Region:Middle East

Author(s):Dev

Product Code:KRAB7573

Pages:98

Published On:October 2025

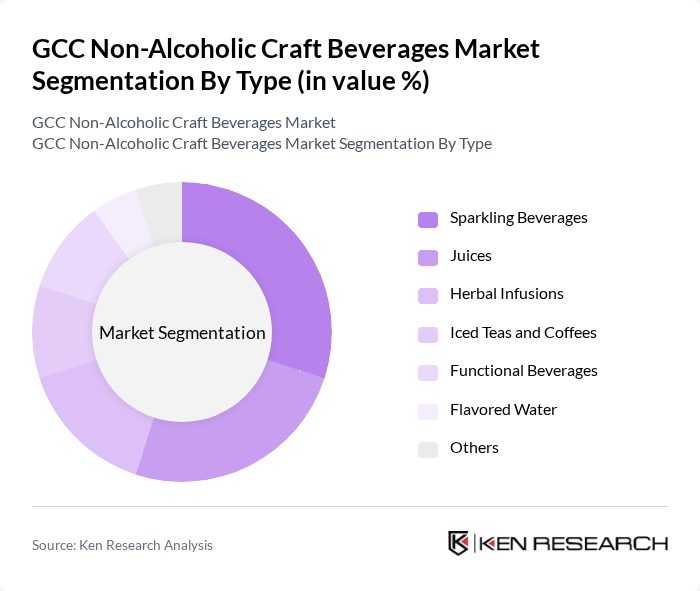

By Type:The market is segmented into various types of beverages, including Sparkling Beverages, Juices, Herbal Infusions, Iced Teas and Coffees, Functional Beverages, Flavored Water, and Others. Among these, Sparkling Beverages and Juices are particularly popular due to their refreshing nature and wide appeal across different consumer segments. The trend towards healthier options has also led to a rise in demand for Herbal Infusions and Functional Beverages, which are perceived as beneficial for health and wellness.

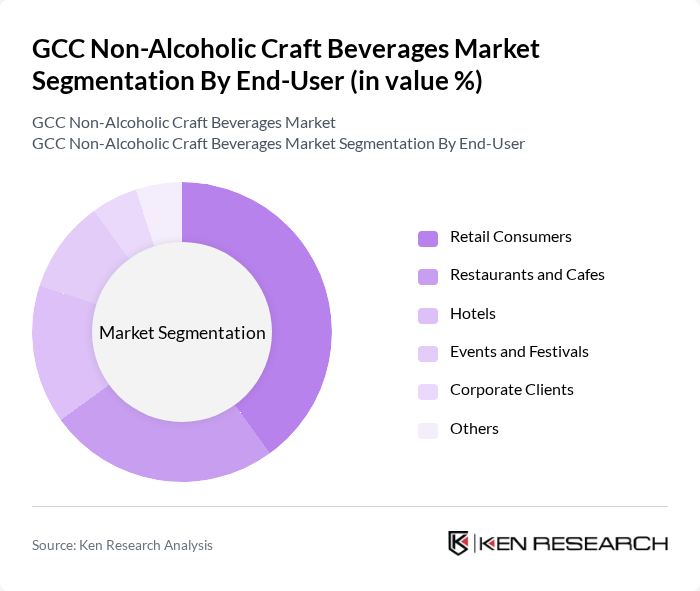

By End-User:The end-user segmentation includes Retail Consumers, Restaurants and Cafes, Hotels, Events and Festivals, Corporate Clients, and Others. Retail Consumers dominate the market as they increasingly seek convenient and healthy beverage options for everyday consumption. The growing café culture in urban areas has also led to a rise in demand from Restaurants and Cafes, while Events and Festivals contribute significantly during peak seasons.

The GCC Non-Alcoholic Craft Beverages Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ain Beverage Company, Juhayna Food Industries, PepsiCo, Inc., Coca-Cola Company, Almarai Company, National Beverage Company, Al Waha Beverages, Al-Fakher Tobacco Company, Al-Maida Beverages, Al-Hokair Group, Al-Mansour Group, Al-Safi Danone, Al-Jazeera Beverages, Al-Baik Food Company, Al-Muhaidib Group contribute to innovation, geographic expansion, and service delivery in this space.

The GCC non-alcoholic craft beverages market is poised for dynamic growth, driven by evolving consumer preferences and increasing health consciousness. As the market matures, innovations in flavor profiles and sustainable practices will likely shape product offerings. Additionally, the rise of e-commerce will facilitate broader distribution, enabling smaller brands to compete effectively. The focus on health and wellness will continue to influence purchasing decisions, creating a favorable environment for new entrants and established brands alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Sparkling Beverages Juices Herbal Infusions Iced Teas and Coffees Functional Beverages Flavored Water Others |

| By End-User | Retail Consumers Restaurants and Cafes Hotels Events and Festivals Corporate Clients Others |

| By Distribution Channel | Supermarkets and Hypermarkets Online Retail Convenience Stores Specialty Stores Direct Sales Others |

| By Packaging Type | Glass Bottles Cans Tetra Packs PET Bottles Others |

| By Flavor Profile | Citrus Berry Tropical Herbal Others |

| By Price Range | Premium Mid-Range Economy Others |

| By Occasion | Everyday Consumption Special Events Seasonal Promotions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Non-Alcoholic Beverages | 150 | General Consumers, Health-Conscious Individuals |

| Retail Distribution Channels for Craft Beverages | 100 | Retail Managers, Beverage Buyers |

| Market Trends in Specialty Juices | 80 | Product Development Managers, Marketing Executives |

| Impact of Social Media on Beverage Choices | 120 | Social Media Influencers, Digital Marketing Specialists |

| Regulatory Compliance in Beverage Production | 70 | Quality Assurance Managers, Compliance Officers |

The GCC Non-Alcoholic Craft Beverages Market is valued at approximately USD 1.5 billion, reflecting a significant growth trend driven by health consciousness and demand for premium products among consumers in the region.