Region:Middle East

Author(s):Shubham

Product Code:KRAD1991

Pages:89

Published On:December 2025

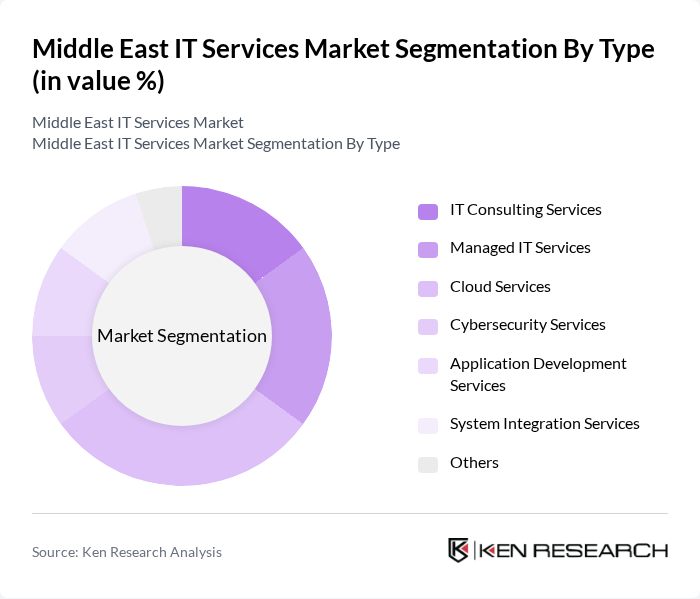

By Type:The IT Services market is segmented into various types, including IT Consulting Services, Managed IT Services, Cloud Services, Cybersecurity Services, Application Development Services, System Integration Services, and Others. Among these, Cloud Services are currently dominating the market due to the increasing demand for scalable and flexible IT solutions. Organizations are increasingly migrating to cloud platforms to enhance operational efficiency and reduce costs, leading to a significant rise in cloud adoption across various sectors.

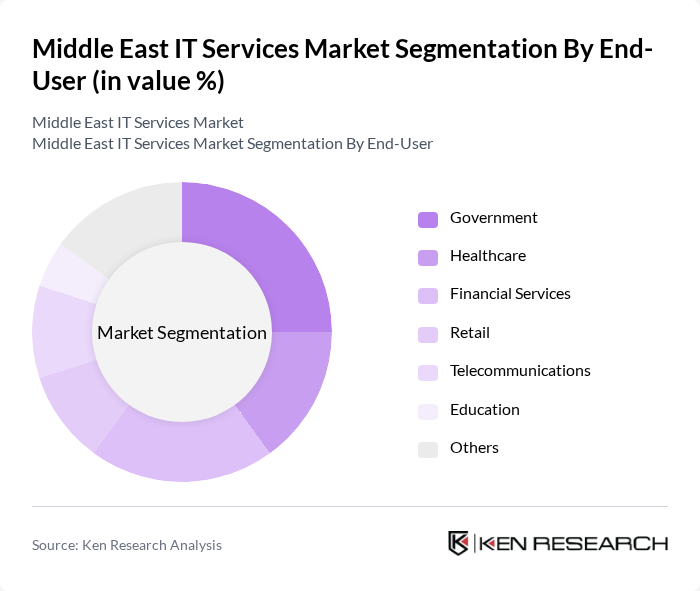

By End-User:The market is segmented by end-users, including Government, Healthcare, Financial Services, Retail, Telecommunications, Education, and Others. The Government sector is currently the leading end-user, driven by significant investments in digital transformation initiatives and the implementation of smart city projects. This sector's focus on enhancing public services through technology adoption is propelling the demand for IT services.

The Middle East IT Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Middle East, Accenture, Oracle, SAP, Microsoft, Cisco Systems, Infosys, Wipro, TCS (Tata Consultancy Services), HCL Technologies, Atos, Fujitsu, Dimension Data, Tech Mahindra, and NTT Data contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East IT services market is poised for significant transformation, driven by accelerating investments in AI and cloud infrastructure. With projected IT services spending reaching USD 27,393 million in future, enterprises are increasingly adopting AI-integrated solutions to enhance operational efficiency. Additionally, the focus on sustainable technology practices is expected to reshape the market landscape, as organizations seek to align with global sustainability goals while leveraging digital innovations for growth.

| Segment | Sub-Segments |

|---|---|

| By Type | IT Consulting Services Managed IT Services Cloud Services Cybersecurity Services Application Development Services System Integration Services Others |

| By End-User | Government Healthcare Financial Services Retail Telecommunications Education Others |

| By Industry Vertical | Banking and Financial Services Manufacturing Energy and Utilities Transportation and Logistics Media and Entertainment Others |

| By Service Model | On-Premises Services Cloud-Based Services Hybrid Services Others |

| By Deployment Type | Public Cloud Private Cloud Hybrid Cloud Others |

| By Geographic Region | GCC Countries Levant Region North Africa Others |

| By Customer Size | Large Enterprises Medium Enterprises Small Enterprises Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cloud Computing Services | 150 | IT Managers, Cloud Architects |

| Cybersecurity Solutions | 100 | CISOs, Security Analysts |

| IT Consulting Services | 80 | Consultants, Project Managers |

| Managed IT Services | 70 | Operations Managers, Service Delivery Heads |

| Software Development Services | 90 | Software Engineers, Product Managers |

The Middle East IT Services Market is valued at approximately USD 235 billion, driven by government-backed digitization programs, 5G deployment, and increased investments in hyperscale data centers, reflecting a robust growth trajectory in the region.