Region:Middle East

Author(s):Dev

Product Code:KRAB1928

Pages:83

Published On:January 2026

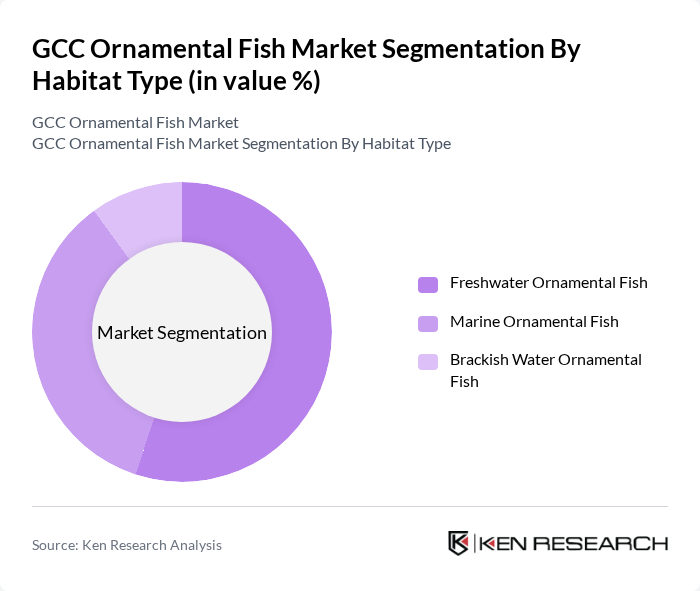

By Habitat Type:The market is segmented into three primary habitat types: Freshwater Ornamental Fish, Marine Ornamental Fish, and Brackish Water Ornamental Fish. Freshwater species dominate the market due to their lower maintenance requirements, wider availability from global suppliers, and broader appeal among novice aquarists, mirroring global patterns where tropical freshwater fish account for the largest revenue share. Marine fish, while more expensive and demanding in terms of water quality, equipment, and husbandry skills, are gaining popularity among enthusiasts and premium commercial installations seeking vibrant and diverse aquatic life. Brackish water fish, although niche, cater to specific consumer preferences and custom aquascaping projects.

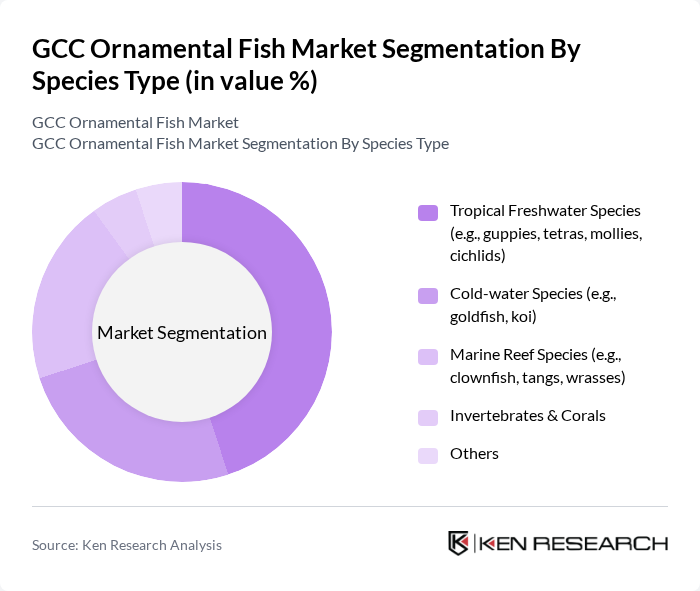

By Species Type:This segmentation includes Tropical Freshwater Species, Cold-water Species, Marine Reef Species, Invertebrates & Corals, and Others. Tropical freshwater species, such as guppies and tetras, lead the market due to their affordability, hardiness, and ease of care, making them popular among beginners and aligning with global trends where tropical freshwater fish hold the largest share. Cold-water species like goldfish and koi are also favored for their aesthetic appeal, especially in villas and outdoor water features. Marine reef species are increasingly sought after by experienced aquarists and public or commercial aquaria, while invertebrates and corals cater to niche marine reef setups and high-end displays.

