Region:Middle East

Author(s):Shubham

Product Code:KRAD5538

Pages:100

Published On:December 2025

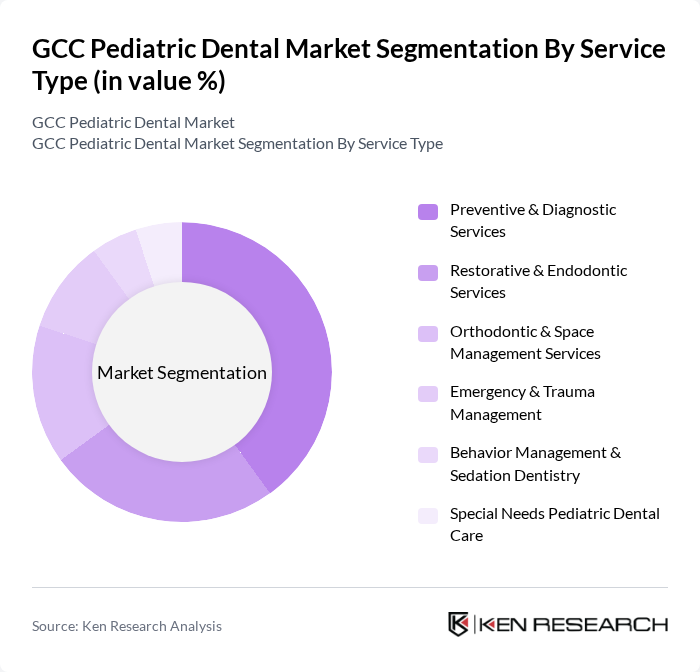

By Service Type:The service type segmentation includes various categories such as preventive and diagnostic services, restorative and endodontic services, orthodontic and space management services, emergency and trauma management, behavior management and sedation dentistry, and special needs pediatric dental care. Preventive and diagnostic services include routine check-ups, oral examinations, fluoride applications, fissure sealants, radiographs, and counseling on diet and oral hygiene, and they dominate the market due to the increasing emphasis on early detection and prevention of dental issues in children. Restorative and endodontic services cover fillings, stainless-steel and zirconia crowns, pulpotomies, and pulpectomies commonly used to manage early childhood caries in GCC pediatric populations. Orthodontic and space management services comprise interceptive orthodontics, habit-breaking appliances, and space maintainers that are increasingly demanded by urban, higher-income families. Emergency and trauma management involves acute treatment of dental trauma, pain, and infections, which is relevant given the documented burden of dental injuries in children in the region. Behavior management and sedation dentistry include non-pharmacological behavior guidance, nitrous oxide sedation, and general anesthesia for uncooperative or anxious children, while special needs pediatric dental care addresses children with medical, developmental, or physical conditions, often delivered in tertiary centers and academic hospitals. Parents are increasingly aware of the importance of regular dental check-ups, which has led to a higher demand for these services, supported by public awareness campaigns and school oral health initiatives.

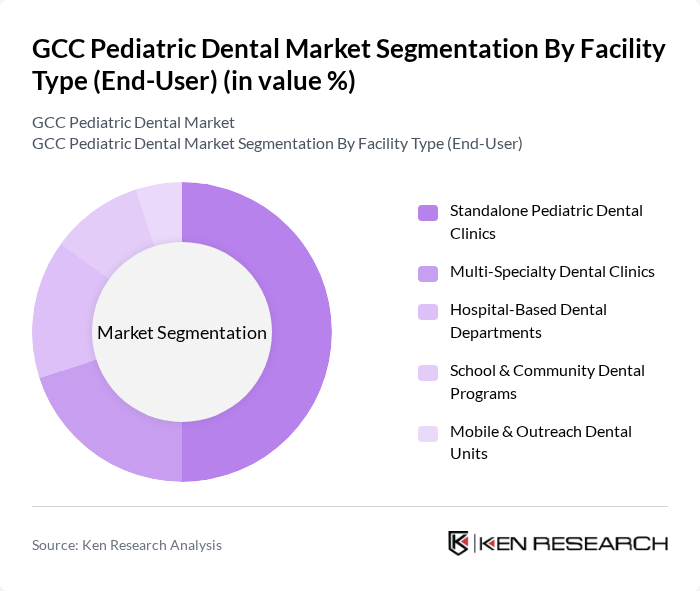

By Facility Type (End-User):This segmentation includes standalone pediatric dental clinics, multi-specialty dental clinics, hospital-based dental departments, school and community dental programs, and mobile and outreach dental units. Standalone pediatric dental clinics are the leading segment, as they provide specialized care tailored to children's needs in a child-friendly environment, often integrating play areas, parental counseling rooms, and conscious sedation capabilities to enhance the pediatric experience. Multi-specialty dental clinics combine pediatric dentistry with orthodontics, prosthodontics, and oral surgery, while hospital-based dental departments in tertiary and teaching hospitals in Riyadh, Jeddah, Dubai, Doha, and Kuwait City manage complex and medically compromised pediatric cases. School and community dental programs deliver screening, fluoride varnish, and sealant programs at schools and primary health centers, and mobile and outreach dental units are leveraged in some GCC countries to extend care to rural or underserved areas. The growth of standalone pediatric clinics is fueled by the increasing number of families seeking dedicated pediatric dental services, higher private healthcare spending, and the entry of branded dental chains across major GCC cities.

