Region:Middle East

Author(s):Shubham

Product Code:KRAD2017

Pages:85

Published On:December 2025

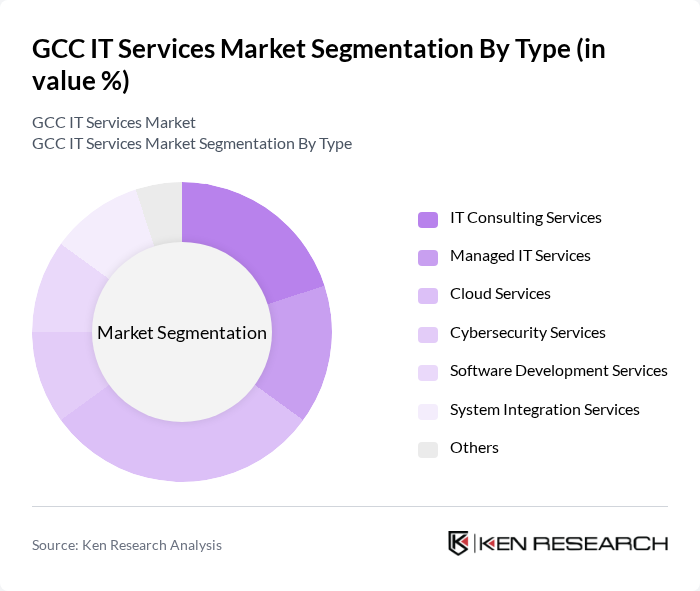

By Type:The IT Services market is segmented into various types, including IT Consulting Services, Managed IT Services, Cloud Services, Cybersecurity Services, Software Development Services, System Integration Services, and Others. Among these, Cloud Services is currently dominating the market due to the increasing adoption of cloud technologies by businesses seeking scalability and flexibility. The demand for IT Consulting Services is also significant as organizations look for expert guidance in navigating digital transformation.

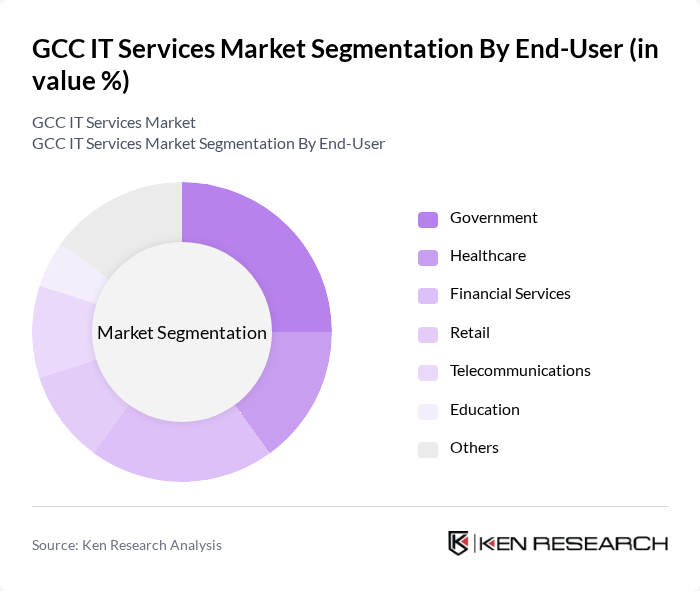

By End-User:The end-user segmentation includes Government, Healthcare, Financial Services, Retail, Telecommunications, Education, and Others. The Government sector is a significant contributor to the IT Services market, driven by initiatives aimed at enhancing public services through technology. The Financial Services sector also plays a crucial role, as banks and financial institutions increasingly invest in IT solutions to improve operational efficiency and customer experience.

The GCC IT Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM, Accenture, Oracle, SAP, Microsoft, Cisco Systems, HPE (Hewlett Packard Enterprise), Dell Technologies, Infosys, Wipro, TCS (Tata Consultancy Services), Fujitsu, Atos, Capgemini, and NTT Data contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC IT services market appears promising, driven by the increasing adoption of artificial intelligence, cloud computing, and smart city initiatives. With AI projected to account for USD 42.2 billion of the digital transformation market in future, and cloud solutions expected to generate USD 24.7 billion, the region is poised for significant technological advancements. Additionally, the ongoing government investments in digital infrastructure will further enhance the market landscape, fostering innovation and growth in IT services.

| Segment | Sub-Segments |

|---|---|

| By Type | IT Consulting Services Managed IT Services Cloud Services Cybersecurity Services Software Development Services System Integration Services Others |

| By End-User | Government Healthcare Financial Services Retail Telecommunications Education Others |

| By Industry Vertical | Banking, Financial Services, and Insurance (BFSI) Manufacturing Energy and Utilities Transportation and Logistics Media and Entertainment Others |

| By Service Model | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid Others |

| By Geographic Presence | UAE Saudi Arabia Qatar Kuwait Oman Bahrain Others |

| By Customer Size | Large Enterprises Medium Enterprises Small Enterprises Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cloud Computing Services | 150 | IT Managers, Cloud Architects |

| Cybersecurity Solutions | 100 | Chief Information Security Officers, IT Security Analysts |

| IT Consulting Services | 80 | Consultants, Project Managers |

| Managed IT Services | 70 | Operations Managers, Service Delivery Managers |

| Software Development Services | 90 | Software Engineers, Product Managers |

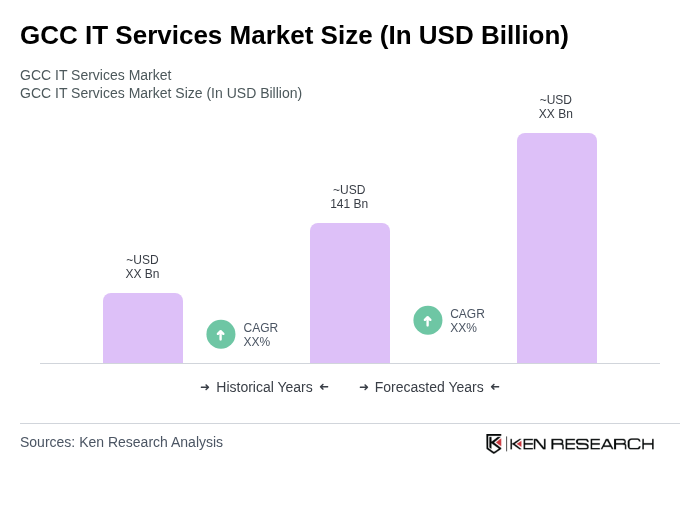

The GCC IT Services Market is valued at approximately USD 141 billion, driven by digital transformation, cloud migration, AI, cybersecurity, and IoT adoption across various industries, supported by government initiatives and investments in technology infrastructure.