Region:Middle East

Author(s):Shubham

Product Code:KRAB7279

Pages:89

Published On:October 2025

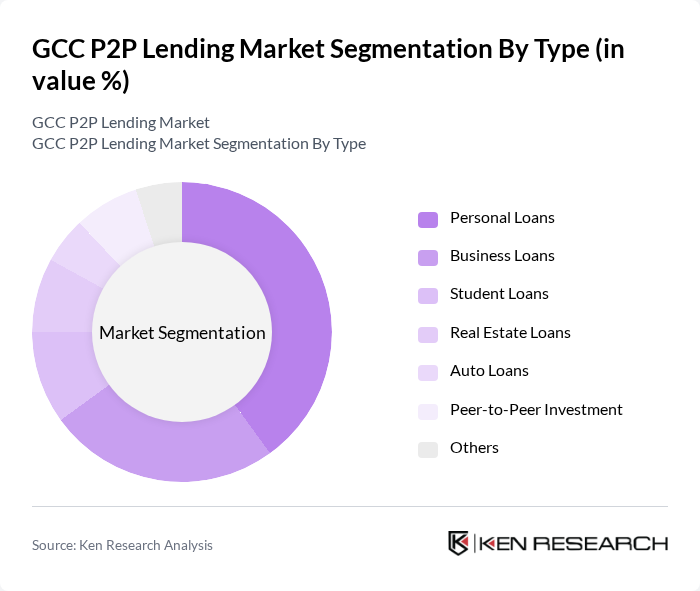

By Type:The P2P lending market can be segmented into various types, including personal loans, business loans, student loans, real estate loans, auto loans, peer-to-peer investment, and others. Among these, personal loans have emerged as the dominant segment due to the increasing consumer preference for unsecured loans that offer flexibility in usage. The convenience of online applications and quick disbursement of funds has further fueled the growth of personal loans in the region.

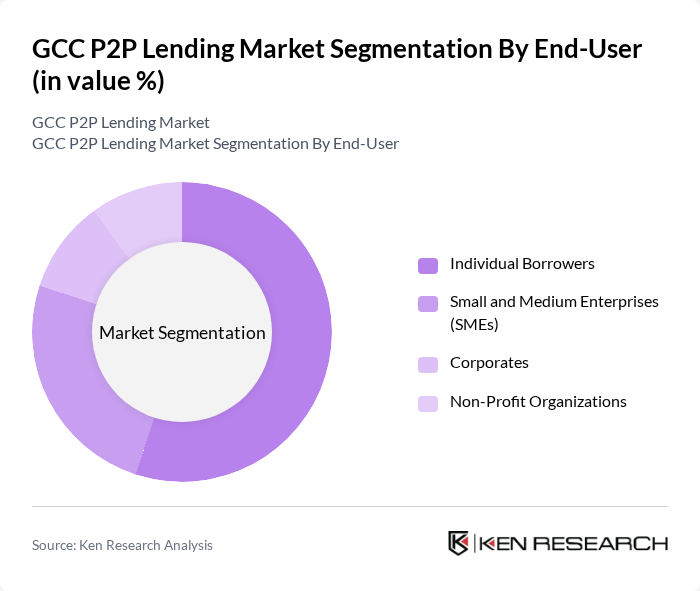

By End-User:The end-user segmentation includes individual borrowers, small and medium enterprises (SMEs), corporates, and non-profit organizations. Individual borrowers represent the largest segment, driven by the increasing need for personal financing solutions among consumers. The rise of digital platforms has made it easier for individuals to access loans, thus propelling this segment's growth.

The GCC P2P Lending Market is characterized by a dynamic mix of regional and international players. Leading participants such as Beehive, PinPay, Liwwa, Funding Circle, YAPILI, Raqamyah, Ethis, Nabbesh, Kiva, Lendico, Zopa, RateSetter, Upstart, Prosper, and Funding Societies contribute to innovation, geographic expansion, and service delivery in this space.

The GCC P2P lending market is poised for significant growth, driven by technological advancements and increasing consumer acceptance of digital financial services. As platforms enhance their risk assessment capabilities through AI and machine learning, the market is expected to attract more investors and borrowers. Additionally, the ongoing push for financial inclusion will likely lead to the development of tailored lending products, catering to diverse consumer needs and expanding the market's reach across the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Student Loans Real Estate Loans Auto Loans Peer-to-Peer Investment Others |

| By End-User | Individual Borrowers Small and Medium Enterprises (SMEs) Corporates Non-Profit Organizations |

| By Loan Purpose | Debt Consolidation Home Improvement Medical Expenses Travel and Leisure |

| By Investment Type | Equity Investments Debt Investments Hybrid Investments |

| By Risk Profile | Low Risk Medium Risk High Risk |

| By Geographic Focus | Domestic Lending Cross-Border Lending |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Individual Borrowers | 150 | Young Professionals, Small Business Owners |

| Investors in P2P Lending | 100 | High Net Worth Individuals, Retail Investors |

| P2P Lending Platform Operators | 80 | CEOs, Product Managers, Compliance Officers |

| Financial Advisors | 70 | Wealth Managers, Financial Planners |

| Regulatory Bodies | 50 | Policy Makers, Financial Regulators |

The GCC P2P Lending Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the demand for alternative financing solutions among individuals and small businesses seeking quick access to funds without traditional banking barriers.