The GCC Pediatric Dental Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dr. Sulaiman Al Habib Medical Services Group (Saudi Arabia), Saudi German Health (Middle East Healthcare Company, Saudi Arabia & GCC), AlManaa Hospitals & Medical Company (Saudi Arabia), Dr. Joy Dental Clinic (United Arab Emirates), Dr. Michael’s Children’s Dental Center (United Arab Emirates), myPediaclinic – Children’s Dental & Orthodontic Center (United Arab Emirates), Dr. Yasmin Pediatric Dentistry & Orthodontics (United Arab Emirates), Kids Dental Zone – Specialist Pediatric Dental Center (Saudi Arabia), Hamad Dental Center – Pediatric Dentistry (Hamad Medical Corporation, Qatar), Sidra Medicine – Pediatric Dentistry Services (Qatar), Al Rass Dental & Pediatric Specialty Clinics (Saudi Arabia), Kuwait Specialized Dental Center – Pediatric Dentistry (Kuwait), Royal Dental Clinic & Orthodontic Center for Children (Bahrain), Muscat Private Hospital – Pediatric Dental Services (Oman), Aspetar Dental & Sports Injury Pediatric Unit (Qatar) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC pediatric dental market appears promising, driven by increasing investments in healthcare infrastructure and a growing emphasis on preventive care. As governments allocate more resources towards dental health initiatives, the market is expected to witness enhanced accessibility and affordability. Additionally, the integration of advanced technologies in dental practices is likely to improve treatment outcomes, fostering a more proactive approach to children's oral health in the region.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Preventive & Diagnostic Services (check?ups, prophylaxis, fluoride, sealants) Restorative & Endodontic Services (fillings, pulp therapy, crowns) Orthodontic & Space Management Services Emergency & Trauma Management Behavior Management & Sedation Dentistry Special Needs Pediatric Dental Care |

| By Facility Type (End-User) | Standalone Pediatric Dental Clinics Multi-Specialty Dental Clinics Hospital-Based Dental Departments School & Community Dental Programs Mobile & Outreach Dental Units |

| By Age Group | Infants (0-2 years) Toddlers (3-5 years) Children (6-12 years) Adolescents (13-18 years) Children with Special Healthcare Needs (0-18 years) |

| By Clinical Indication | Dental Caries & Pulpal Diseases Developmental & Enamel Defects Malocclusion & Alignment Issues Dental Trauma & Sports Injuries Preventive & Aesthetic Indications |

| By Geography (Within GCC) | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain |

| By Payer / Insurance Coverage | Government-Funded Schemes Private Health Insurance Employer-Sponsored Plans Self-Pay / Out-of-Pocket |

| By Service Delivery Model | In-Clinic, Appointment-Based Care School-Based & Community Outreach Programs Mobile Clinics & Home-Visit Services Tele-dentistry & Remote Consultations |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pediatric Dental Clinics | 80 | Pediatric Dentists, Clinic Managers |

| Parents of Children Aged 0-12 | 120 | Parents, Guardians |

| Healthcare Professionals | 60 | General Dentists, Pediatricians |

| Dental Product Suppliers | 50 | Sales Representatives, Product Managers |

| Insurance Providers | 40 | Underwriters, Claims Adjusters |

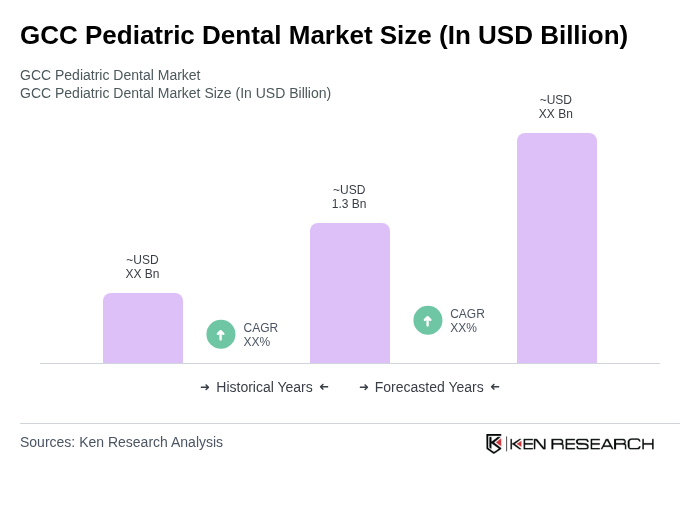

The GCC Pediatric Dental Market is valued at approximately USD 1.3 billion, reflecting a significant increase driven by rising awareness of oral health, higher disposable incomes, and expanded pediatric dental services across the region.