Region:Middle East

Author(s):Rebecca

Product Code:KRAC9848

Pages:83

Published On:November 2025

By Type:The luxury leather goods market can be segmented into various types, including handbags, wallets, footwear, belts, small leather accessories, luggage (travel bags & backpacks), and others. Among these, handbags and footwear are the most popular segments, driven by fashion trends and consumer preferences for stylish and functional products. The increasing demand for personalized and unique items has also led to a rise in small leather accessories. Luggage and travel bags are gaining traction due to increased travel and tourism across the region, while belts and wallets remain staple purchases among male consumers.

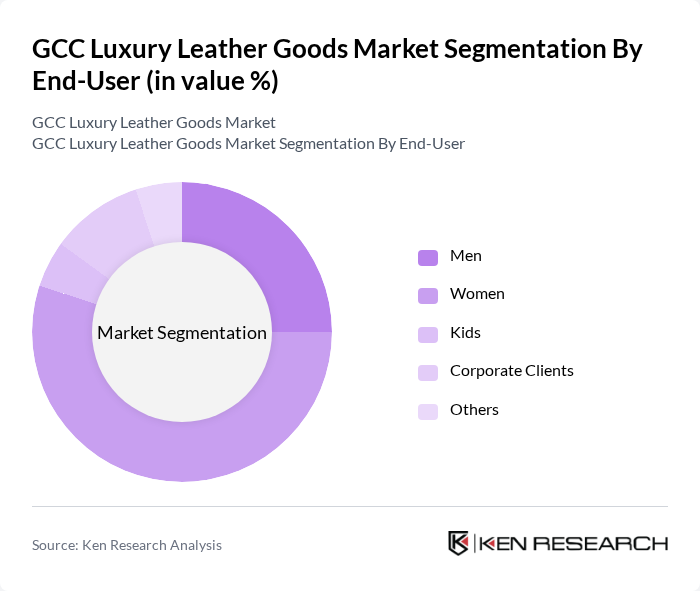

By End-User:The end-user segmentation includes men, women, kids, corporate clients, and others. Women represent the largest consumer group in the luxury leather goods market, driven by their higher spending on fashion and accessories. Men are also increasingly investing in luxury leather products, particularly in categories like wallets and belts, while corporate clients often purchase high-end items for gifting and branding purposes. The rise of digital luxury platforms and omnichannel retailing has further broadened access for all segments.

The GCC Luxury Leather Goods Market is characterized by a dynamic mix of regional and international players. Leading participants such as Louis Vuitton (LVMH), Gucci (Kering), Prada, Hermès, Chanel, Burberry, Fendi (LVMH), Bottega Veneta (Kering), Salvatore Ferragamo, Valentino, Michael Kors (Capri Holdings), Coach (Tapestry, Inc.), Rimowa (LVMH), Montblanc (Richemont), Bally, Saint Laurent (Kering), Moynat (LVMH), Chalhoub Group (regional distributor/retailer), Trafalgar Luxury Group (regional distributor/retailer) contribute to innovation, geographic expansion, and service delivery in this space.

The GCC luxury leather goods market is poised for continued growth, driven by evolving consumer preferences and technological advancements. As digital transformation reshapes retail, brands are expected to enhance their online presence and leverage data analytics for personalized marketing. Additionally, sustainability will play a crucial role, with consumers increasingly favoring eco-friendly products. The integration of innovative designs and craftsmanship will further attract discerning buyers, ensuring a vibrant market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Handbags Wallets Footwear Belts Small Leather Accessories Luggage (Travel Bags & Backpacks) Others |

| By End-User | Men Women Kids Corporate Clients Others |

| By Distribution Channel | Exclusive Brand Outlets Multi-Brand Stores Online Retail Airports Others |

| By Material | Cowhide Sheepskin Goatskin Exotic Leathers (e.g., crocodile, ostrich) Synthetic Leather Others |

| By Price Range | Premium Super Premium Luxury Ultra-Luxury Others |

| By Consumer Demographics | Age Group Gender Income Level Nationality (Local vs. Expatriate) Lifestyle Preferences Others |

| By Occasion | Everyday Use Formal Events Gifting Travel Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Handbag Purchases | 120 | Affluent Consumers, Fashion Enthusiasts |

| Leather Accessories Market | 90 | Retail Managers, Brand Representatives |

| Consumer Preferences in Luxury Goods | 100 | High-Income Shoppers, Trend Analysts |

| Online vs. Offline Purchasing Behavior | 60 | E-commerce Managers, Digital Marketing Experts |

| Market Trends and Insights | 70 | Fashion Industry Experts, Retail Analysts |

The GCC Luxury Leather Goods Market is valued at approximately USD 130 million, reflecting a five-year historical analysis. This growth is attributed to rising disposable incomes and an increasing number of affluent consumers in the region.