 billion, reflecting significant growth driven by digital technology adoption, consumer demand for personalized insurance products, and the need for operational efficiency among insurance providers.