Region:Middle East

Author(s):Dev

Product Code:KRAA9701

Pages:80

Published On:November 2025

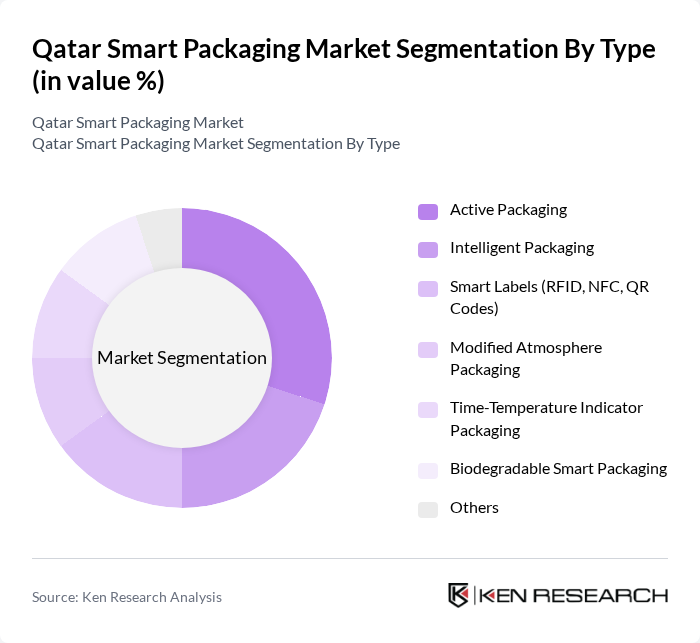

By Type:The smart packaging market can be segmented into various types, including Active Packaging, Intelligent Packaging, Smart Labels (RFID, NFC, QR Codes), Modified Atmosphere Packaging, Time-Temperature Indicator Packaging, Biodegradable Smart Packaging, and Others. Among these, Active Packaging is gaining significant traction due to its ability to enhance product shelf life and maintain quality. The increasing consumer demand for fresh and safe food products drives the adoption of active packaging solutions, making it a leading subsegment in the market. Digital printing and QR-code integration are rapidly expanding, especially for e-commerce and retail applications, while biodegradable smart packaging is increasingly prioritized by food and beverage brands to meet sustainability targets .

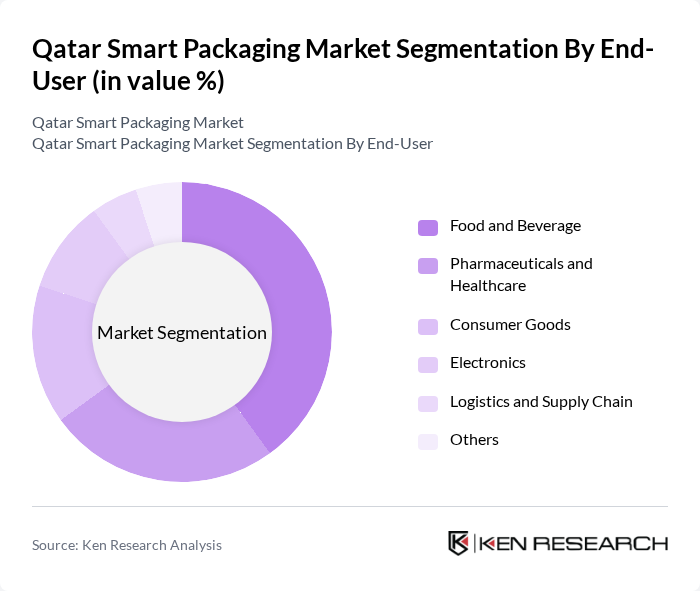

By End-User:The end-user segmentation of the smart packaging market includes Food and Beverage, Pharmaceuticals and Healthcare, Consumer Goods, Electronics, Logistics and Supply Chain, and Others. The Food and Beverage sector is the largest end-user, driven by the increasing demand for packaged food products and the need for enhanced safety and freshness. This sector's focus on innovative packaging solutions to attract consumers and ensure product quality solidifies its position as the leading segment. Pharmaceuticals and Healthcare are rapidly growing due to hospital expansions and cold-chain investments, while e-commerce and logistics are expanding secondary packaging requirements .

The Qatar Smart Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Plastic Products Company (QPPC), Gulf Packaging Industries Limited (GPIL), Qatari German Company for Smart Packaging, Al Jazeera Packaging Company, Qatar National Plastic Factory, Doha Plastic Co. Ltd., Zultec Group (Qatar), Al Mufeed Packaging & Packing Materials, SIG Combibloc Obeikan (Qatar), Gulf Plastic Industries Co. (Qatar), Huhtamaki Flexible Packaging Middle East (Qatar), Mondi Group (Qatar Operations), Amcor Flexibles Middle East (Qatar), Tetra Pak (Qatar), Qatar Green Packaging Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar smart packaging market appears promising, driven by increasing investments in technology and sustainability initiatives. As consumer preferences shift towards personalized and eco-friendly packaging, companies are likely to innovate rapidly. The integration of IoT technologies will enhance supply chain transparency and efficiency, while government incentives for sustainable practices will further stimulate market growth. Overall, the sector is poised for significant advancements, aligning with Qatar's broader economic diversification goals and commitment to sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Active Packaging Intelligent Packaging Smart Labels (RFID, NFC, QR Codes) Modified Atmosphere Packaging Time-Temperature Indicator Packaging Biodegradable Smart Packaging Others |

| By End-User | Food and Beverage Pharmaceuticals and Healthcare Consumer Goods Electronics Logistics and Supply Chain Others |

| By Material | Plastic Paper & Paperboard Metal Glass Others |

| By Application | Retail Packaging Industrial Packaging Medical Packaging Transportation & Logistics Packaging Others |

| By Technology | RFID Technology NFC Technology QR Code Technology Sensor & Indicator Technology Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Distributors Others |

| By Region | Doha Al Rayyan Umm Salal Al Wakrah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Packaging | 100 | Packaging Managers, Quality Assurance Officers |

| Pharmaceutical Packaging Solutions | 60 | Regulatory Affairs Specialists, Product Managers |

| Consumer Goods Packaging Innovations | 50 | Brand Managers, R&D Directors |

| Smart Labeling Technologies | 40 | Technology Officers, Supply Chain Analysts |

| Sustainability in Packaging | 70 | Sustainability Managers, Environmental Compliance Officers |

The Qatar Smart Packaging Market is valued at approximately USD 220 million, reflecting a significant growth trend driven by the demand for innovative packaging solutions that enhance product safety and sustainability.