Region:Middle East

Author(s):Shubham

Product Code:KRAD6654

Pages:86

Published On:December 2025

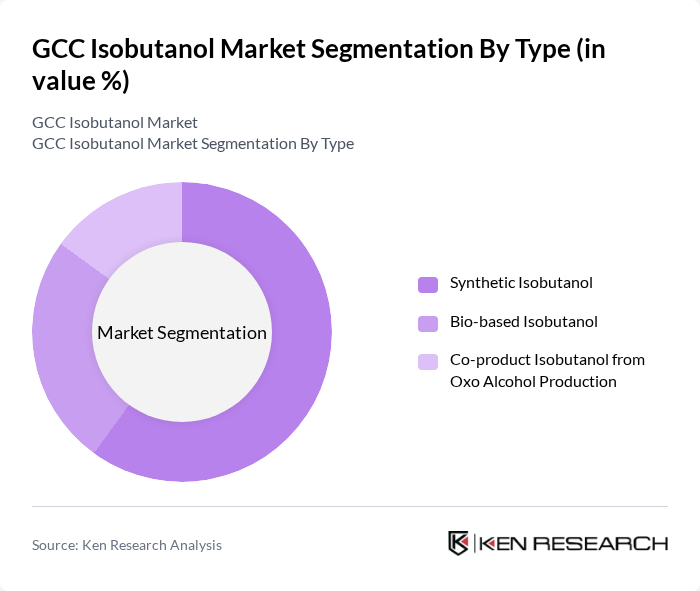

By Type:The market is segmented into three main types: Synthetic Isobutanol, Bio-based Isobutanol, and Co-product Isobutanol from Oxo Alcohol Production. Synthetic Isobutanol, produced mainly via oxo synthesis from petrochemical feedstocks, is widely used due to its cost-effectiveness, established supply base, and suitability for large-volume applications such as solvents and chemical intermediates. Bio-based Isobutanol, manufactured through fermentation routes, is gaining traction globally because of increasing environmental concerns, carbon reduction targets, and demand for renewable fuels and green solvents, with GCC players monitoring or partnering on such technologies for future deployment. Co-product Isobutanol from Oxo Alcohol Production remains significant in the GCC as it leverages existing butanol and oxo-alcohol chains integrated with large refinery and cracker complexes, improving overall plant economics and feedstock utilization.

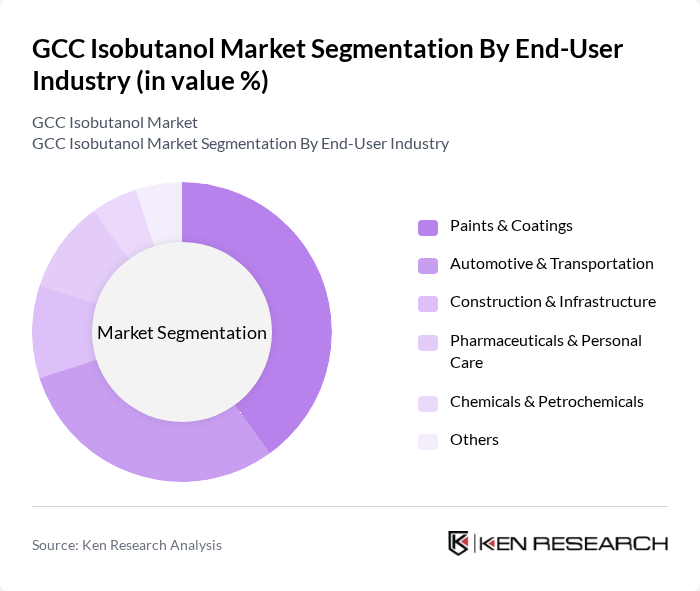

By End-User Industry:The end-user industries for isobutanol include Paints & Coatings, Automotive & Transportation, Construction & Infrastructure, Pharmaceuticals & Personal Care, Chemicals & Petrochemicals, and Others. The Paints & Coatings industry is globally the largest consumer of isobutanol because it is used as a solvent and intermediate in resins and additives, supporting high demand for architectural, industrial, and protective coatings that are important in GCC construction and infrastructure projects. The Automotive & Transportation sector is also significant, driven by its use in fuel formulations, specialty lubricants and additives, and coatings for vehicles and equipment, while pharmaceuticals, personal care, and broader chemicals and petrochemicals consume isobutanol as a versatile intermediate in specialty formulations and synthesis.

The GCC Isobutanol Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Basic Industries Corporation (SABIC), Saudi Kayan Petrochemical Company, Saudi Chevron Phillips Company, Sadara Chemical Company, QatarEnergy, Qatar Petroleum for Refining & Petrochemicals (Q-Chem), Petro Rabigh (Rabigh Refining and Petrochemical Company), Tasnee – National Industrialization Company, Borouge Plc, Abu Dhabi National Oil Company (ADNOC), Saudi Arabian Oil Company (Aramco), Equate Petrochemical Company (Kuwait), Kuwait Petroleum Corporation (KPC), Oman Oil Refineries and Petroleum Industries Company (Orpic), LyondellBasell Industries Holdings B.V. (Key Import Supplier to GCC) contribute to innovation, geographic expansion, and service delivery in this space.

The GCC isobutanol market is expected to evolve significantly, driven by increasing investments in sustainable chemical production and a growing emphasis on eco-friendly products. As industries adapt to stringent environmental regulations, the demand for isobutanol is likely to rise, particularly in biofuels and specialty chemicals. Furthermore, technological advancements in production processes will enhance efficiency and reduce costs, positioning isobutanol as a competitive choice in the solvent market. Strategic collaborations will also play a crucial role in expanding market reach and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Synthetic Isobutanol Bio-based Isobutanol Co-product Isobutanol from Oxo Alcohol Production |

| By End-User Industry | Paints & Coatings Automotive & Transportation Construction & Infrastructure Pharmaceuticals & Personal Care Chemicals & Petrochemicals Others |

| By Application | Solvents & Coalescing Agents Fuel and Oxygenate Blending (Gasoline/Biofuel) Chemical Intermediate (Isobutyl Acrylate, Isobutyl Acetate, etc.) Lube Oil Additives & Plasticizers Others |

| By Distribution Channel | Direct Sales to End Users Sales via Regional Chemical Distributors Long?term Offtake / Supply Agreements Spot / Trader-Based Sales |

| By Geography (Within GCC) | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain |

| By Production Route | Oxo Process (Propylene-Based Petrochemical Route) Bio-Fermentation Route Import & Repackaging |

| By Regulatory & Specification Compliance | REACH / GHS & Local GCC Chemical Registration Environmental & Emissions Standards (e.g., GSO, SFDA, MOCCAE) Quality & Management Standards (ISO 9001, ISO 14001, etc.) Industry-Specific Specifications (Automotive, Coatings, Pharma) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Fuel Additives | 100 | Product Managers, R&D Engineers |

| Personal Care Products | 80 | Formulation Chemists, Brand Managers |

| Industrial Solvents | 70 | Procurement Managers, Operations Directors |

| Pharmaceutical Applications | 60 | Regulatory Affairs Specialists, Quality Control Managers |

| Food and Beverage Industry | 90 | Product Development Managers, Supply Chain Analysts |

The GCC Isobutanol Market is valued at approximately USD 90 million, driven by the increasing demand for isobutanol as a solvent and chemical intermediate in various industries, including paints, coatings, and specialty chemicals.