Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3075

Pages:96

Published On:October 2025

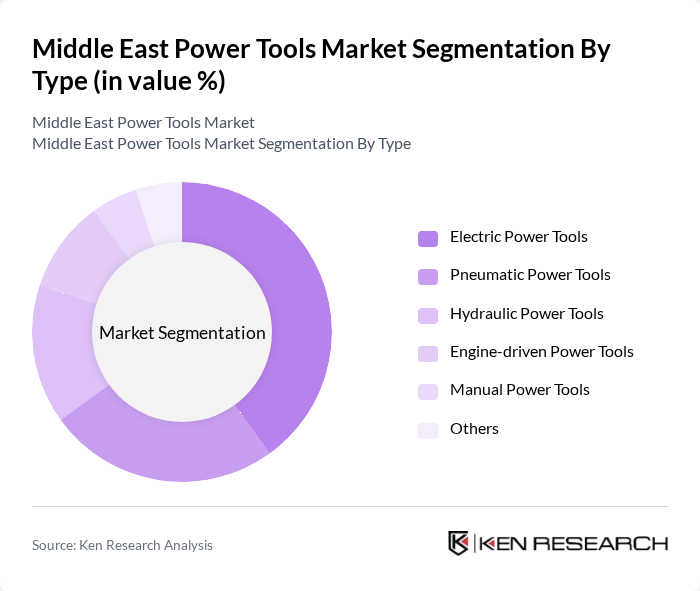

By Type:The market is segmented into various types of power tools, including Electric Power Tools, Pneumatic Power Tools, Hydraulic Power Tools, Engine-driven Power Tools, Manual Power Tools, and Others. Among these, Electric Power Tools are the most dominant due to their versatility, ease of use, and increasing adoption in both residential and industrial applications. The growing trend of cordless electric tools, driven by advancements in lithium-ion battery technology and demand for portability, has further enhanced their appeal, making them a preferred choice for consumers and professionals alike.

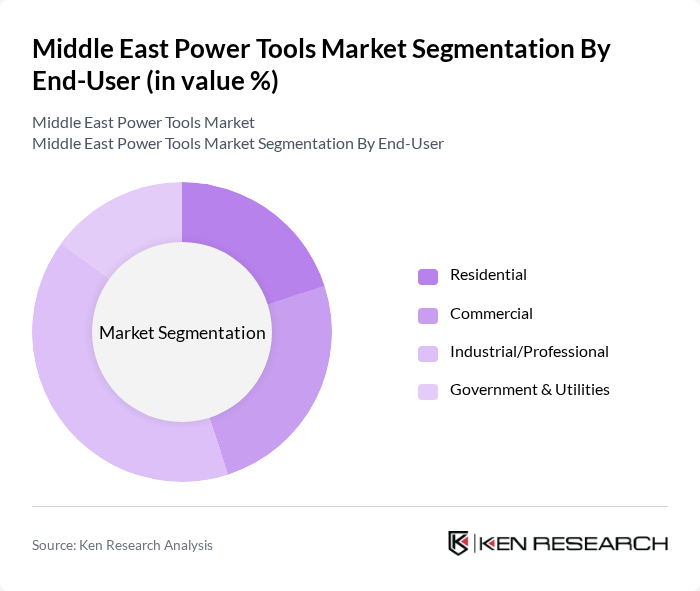

By End-User:The end-user segmentation includes Residential, Commercial, Industrial/Professional, and Government & Utilities. The Industrial/Professional segment leads the market, driven by the high demand for power tools in manufacturing and construction industries. The increasing number of construction projects, automation in industrial processes, and the need for efficient, durable tools in professional applications have significantly boosted this segment's growth, making it a key player in the overall market.

The Middle East Power Tools Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bosch Power Tools (Robert Bosch GmbH), DeWalt (Stanley Black & Decker), Makita Corporation, Stanley Black & Decker, Hilti Corporation, Ryobi (Techtronic Industries), Milwaukee Tool (Techtronic Industries), Festool (TTS Tooltechnic Systems), Metabo (KOKI Holdings Co., Ltd.), Einhell Germany AG, Kobalt (Lowe's Companies, Inc.), AEG Power Tools (Techtronic Industries), Black+Decker (Stanley Black & Decker), Hikoki Power Tools (KOKI Holdings Co., Ltd.), Techtronic Industries Co. Ltd. (TTI), Atlas Copco AB, Ingersoll Rand Inc., Apex Tool Group, Snap-on Incorporated contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East power tools market is poised for transformative growth, driven by technological innovations and evolving consumer preferences. As smart tools gain traction, manufacturers are likely to invest in R&D to enhance product features. Additionally, the rise of e-commerce platforms will facilitate wider distribution, making power tools more accessible. Sustainability will also play a crucial role, with increasing demand for eco-friendly products shaping future offerings and driving market expansion in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Electric Power Tools Pneumatic Power Tools Hydraulic Power Tools Engine-driven Power Tools Manual Power Tools Others |

| By End-User | Residential Commercial Industrial/Professional Government & Utilities |

| By Application | Construction Automotive Woodworking Metalworking Concrete & Masonry Others |

| By Sales Channel | Online Retail Offline Retail Direct Sales Distributors |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Platforms |

| By Price Range | Budget Mid-range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-sensitive Customers First-time Buyers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Professionals | 120 | Project Managers, Site Supervisors |

| Retail Power Tool Distributors | 85 | Sales Managers, Inventory Controllers |

| DIY Enthusiasts and Hobbyists | 65 | Home Improvement Bloggers, Community Workshop Leaders |

| Manufacturers of Power Tools | 60 | Product Development Managers, Marketing Directors |

| Regulatory Bodies and Industry Associations | 45 | Policy Makers, Industry Analysts |

The Middle East Power Tools Market is valued at approximately USD 1.5 billion, driven by increasing demand in construction, automotive, and manufacturing sectors, along with a rise in infrastructure projects across the region.