Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8242

Pages:97

Published On:November 2025

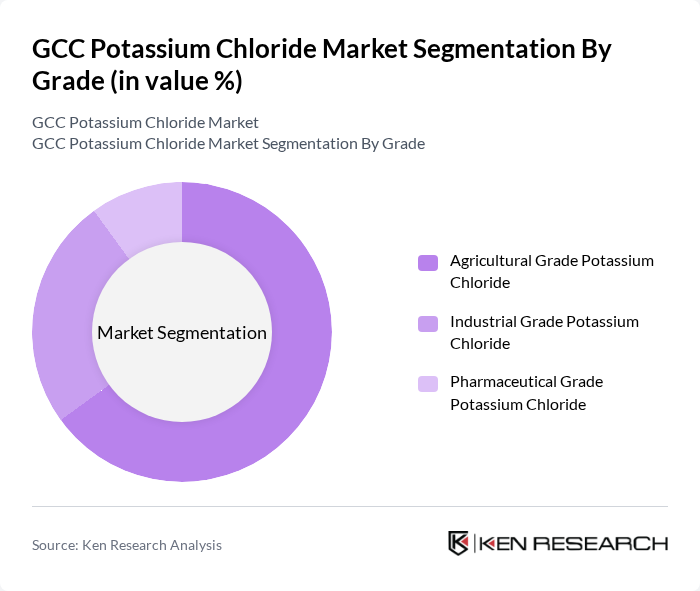

By Grade:The market is segmented into three grades: Agricultural Grade Potassium Chloride, Industrial Grade Potassium Chloride, and Pharmaceutical Grade Potassium Chloride. Agricultural Grade Potassium Chloride is the most dominant segment due to its extensive use in fertilizers, which are essential for crop production. The increasing global population and the consequent demand for food have led to a surge in the agricultural sector, driving the need for high-quality fertilizers. Industrial Grade Potassium Chloride is also significant, primarily used in chemical manufacturing processes, while Pharmaceutical Grade Potassium Chloride is utilized in healthcare applications, including IV solutions and dietary supplements.

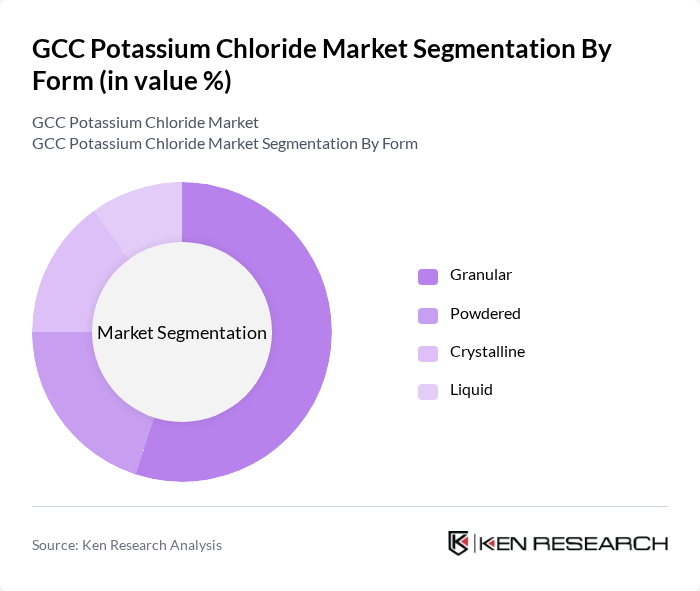

By Form:The market is categorized into Granular, Powdered, Crystalline, and Liquid forms. Granular Potassium Chloride is the leading form due to its ease of application in agricultural practices, making it the preferred choice among farmers. The powdered form is also popular for its quick dissolution in water, which is beneficial for certain industrial applications. Crystalline and liquid forms are used in specialized applications, including pharmaceuticals and water treatment processes.

The GCC Potassium Chloride Market is characterized by a dynamic mix of regional and international players. Leading participants such as Arab Potash Company (APC), Nutrien Ltd., The Mosaic Company, K+S AG, Yara International ASA, Israel Chemicals Ltd. (ICL), Sociedad Química y Minera de Chile (SQM), OCP Group (Office Chérifien des Phosphates), Compass Minerals International, Inc., Sinofert Holdings Limited, Intrepid Potash, Inc., Eurochem Group contribute to innovation, geographic expansion, and service delivery in this space.

The GCC potassium chloride market is poised for significant transformation, driven by a shift towards sustainable agricultural practices and technological advancements in farming. As governments prioritize food security and environmental sustainability, the adoption of precision farming techniques is expected to rise. Additionally, digitalization in supply chain management will enhance efficiency and transparency, allowing producers to respond swiftly to market demands. These trends will likely create a more resilient and competitive market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Grade | Agricultural Grade Potassium Chloride Industrial Grade Potassium Chloride Pharmaceutical Grade Potassium Chloride |

| By Form | Granular Powdered Crystalline Liquid |

| By End-User Application | Agriculture & Fertilizers Chemical Manufacturing Pharmaceutical & Healthcare Food Processing & Preservation Water Treatment Industrial Applications |

| By Distribution Channel | Direct Sales Distributors & Wholesalers Online Sales Retail |

| By Packaging Type | Bulk Packaging Bagged Packaging (25kg, 50kg) Containerized |

| By Country/Region | Saudi Arabia United Arab Emirates Qatar Kuwait Bahrain Oman |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agrochemicals Sector | 45 | Agrochemical Specialists, Product Managers |

| Industrial Applications | 50 | Production Managers, Chemical Engineers |

| Food Processing Sector | 40 | Quality Control Managers, Food Technologists |

| Export Market Insights | 35 | Export Managers, Trade Analysts |

| Regulatory Compliance | 30 | Compliance Officers, Regulatory Affairs Specialists |

The GCC Potassium Chloride market is valued at approximately USD 1.4 billion, driven by the increasing demand for fertilizers in agriculture, the importance of potassium in plant nutrition, and advancements in precision agriculture technologies.