Region:Middle East

Author(s):Rebecca

Product Code:KRAD2408

Pages:94

Published On:January 2026

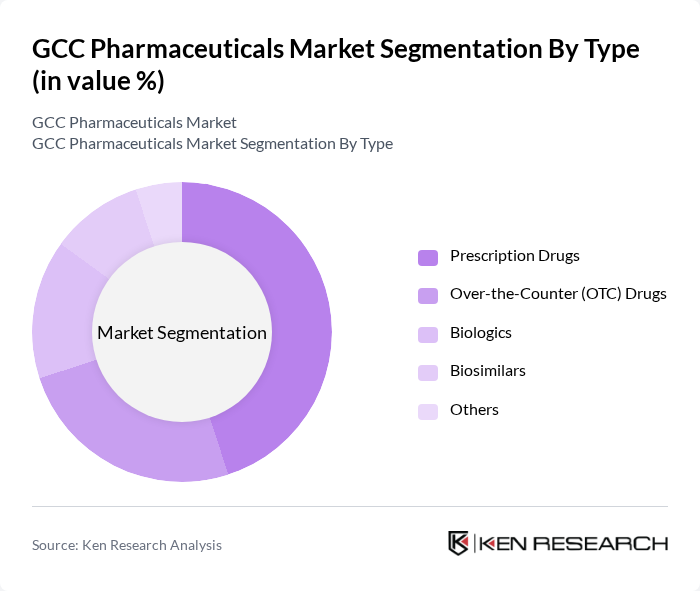

By Type:The pharmaceutical market can be segmented into various types, including Prescription Drugs, Over-the-Counter (OTC) Drugs, Biopharmaceuticals, Generic Drugs, and Others. Among these, Prescription Drugs are currently leading the market due to the increasing prevalence of chronic diseases and the growing demand for specialized medications including branded drugs preferred for perceived higher quality. The rise in healthcare awareness and the expansion of health insurance coverage have also contributed to the increased consumption of prescription medications.

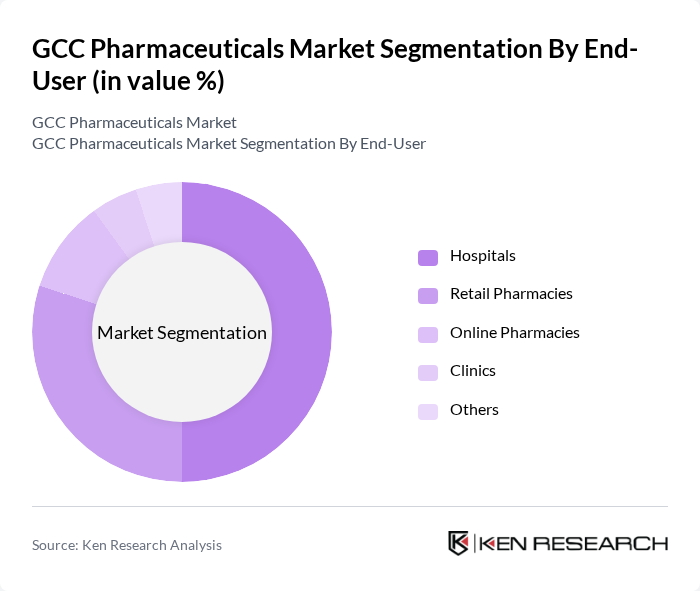

By End-User:The end-user segmentation includes Hospitals, Retail Pharmacies, Clinics, Online Pharmacies, and Others. Hospitals are the dominant segment, driven by the increasing number of healthcare facilities and the rising demand for advanced medical treatments. The trend towards outpatient care and the growing preference for specialized hospitals have further fueled the demand for pharmaceuticals in this segment.

The GCC Pharmaceuticals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pfizer, Novartis, Roche, Sanofi, GSK, Merck & Co., AbbVie, AstraZeneca, Bayer, Teva Pharmaceutical Industries, Hikma Pharmaceuticals, Mylan, Amgen, Boehringer Ingelheim, Takeda Pharmaceutical Company contribute to innovation, geographic expansion, and service delivery in this space.

The GCC pharmaceuticals market is poised for significant transformation, driven by advancements in biotechnology and personalized medicine. As healthcare providers increasingly adopt digital health solutions, the integration of telemedicine and e-pharmacies will reshape patient engagement and access to medications. Furthermore, collaborations between pharmaceutical companies and research institutions are expected to accelerate drug development, enhancing the region's capacity to address chronic diseases and improve overall health outcomes.

| Segment | Sub-Segments |

|---|---|

| By Type | Prescription Drugs Over-the-Counter (OTC) Drugs Biopharmaceuticals Generic Drugs Others |

| By End-User | Hospitals Retail Pharmacies Clinics Online Pharmacies Others |

| By Therapeutic Area | Cardiovascular Oncology Neurology Infectious Diseases Others |

| By Distribution Channel | Direct Sales Wholesalers Retail Pharmacies Online Sales Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman |

| By Product Formulation | Tablets Capsules Injectables Topicals Others |

| By Policy Support | Subsidies for local manufacturers Tax incentives for R&D Regulatory support for new entrants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Retail Market | 120 | Pharmacy Owners, Retail Managers |

| Hospital Pharmacy Operations | 100 | Pharmacy Directors, Clinical Pharmacists |

| Generic Drug Market Insights | 80 | Procurement Managers, Regulatory Affairs Specialists |

| Biopharmaceuticals and Biotechnology | 70 | Research Scientists, Product Development Managers |

| Patient Access and Affordability | 90 | Healthcare Policy Analysts, Patient Advocacy Representatives |

The GCC Pharmaceuticals Market is valued at approximately USD 17 billion, driven by increasing healthcare expenditure, a rise in chronic diseases, and a demand for innovative therapies. This valuation is based on a comprehensive five-year historical analysis.