Region:Middle East

Author(s):Rebecca

Product Code:KRAD4284

Pages:93

Published On:December 2025

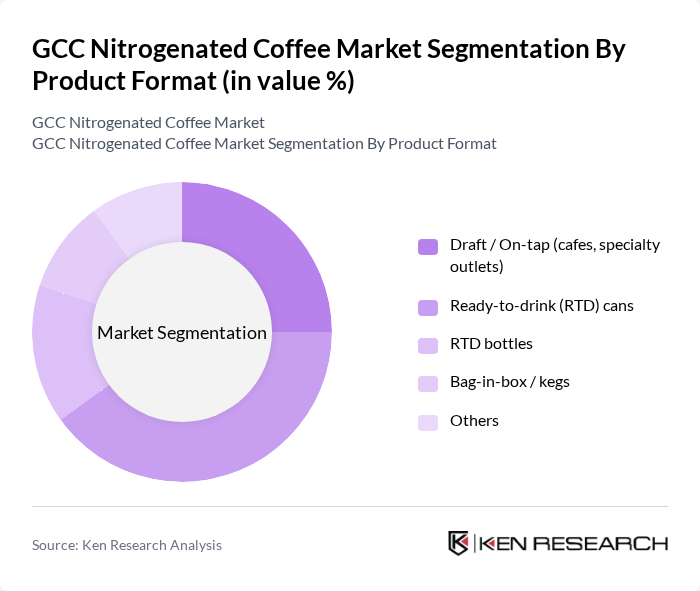

By Product Format:The product format segmentation includes various ways nitrogenated coffee is offered to consumers. The subsegments are Draft / On-tap (cafes, specialty outlets), Ready-to-drink (RTD) cans, RTD bottles, Bag-in-box / kegs, and Others. Among these, Ready-to-drink (RTD) cans have gained significant traction due to their convenience and portability, appealing to busy consumers seeking quick coffee solutions. The on-tap format is also popular in cafes, providing a fresh and unique experience.

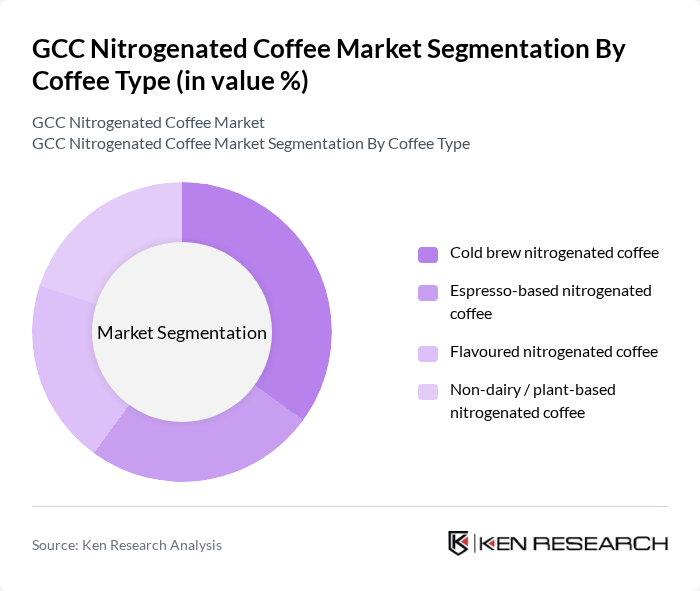

By Coffee Type:This segmentation focuses on the different types of nitrogenated coffee available in the market, including Cold brew nitrogenated coffee, Espresso-based nitrogenated coffee, Flavoured nitrogenated coffee, and Non-dairy / plant-based nitrogenated coffee. Cold brew nitrogenated coffee is currently the leading subsegment, driven by consumer demand for smoother, less acidic coffee options. The trend towards plant-based diets has also boosted the popularity of non-dairy options, appealing to health-conscious consumers.

