Region:Middle East

Author(s):Dev

Product Code:KRAD5169

Pages:99

Published On:December 2025

By Product Type:The product type segmentation includes various devices used for kidney stone retrieval. The dominant sub-segment is lithotripters, particularly extracorporeal shock wave lithotripsy (ESWL) systems and laser lithotripters, which are widely used for fragmentation of stones and support non-invasive or minimally invasive procedures. Ureteroscopes, both flexible and rigid, are also gaining traction as they allow direct visualization and intraluminal treatment of stones throughout the ureter and intrarenal collecting system, and their role is expanding with the shift toward ureteroscopic lithotripsy as a primary modality. Stone retrieval baskets and forceps remain essential for manual extraction of fragments following lithotripsy, while ureteral stents and access sheaths facilitate access, drainage, and pressure control during and after procedures. Other devices, including guidewires, catheters, and ancillary accessories such as suction?enabled sheaths, support navigation, irrigation, and clearance of residual fragments, contributing to higher stone?free rates.

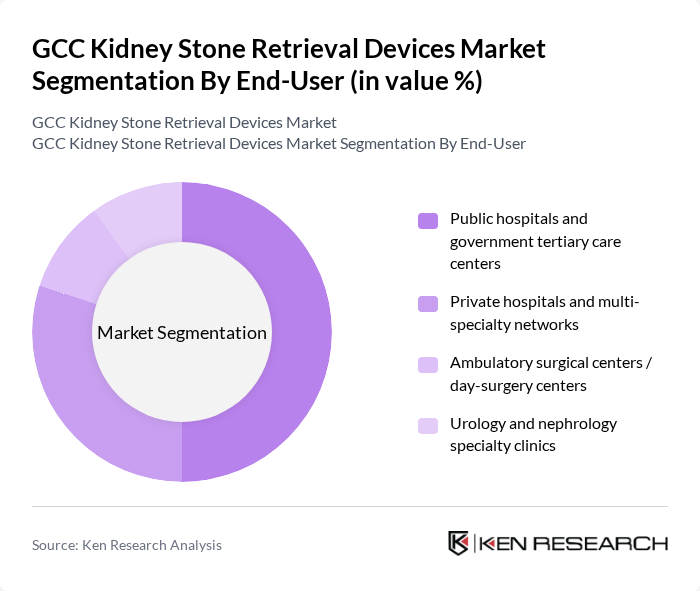

By End-User:The end-user segmentation highlights the various healthcare settings utilizing kidney stone retrieval devices. Public hospitals and government tertiary care centers are the largest users due to their 24/7 emergency coverage, ability to manage complex stone disease (including PCNL and combined procedures), and access to capital-intensive technologies such as ESWL units and digital ureteroscopes. Private hospitals and multi-specialty networks follow closely, increasingly investing in day?surgery capable endourology suites to attract insured and medical tourism patients with advanced minimally invasive options. Ambulatory surgical centers are becoming more common for elective ureteroscopy and short?stay procedures as payers and providers look to shift suitable cases from inpatient to outpatient settings, while urology and nephrology specialty clinics focus on diagnosis, metabolic evaluation, and longitudinal management, often coordinating with hospital-based surgical units for definitive stone removal.

The GCC Kidney Stone Retrieval Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Boston Scientific Corporation, Olympus Corporation, Karl Storz SE & Co. KG, Cook Medical LLC, Richard Wolf GmbH, Dornier MedTech GmbH, Coloplast A/S, Becton, Dickinson and Company (BD), Stryker Corporation, Teleflex Incorporated, Boston Scientific LithoVue Single-Use Digital Flexible Ureteroscope Business, EMS Electro Medical Systems S.A., Allium Medical Solutions Ltd., Polymed Medical Devices (Poly Medicure Limited), Local GCC distributors and integrators (e.g., Gulf Medical Co. Ltd., Arabian Healthcare Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC kidney stone retrieval devices market appears promising, driven by ongoing technological advancements and increasing healthcare investments. As the region continues to prioritize healthcare infrastructure, the adoption of minimally invasive procedures is expected to rise, enhancing patient experiences. Furthermore, the integration of artificial intelligence in medical devices will likely streamline operations and improve diagnostic accuracy, positioning the market for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Lithotripters (ESWL systems, laser lithotripters) Ureteroscopes (flexible and rigid) Stone retrieval baskets and forceps Ureteral stents and access sheaths Others (guidewires, catheters, ancillary devices) |

| By End-User | Public hospitals and government tertiary care centers Private hospitals and multi-specialty networks Ambulatory surgical centers / day-surgery centers Urology and nephrology specialty clinics |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain |

| By Procedure Type | Ureteroscopy (URS) and retrograde intrarenal surgery (RIRS) Extracorporeal shock wave lithotripsy (ESWL) Percutaneous nephrolithotomy (PCNL) / mini-PCNL Open and laparoscopic stone surgery |

| By Stone Location | Kidney (renal calyces and pelvis) Ureter (proximal, mid, and distal) Bladder and urethra |

| By Purchasing Channel | Direct tenders and centralized government procurement Group purchasing organizations (GPOs) Direct hospital and clinic contracts Distributor and dealer networks |

| By Device Usage | Single-use (disposable) devices Reusable devices |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urology Clinics | 100 | Urologists, Clinic Managers |

| Hospitals with Urology Departments | 120 | Procurement Officers, Department Heads |

| Medical Device Distributors | 80 | Sales Managers, Product Specialists |

| Healthcare Regulatory Bodies | 50 | Regulatory Affairs Managers, Policy Analysts |

| Patient Advocacy Groups | 60 | Patient Representatives, Health Educators |

The GCC Kidney Stone Retrieval Devices Market is valued at approximately USD 140 million, based on historical analysis and extrapolation from global market trends. This growth is driven by increasing kidney stone prevalence and advancements in minimally invasive urology technologies.