Region:Middle East

Author(s):Shubham

Product Code:KRAC4357

Pages:89

Published On:October 2025

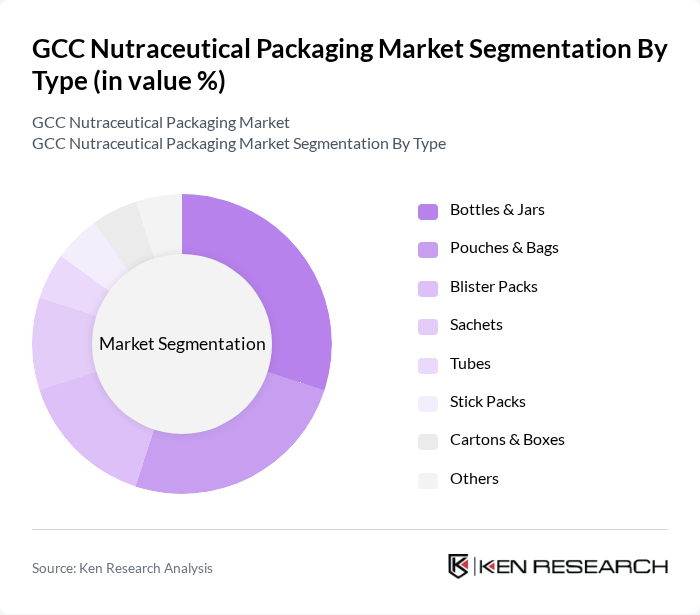

By Type:The market is segmented into various types of packaging solutions, including Bottles & Jars, Pouches & Bags, Blister Packs, Sachets, Tubes, Stick Packs, Cartons & Boxes, and Others. Each type serves different product requirements and consumer preferences, with specific advantages in terms of usability, protection, and branding.

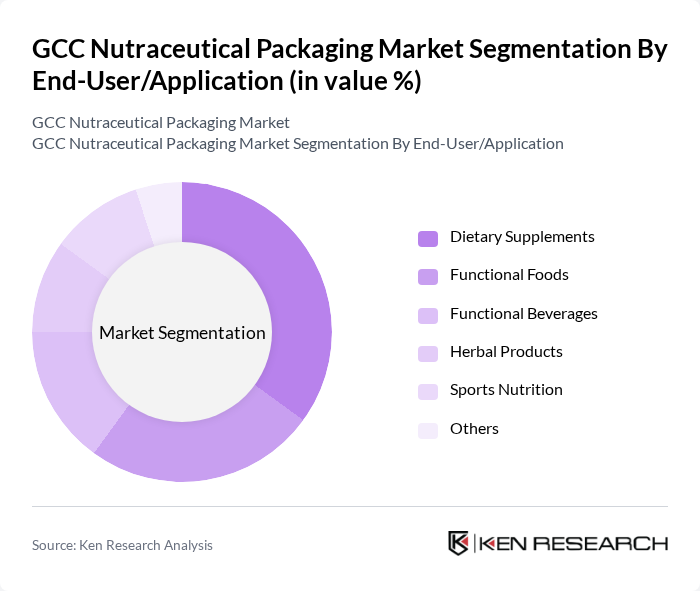

By End-User/Application:The market is further segmented by end-user applications, including Dietary Supplements, Functional Foods, Functional Beverages, Herbal Products, Sports Nutrition, and Others. Each application has unique packaging needs based on product characteristics and consumer usage patterns.

The GCC Nutraceutical Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, Berry Global, Inc., Sealed Air Corporation, WestRock Company, Mondi Group, Smurfit Kappa Group, Huhtamaki Oyj, Sonoco Products Company, Constantia Flexibles, Schott AG, AptarGroup, Inc., ProAmpac LLC, Gerresheimer AG, Sanner Group, Alpla Group contribute to innovation, geographic expansion, and service delivery in this space.

The GCC nutraceutical packaging market is poised for transformative growth, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, companies are increasingly adopting eco-friendly materials, with a projected 25% of packaging expected to be biodegradable in the future. Additionally, the integration of smart packaging technologies is anticipated to enhance consumer engagement and product traceability, aligning with the region's digital transformation initiatives. These trends will shape the market landscape, fostering innovation and competitiveness.

| Segment | Sub-Segments |

|---|---|

| By Type | Bottles & Jars Pouches & Bags Blister Packs Sachets Tubes Stick Packs Cartons & Boxes Others |

| By End-User/Application | Dietary Supplements Functional Foods Functional Beverages Herbal Products Sports Nutrition Others |

| By Material | Plastic Glass Metal Paper & Paperboard Aluminum Foil Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Pharmacies/Drug Stores Others |

| By Country/Region | UAE Saudi Arabia Qatar Kuwait Oman Bahrain Others |

| By Packaging Type | Rigid Packaging Flexible Packaging Semi-rigid Packaging |

| By Price Range | Economy Mid-range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Nutraceutical Manufacturers | 100 | Production Managers, Quality Assurance Heads |

| Packaging Suppliers | 60 | Sales Directors, Product Development Managers |

| Retailers of Nutraceutical Products | 50 | Store Managers, Category Buyers |

| Health and Wellness Experts | 40 | Nutritionists, Health Coaches |

| Consumers of Nutraceuticals | 120 | Health-Conscious Shoppers, Regular Nutraceutical Users |

The GCC Nutraceutical Packaging Market is valued at approximately USD 1.4 billion, reflecting a significant growth driven by increasing consumer awareness of health and wellness, alongside rising demand for dietary supplements and functional foods.