Region:Global

Author(s):Rebecca

Product Code:KRAC8545

Pages:88

Published On:November 2025

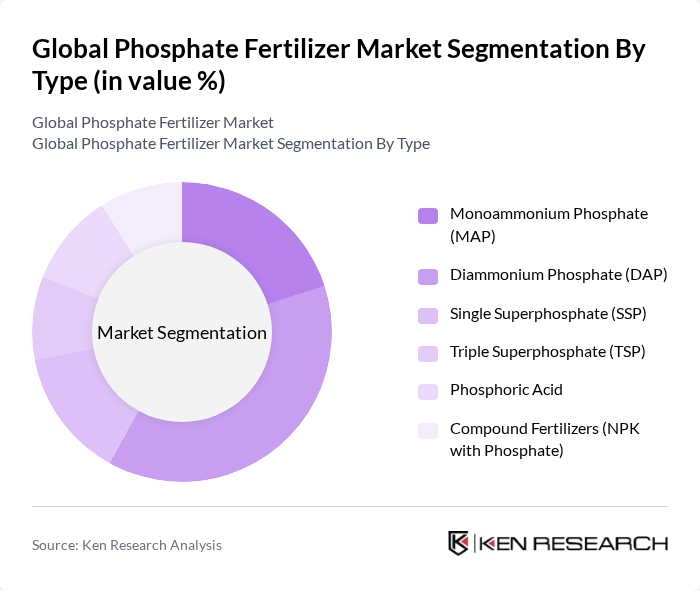

By Type:The phosphate fertilizer market is segmented into Monoammonium Phosphate (MAP), Diammonium Phosphate (DAP), Single Superphosphate (SSP), Triple Superphosphate (TSP), Phosphoric Acid, and Compound Fertilizers (NPK with Phosphate). Diammonium Phosphate (DAP) remains the leading sub-segment, accounting for the largest share due to its high nutrient content, dual nitrogen-phosphorus value, and versatility across diverse crops. The adoption of DAP is further supported by entrenched distribution channels and government subsidies in major agricultural economies .

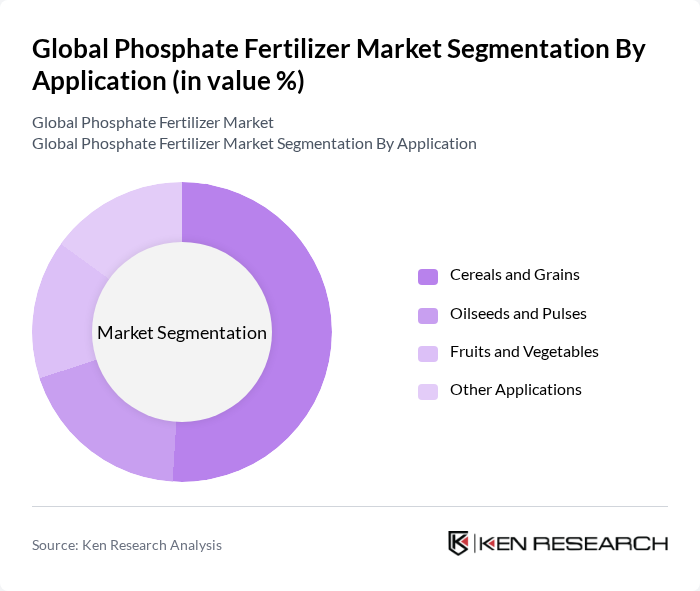

By Application:The application of phosphate fertilizers is categorized into Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, and Other Applications. The Cereals and Grains segment holds the largest market share, driven by the global demand for staple foods such as rice, wheat, and corn. Population growth, changing dietary patterns, and the need for higher yields in cereal production continue to make this segment the primary driver for phosphate fertilizer demand .

The Global Phosphate Fertilizer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nutrien Ltd., The Mosaic Company, CF Industries Holdings, Inc., Yara International ASA, OCP Group, PhosAgro, ICL Group Ltd., EuroChem Group AG, Incitec Pivot Limited, and Saudi Arabian Mining Company (Ma'aden) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the phosphate fertilizer market appears promising, driven by increasing agricultural demands and technological advancements. As farmers adopt more sustainable practices, the shift towards eco-friendly fertilizers is expected to gain momentum. Additionally, the integration of digital agriculture tools will enhance efficiency in fertilizer application, further supporting crop yields. The focus on nutrient management will also play a critical role in shaping the market landscape, ensuring that phosphate fertilizers are used effectively to meet global food needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Monoammonium Phosphate (MAP) Diammonium Phosphate (DAP) Single Superphosphate (SSP) Triple Superphosphate (TSP) Phosphoric Acid Compound Fertilizers (NPK with Phosphate) |

| By Application | Cereals and Grains Oilseeds and Pulses Fruits and Vegetables Other Applications |

| By Distribution Channel | Online Offline |

| By Product Form | Granular Liquid Powder |

| By Region | North America Western Europe Eastern Europe Asia-Pacific Latin America Middle East Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Producers | 100 | Farm Owners, Crop Managers |

| Fertilizer Distributors | 60 | Supply Chain Managers, Sales Representatives |

| Research Institutions | 40 | Agricultural Researchers, Soil Scientists |

| Government Agricultural Departments | 50 | Policy Makers, Agricultural Advisors |

| Environmental NGOs | 40 | Sustainability Advocates, Environmental Scientists |

The Global Phosphate Fertilizer Market is valued at approximately USD 70 billion, driven by the increasing demand for food production and the need for enhanced crop yields through phosphate fertilizers.