Region:Europe

Author(s):Shubham

Product Code:KRAA0795

Pages:96

Published On:August 2025

By Function:The logistics services market is segmented into various functions that cater to different aspects of the supply chain. The key subsegments include Freight Transport (Road, Rail, Air, Sea, Inland Water), Freight Forwarding, Warehousing, Value-Added Services, Distribution Services, Supply Chain Management, Cold Chain Logistics, Last-Mile Delivery, and Others. Each of these functions plays a crucial role in ensuring the smooth flow of goods and services across the logistics network .

The Freight Transport segment, particularly road transport, dominates the logistics services market due to Turkey’s extensive road network, which facilitates efficient movement of goods across the country. The surge in e-commerce has further fueled demand for last-mile delivery services, while air and sea transport remain essential for international trade. The increasing focus on supply chain optimization and the need for timely deliveries are driving growth in this segment, making it a critical component of the logistics ecosystem .

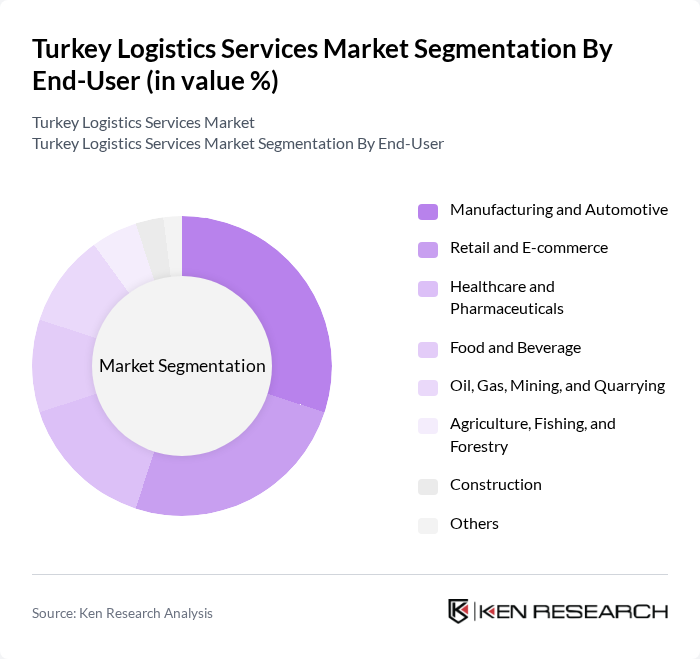

By End-User:The logistics services market is also segmented by end-user industries, which include Manufacturing and Automotive, Retail and E-commerce, Healthcare and Pharmaceuticals, Food and Beverage, Oil, Gas, Mining, and Quarrying, Agriculture, Fishing, and Forestry, Construction, and Others. Each of these sectors has unique logistics requirements that drive demand for specialized services .

The Manufacturing and Automotive sector is the leading end-user in the logistics services market, driven by the need for efficient supply chain management and just-in-time delivery practices. The rapid growth of the retail and e-commerce sector has significantly impacted logistics demand, as consumers increasingly expect fast and reliable delivery services. The healthcare and pharmaceuticals segment is expanding due to stringent regulations and the need for temperature-controlled logistics, further diversifying the market .

The Turkey Logistics Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aras Kargo, MNG Kargo, Yurtiçi Kargo, PTT Kargo, DHL Supply Chain Turkey, UPS Turkey, FedEx Express Turkey, Kuehne + Nagel Turkey, DB Schenker Arkas, CEVA Logistics Turkey, Geodis Turkey, Maersk Logistics Turkey, Ekol Logistics, Borusan Lojistik, Netlog Logistics, D B Deniz Nakliyati Ticaret, Istanbul Express contribute to innovation, geographic expansion, and service delivery in this space.

The Turkey logistics services market is poised for significant transformation, driven by advancements in technology and evolving consumer expectations. As e-commerce continues to expand, logistics providers will increasingly adopt automation and digital solutions to enhance efficiency. Furthermore, sustainability will become a focal point, with companies investing in green logistics practices. The integration of AI and big data analytics will also play a crucial role in optimizing supply chain operations, ensuring that logistics services remain agile and responsive to market demands.

| Segment | Sub-Segments |

|---|---|

| By Function | Freight Transport (Road, Rail, Air, Sea, Inland Water) Freight Forwarding Warehousing Value-Added Services Distribution Services Supply Chain Management Cold Chain Logistics Last-Mile Delivery Others |

| By End-User | Manufacturing and Automotive Retail and E-commerce Healthcare and Pharmaceuticals Food and Beverage Oil, Gas, Mining, and Quarrying Agriculture, Fishing, and Forestry Construction Others |

| By Service Mode | Road Transport Rail Transport Air Transport Sea Transport Intermodal/Multimodal Transport Others |

| By Industry Vertical | Consumer Goods Electronics Pharmaceuticals Chemicals Textiles Others |

| By Delivery Type | Standard Delivery Express Delivery Scheduled Delivery Same-Day Delivery Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| By Geographic Coverage | Domestic Logistics International Logistics Regional Logistics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Services | 100 | Logistics Coordinators, Fleet Managers |

| Warehousing Solutions | 70 | Warehouse Managers, Operations Directors |

| Last-Mile Delivery Services | 60 | Delivery Managers, eCommerce Logistics Heads |

| Cold Chain Logistics | 40 | Supply Chain Managers, Quality Assurance Officers |

| Freight Forwarding Services | 50 | Import/Export Managers, Trade Compliance Officers |

The Turkey Logistics Services Market is valued at approximately USD 45 billion, driven by increasing demand for efficient supply chain solutions, e-commerce growth, and significant investments in logistics infrastructure.