The GCC Nitrogenated Coffee Market is characterized by a dynamic mix of regional and international players. Leading participants such as Starbucks Corporation, Nestlé S.A. (including Nescafé and Nespresso), Dunkin' (Inspire Brands, Inc.), Costa Coffee (The Coca?Cola Company), Tim Hortons (Restaurant Brands International Inc.), % Arabica (Asiamix Group / % Arabica International), Coffee Planet LLC, Boneshaker Coffee Roaster (regional nitro and cold brew supplier), Tres Marias Coffee Company, RAW Coffee Company, Seven Fortunes Coffee Roasters, Black Sheep Coffee, Blue Bottle Coffee (Nestlé Group), La Colombe Coffee Roasters, Stumptown Coffee Roasters contribute to innovation, geographic expansion, and service delivery in this space.

The GCC nitrogenated coffee market is poised for significant growth, driven by evolving consumer preferences and technological advancements. As the trend towards convenience and specialty coffee continues, companies are likely to invest in innovative product development and marketing strategies. Additionally, the integration of e-commerce platforms will facilitate wider distribution, making nitrogenated coffee more accessible. With increasing health consciousness, brands that emphasize quality and sustainability are expected to resonate well with consumers, further enhancing market dynamics in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Format | Draft / On-tap (cafes, specialty outlets) Ready-to-drink (RTD) cans RTD bottles Bag-in-box / kegs Others |

| By Coffee Type | Cold brew nitrogenated coffee Espresso-based nitrogenated coffee Flavoured nitrogenated coffee Non-dairy / plant-based nitrogenated coffee |

| By Packaging Type | Aluminum cans Glass bottles PET bottles Kegs and growlers Others |

| By Distribution Channel | On-trade (cafes, coffee chains, specialty coffee shops) Hotels, restaurants, and catering (HoReCa) Supermarkets/Hypermarkets Convenience stores Online retail and delivery platforms Others |

| By Flavor Profile | Original / unflavoured Vanilla Mocha / chocolate Caramel and indulgent flavours Seasonal and limited-edition flavours |

| By Region | UAE Saudi Arabia Qatar Kuwait Oman Bahrain |

| By Consumer Demographics | Age group (Gen Z, Millennials, others) Income level Expat vs. local consumers Lifestyle & health orientation (fitness-focused, premium seekers, convenience-driven) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Coffee Outlets | 120 | Café Owners, Baristas, Retail Managers |

| Consumer Preferences | 140 | Coffee Drinkers, Health-Conscious Consumers |

| Distribution Channels | 90 | Distributors, Wholesalers, Supply Chain Managers |

| Market Trends Analysis | 80 | Market Analysts, Industry Experts |

| Product Development Insights | 70 | Product Managers, R&D Specialists |

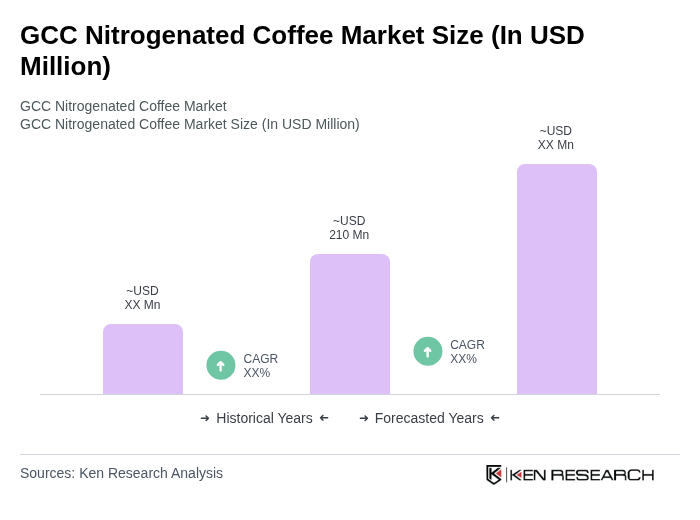

The GCC Nitrogenated Coffee Market is valued at approximately USD 210 million, reflecting a growing consumer interest in cold brew and nitrogen-infused coffee beverages, driven by evolving preferences and an expanding café culture in the region.