Region:Asia

Author(s):Shubham

Product Code:KRAA8767

Pages:88

Published On:November 2025

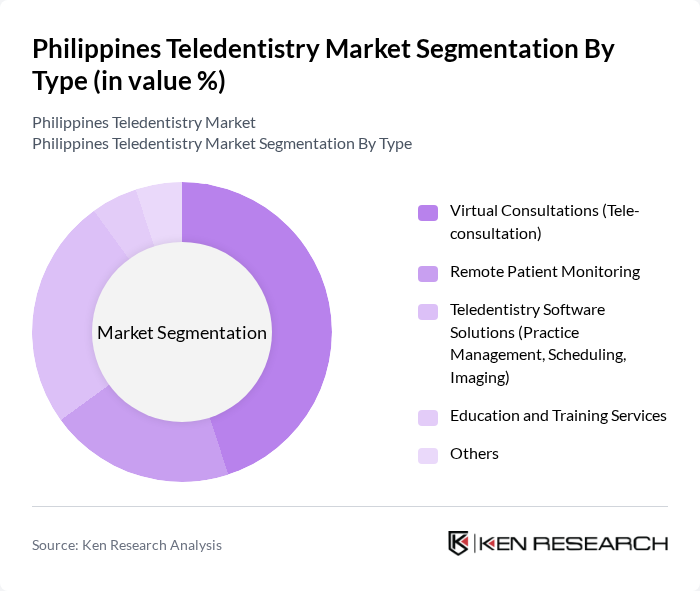

By Type:The market is segmented into various types, including Virtual Consultations (Tele-consultation), Remote Patient Monitoring, Teledentistry Software Solutions (Practice Management, Scheduling, Imaging), Education and Training Services, and Others. Among these, Virtual Consultations are leading due to their convenience and the growing acceptance of remote healthcare services. Patients prefer the ease of accessing dental consultations from home, which has significantly increased the demand for this service. The software solutions segment is also expanding rapidly, driven by the need for efficient practice management and integration with broader telehealth platforms .

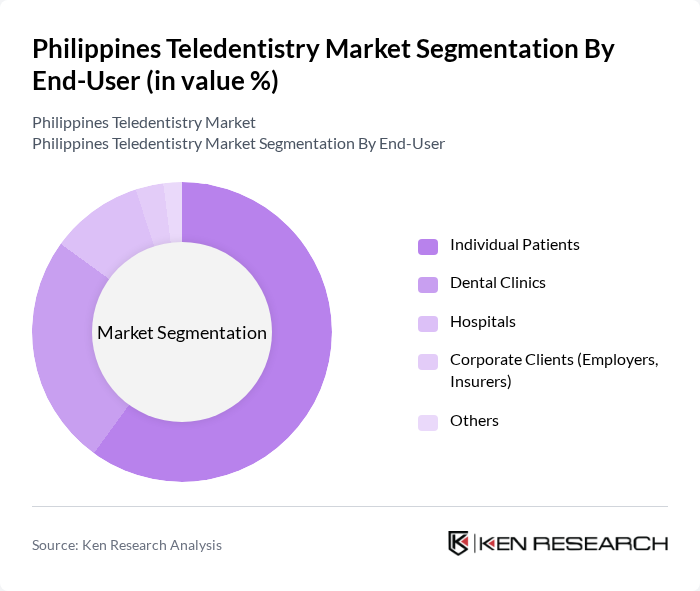

By End-User:The end-user segmentation includes Individual Patients, Dental Clinics, Hospitals, Corporate Clients (Employers, Insurers), and Others. Individual Patients dominate the market as they increasingly seek convenient dental care solutions. The rise in health consciousness and the need for preventive dental care have led to a surge in teleconsultations among patients, making them the primary users of teledentistry services. Dental clinics and hospitals are also increasing adoption, leveraging teledentistry to expand reach and optimize resource allocation .

The Philippines Teledentistry Market is characterized by a dynamic mix of regional and international players. Leading participants such as SmileDirectClub, Teledentix, DentalMonitoring, The TeleDentists, Virtudent, Zenyum, MyDentalClinic (Philippines), DentalHub Philippines, HealthNow (Philippines), KonsultaMD, Carestream Dental, Oral-B (Philippines Digital Services), DentalMatch Asia, 1-800-DENTIST, Denteractive contribute to innovation, geographic expansion, and service delivery in this space.

The future of teledentistry in the Philippines appears promising, driven by ongoing technological advancements and increasing consumer acceptance. As the government continues to invest in digital health infrastructure, the integration of telehealth services with traditional dental practices is likely to become more seamless. Additionally, the rise of mobile health applications will facilitate greater access to preventive dental care, ultimately improving overall oral health outcomes for the population.

| Segment | Sub-Segments |

|---|---|

| By Type | Virtual Consultations (Tele-consultation) Remote Patient Monitoring Teledentistry Software Solutions (Practice Management, Scheduling, Imaging) Education and Training Services Others |

| By End-User | Individual Patients Dental Clinics Hospitals Corporate Clients (Employers, Insurers) Others |

| By Service Model | Subscription-Based Services Pay-Per-Use Services Bundled Services Others |

| By Technology Used | Video Conferencing Tools Mobile Applications Cloud-Based Platforms AI-Enabled Diagnostic Tools Others |

| By Patient Demographics | Children Adults Seniors Others |

| By Geographic Reach | Urban Areas Rural Areas Nationwide Services Others |

| By Payment Model | Insurance-Based Payments Out-of-Pocket Payments Employer-Sponsored Plans Government Health Schemes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Teledentistry Service Users | 100 | Patients who have used teledentistry services |

| Dental Practitioners | 80 | Dentists offering teledentistry consultations |

| Healthcare Technology Developers | 50 | Developers of teledentistry platforms and software |

| Dental Health Policy Makers | 40 | Government officials and health regulators |

| Insurance Providers | 40 | Representatives from health insurance companies covering dental services |

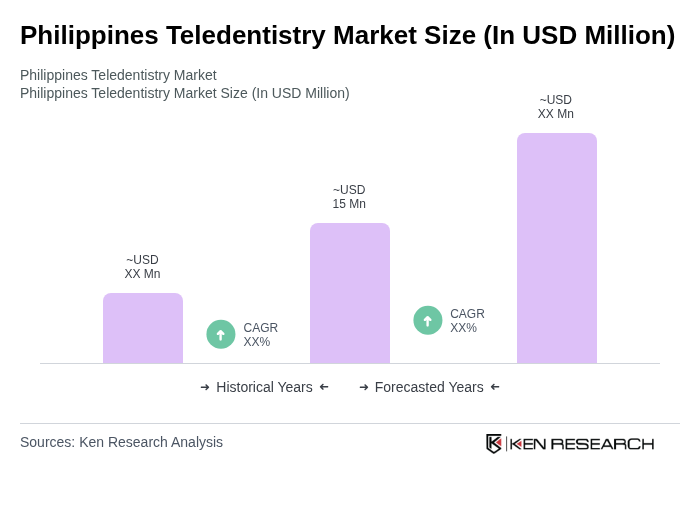

The Philippines Teledentistry Market is valued at approximately USD 15 million, reflecting a significant growth trend driven by the increasing adoption of digital health solutions and the demand for accessible dental care, particularly in remote areas.