Region:Middle East

Author(s):Rebecca

Product Code:KRAC3182

Pages:94

Published On:October 2025

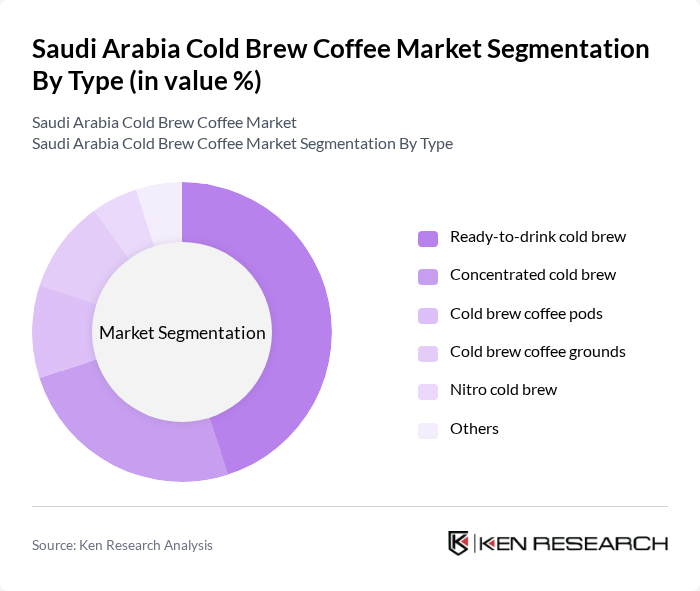

By Type:The market is segmented into various types of cold brew coffee products, including ready-to-drink cold brew, concentrated cold brew, cold brew coffee pods, cold brew coffee grounds, nitro cold brew, and others. Among these, ready-to-drink cold brew is the most popular due to its convenience and growing consumer preference for on-the-go beverages. Concentrated cold brew is also gaining traction as consumers look for versatile coffee options that can be customized at home.

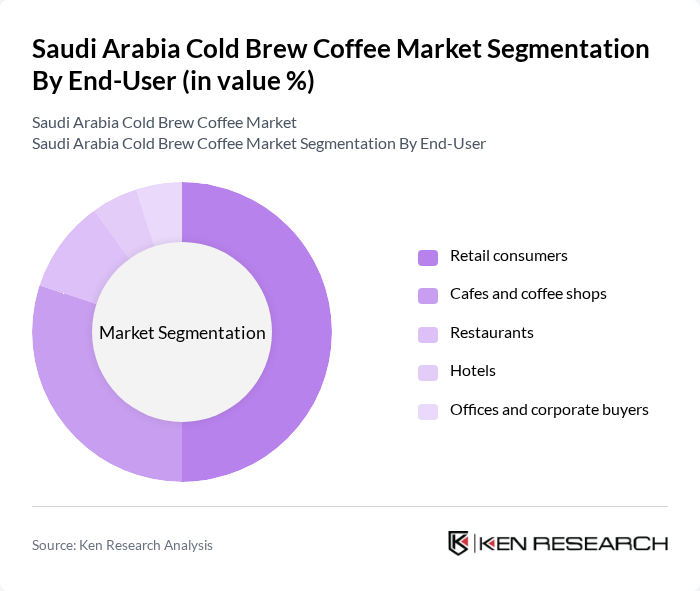

By End-User:The end-user segmentation includes retail consumers, cafes and coffee shops, restaurants, hotels, and offices and corporate buyers. Retail consumers dominate the market as the trend of home brewing and on-the-go consumption rises. Cafes and coffee shops are also significant contributors, as they offer a variety of cold brew options to cater to customer preferences, enhancing the overall coffee experience. The segment is further supported by the proliferation of specialty coffee outlets and the rising popularity of premium coffee beverages among young urban consumers.

The Saudi Arabia Cold Brew Coffee Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Coffee Company, Almarai Company, Nespresso Middle East, Starbucks Coffee Company, Coffee Planet, Lavazza S.p.A., Illycaffè S.p.A., Costa Coffee, Dunkin' Brands Group, Inc., Nestlé S.A., JDE Peet's, The Coffee Bean & Tea Leaf, Tim Hortons, Peet's Coffee, Blue Bottle Coffee, Stumptown Coffee Roasters, Cold Brew Coffee Co. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold brew coffee market in Saudi Arabia appears promising, driven by evolving consumer preferences and a burgeoning coffee culture. As the market matures, innovations in flavors and brewing techniques are expected to attract a broader audience. Additionally, the rise of e-commerce platforms will facilitate easier access to cold brew products, enhancing market penetration. With increasing health consciousness, cold brew coffee is likely to become a staple in the beverage choices of health-oriented consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Ready-to-drink cold brew Concentrated cold brew Cold brew coffee pods Cold brew coffee grounds Nitro cold brew Others |

| By End-User | Retail consumers Cafes and coffee shops Restaurants Hotels Offices and corporate buyers |

| By Distribution Channel | Supermarkets and hypermarkets Online retail Specialty coffee shops Convenience stores Foodservice distributors |

| By Packaging Type | Bottled (PET, glass) Canned Bagged Carton packs |

| By Flavor Profile | Original Flavored (vanilla, mocha, caramel, etc.) Seasonal flavors Functional blends (protein, vitamins, etc.) |

| By Price Range | Premium Mid-range Budget |

| By Brand Loyalty | Established brands Emerging brands Private label brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Cold Brew Coffee | 120 | Coffee Drinkers, Ages 18-45 |

| Retailer Insights on Cold Brew Sales | 60 | Store Managers, Beverage Category Managers |

| Distribution Channel Effectiveness | 50 | Distributors, Importers, Wholesalers |

| Market Trends and Innovations | 40 | Product Development Managers, Marketing Executives |

| Consumer Awareness and Brand Loyalty | 90 | Frequent Coffee Consumers, Brand Advocates |

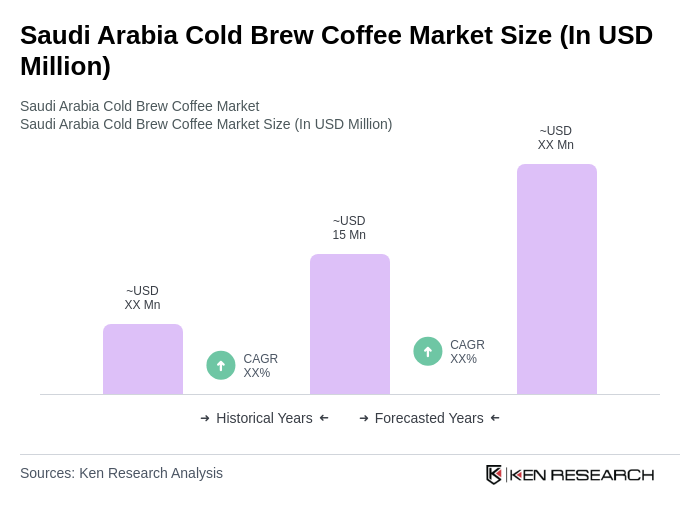

The Saudi Arabia Cold Brew Coffee Market is valued at approximately USD 15 million, reflecting a growing consumer interest in cold brew coffee driven by the rising coffee culture and demand for convenient, ready-to-drink beverages.