The GCC Ornamental Fish Market is characterized by a dynamic mix of regional and international players. Leading participants such as Petzone (Kuwait), Aquarium Lives Centre (Dubai Aquarium & Underwater Zoo Partners, UAE), The Tropical Fish Trading LLC (UAE), The Fish Shop Dubai (UAE), Dubai Aquarium & Underwater Zoo (UAE), Sharjah Aquarium (UAE), Fishes World Pet Store (Saudi Arabia), Fish World Aquarium (Qatar), Ocean Fish Aquarium (Saudi Arabia), Kuwait Zoo & Aquarium Retailers (Kuwait), Blue Fin Aquarium (UAE), Gulf Aquatics Trading (UAE), Marine World Aquarium (Saudi Arabia), Coral Reef Aquarium LLC (UAE), Other Emerging Local Breeders & Retail Chains in GCC contribute to innovation, geographic expansion, and service delivery in this space.

The GCC ornamental fish market is expected to evolve significantly, driven by increasing consumer awareness and a shift towards sustainable practices. As environmental concerns rise, businesses are likely to adopt eco-friendly breeding and sourcing methods. Additionally, the integration of technology in aquarium maintenance and design will attract a younger demographic. Collaborations with local aquarists and educational initiatives will further enhance community engagement, fostering a robust market environment that supports both growth and sustainability.

| Segment | Sub-Segments |

|---|---|

| By Habitat Type | Freshwater Ornamental Fish Marine Ornamental Fish Brackish Water Ornamental Fish |

| By Species Type | Tropical Freshwater Species (e.g., guppies, tetras, mollies, cichlids) Cold-water Species (e.g., goldfish, koi) Marine Reef Species (e.g., clownfish, tangs, wrasses) Invertebrates & Corals Others |

| By Application / End-User | Household / Residential Aquariums Commercial Aquariums (public aquaria, malls, offices, hotels) Educational & Research Institutions Retailers & Aquatic Stores Others |

| By Distribution Channel | Online (marketplaces, specialist e-commerce, company websites) Offline Specialty & Pet Stores Breeding Farms & Wholesalers Supermarkets / Hypermarkets Others |

| By Price Point | Mass-Market / Budget Mid-Range Premium Luxury / Collector Grade Others |

| By Species Popularity | Goldfish & Koi Livebearers (guppies, mollies, platys) Cichlids & Other Tropical Community Fish Marine Reef Fish & Corals Others |

| By Customer Demographics | Age Group Income Level Expatriate vs Local Population Lifestyle & Housing Type (villas, apartments, commercial complexes) Others |

| By Country | United Arab Emirates Saudi Arabia Qatar Kuwait Oman Bahrain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Aquarium Sales | 120 | Aquarium Owners, Retail Managers |

| Wholesale Fish Distributors | 90 | Wholesale Managers, Supply Chain Coordinators |

| Aquaculture Farms | 70 | Farm Operators, Aquaculture Specialists |

| Pet Shop Owners | 110 | Store Owners, Inventory Managers |

| Marine Biologists and Experts | 40 | Research Scientists, Academic Professionals |

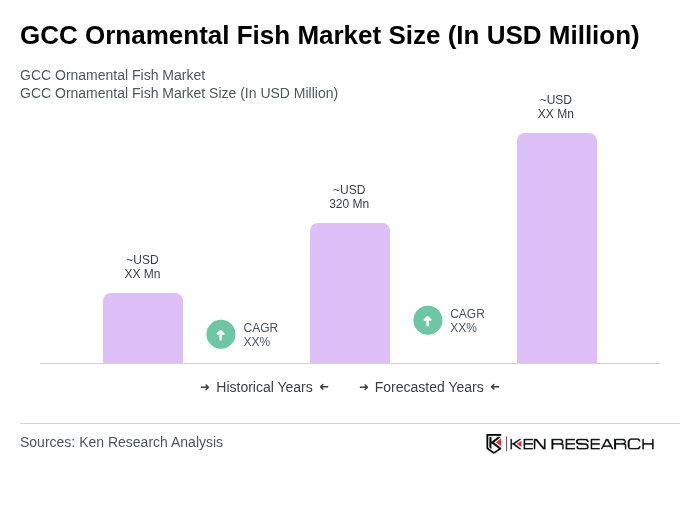

The GCC Ornamental Fish Market is valued at approximately USD 320 million, reflecting a significant growth trend driven by increasing consumer interest in home aquariums and rising disposable incomes across the region.