Region:Middle East

Author(s):Rebecca

Product Code:KRAB0861

Pages:85

Published On:December 2025

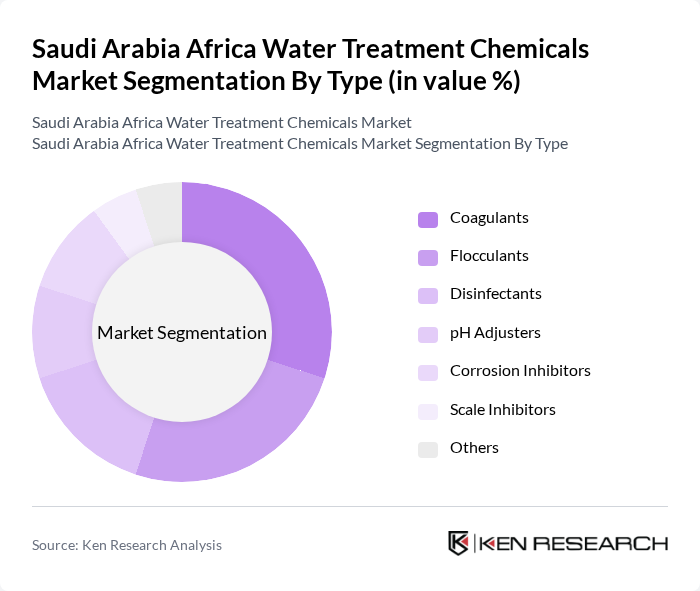

By Type:The water treatment chemicals market is segmented into various types, including coagulants, flocculants, disinfectants, pH adjusters, corrosion inhibitors, scale inhibitors, and others. Among these, coagulants and flocculants are particularly dominant due to their essential roles in the treatment processes, especially in municipal and industrial applications. The increasing focus on water quality and safety has led to a higher demand for these chemicals, making them critical in the overall market landscape.

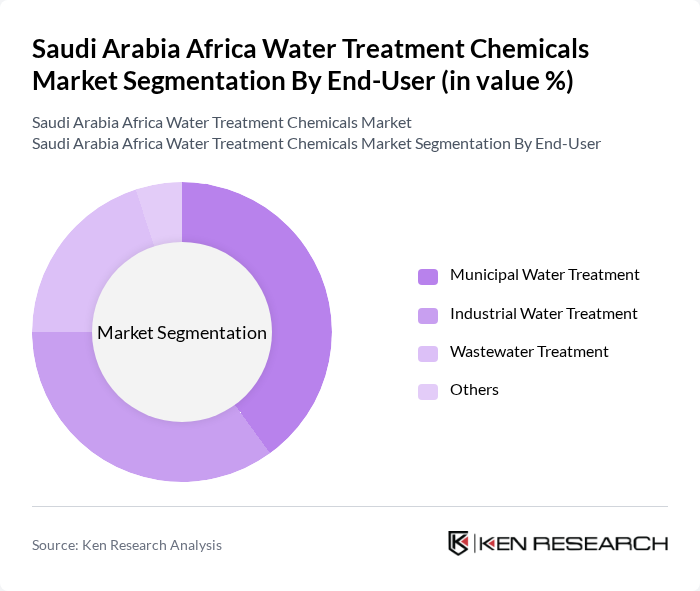

By End-User:The end-user segmentation includes municipal water treatment, industrial water treatment, wastewater treatment, and others. Municipal water treatment is the leading segment, driven by the increasing need for clean drinking water and the implementation of stringent regulations regarding water quality. The industrial sector also shows significant demand due to the need for water in various manufacturing processes, making it a crucial part of the market.

The Saudi Arabia Africa Water Treatment Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Ecolab Inc., Kemira Oyj, SNF Group, Solvay S.A., Dow Chemical Company, AkzoNobel N.V., Veolia Environnement S.A., SUEZ S.A., Kurita Water Industries Ltd., Nalco Water, Orion Engineered Carbons S.A., American Water Chemicals, Inc., ChemTreat, Inc., and Shandong Taihe Water Treatment Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future outlook for the Saudi Arabia water treatment chemicals market appears promising, driven by ongoing infrastructure investments and a growing emphasis on sustainability. As the market is projected to expand significantly, innovations in membrane technologies and biodegradable chemicals are expected to play a crucial role. Additionally, the increasing integration of smart water management systems will enhance operational efficiency, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Coagulants Flocculants Disinfectants pH Adjusters Corrosion Inhibitors Scale Inhibitors Others |

| By End-User | Municipal Water Treatment Industrial Water Treatment Wastewater Treatment Others |

| By Application | Drinking Water Treatment Industrial Process Water Treatment Wastewater Reuse Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Chemical Composition | Organic Chemicals Inorganic Chemicals Biochemical Products Others |

| By Regulatory Compliance | ISO Standards Local Regulations International Standards Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Water Treatment Facilities | 100 | Facility Managers, Operations Directors |

| Industrial Water Treatment Applications | 80 | Procurement Managers, Chemical Engineers |

| Agricultural Water Treatment Solutions | 70 | Agronomists, Farm Managers |

| Desalination Plants | 60 | Project Managers, Technical Directors |

| Environmental Regulatory Bodies | 50 | Policy Makers, Environmental Scientists |

The Saudi Arabia Africa Water Treatment Chemicals Market is valued at approximately USD 355 million, reflecting significant growth driven by urbanization, industrial expansion, and increasing water scarcity issues that necessitate effective water treatment solutions.