Region:Middle East

Author(s):Rebecca

Product Code:KRAD1361

Pages:88

Published On:November 2025

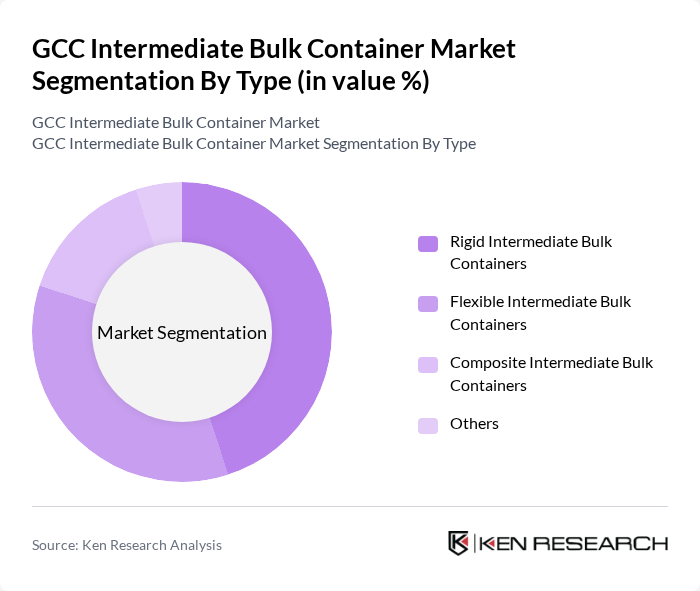

By Type:The market is segmented into Rigid Intermediate Bulk Containers, Flexible Intermediate Bulk Containers, Composite Intermediate Bulk Containers, and Others. Rigid Intermediate Bulk Containers are widely used due to their durability and ability to handle heavy loads, while Flexible Intermediate Bulk Containers are favored for their lightweight and cost-effective nature. Composite Intermediate Bulk Containers combine the benefits of both rigid and flexible types, catering to specific industry needs .

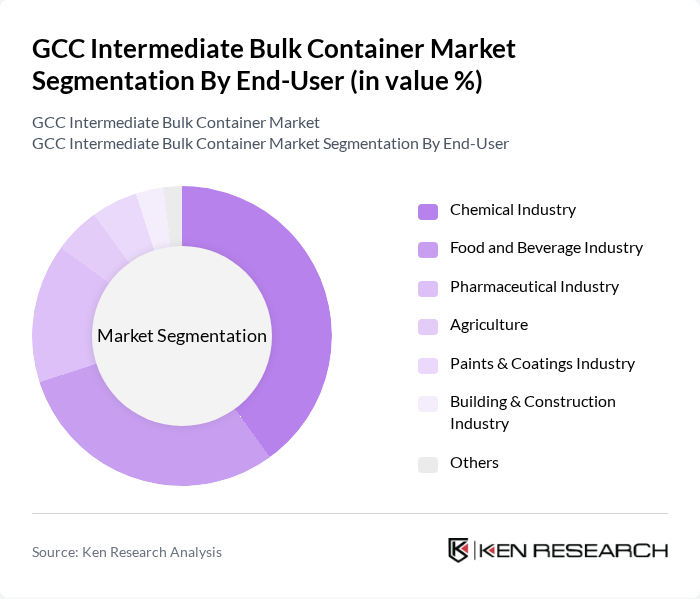

By End-User:The end-user segments include the Chemical Industry, Food and Beverage Industry, Pharmaceutical Industry, Agriculture, Paints & Coatings Industry, Building & Construction Industry, and Others. The Chemical Industry is the largest consumer of intermediate bulk containers due to the need for safe and efficient transport of hazardous materials, while the Food and Beverage Industry follows closely, driven by the demand for safe packaging solutions .

The GCC Intermediate Bulk Container Market is characterized by a dynamic mix of regional and international players. Leading participants such as Schütz GmbH & Co. KGaA, Mauser Packaging Solutions, Greif, Inc., Berry Global, Inc., Hoover Circular Solutions, DS Smith Plc, FlexiTuff Ventures International Ltd., LC Packaging International BV, Mondi Plc, Thielmann Portinox Spain SA, Snyder Industries Inc., Bulk Lift International LLC, Global-Pak Inc., CDF Corporation, Hawman Container Services contribute to innovation, geographic expansion, and service delivery in this space.

The GCC Intermediate Bulk Container market is poised for significant transformation, driven by technological advancements and a growing emphasis on sustainability. As industries increasingly adopt automation and IoT technologies, the efficiency of supply chain management is expected to improve. Furthermore, the rising focus on recycling and sustainable packaging solutions will likely create new avenues for growth, encouraging companies to innovate and adapt to changing consumer preferences and regulatory requirements in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Rigid Intermediate Bulk Containers Flexible Intermediate Bulk Containers Composite Intermediate Bulk Containers Others |

| By End-User | Chemical Industry Food and Beverage Industry Pharmaceutical Industry Agriculture Paints & Coatings Industry Building & Construction Industry Others |

| By Material | Plastic Metal Paperboard Composite Materials Others |

| By Capacity | Below 500 Liters 1000 Liters Above 1000 Liters Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain |

| By Application | Bulk Liquid Transport Bulk Solid Transport Hazardous Material Transport Food Ingredients Transport Chemical Storage & Handling Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Chemical Manufacturing Sector | 45 | Production Managers, Supply Chain Analysts |

| Food and Beverage Industry | 40 | Logistics Coordinators, Operations Managers |

| Pharmaceutical Sector | 35 | Regulatory Affairs Managers, Operations Directors |

| Construction Materials Sector | 30 | Procurement Managers, Warehouse Supervisors |

| Environmental Services and Recycling | 25 | Sustainability Managers, Operations Managers |

The GCC Intermediate Bulk Container market is valued at approximately USD 370 million, driven by the increasing demand for efficient transportation of bulk liquids and solids across various industries, including chemicals, food and beverage, and pharmaceuticals.