Region:Middle East

Author(s):Dev

Product Code:KRAA8379

Pages:94

Published On:November 2025

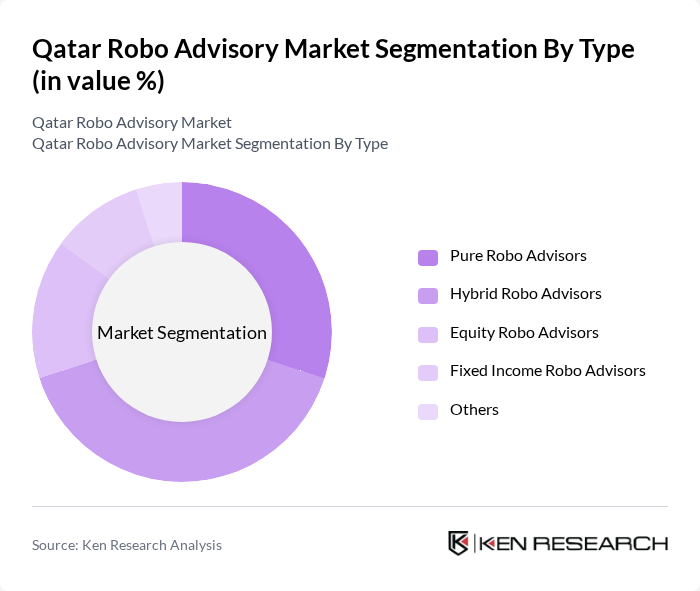

By Type:The market is segmented into various types of robo advisory services, including Pure Robo Advisors, Hybrid Robo Advisors, Equity Robo Advisors, Fixed Income Robo Advisors, and Others. Each type caters to different investor needs and preferences, with Pure Robo Advisors focusing solely on automated services, while Hybrid Robo Advisors combine human expertise with automated solutions. Equity and Fixed Income Robo Advisors specialize in specific asset classes, appealing to investors with targeted investment strategies.

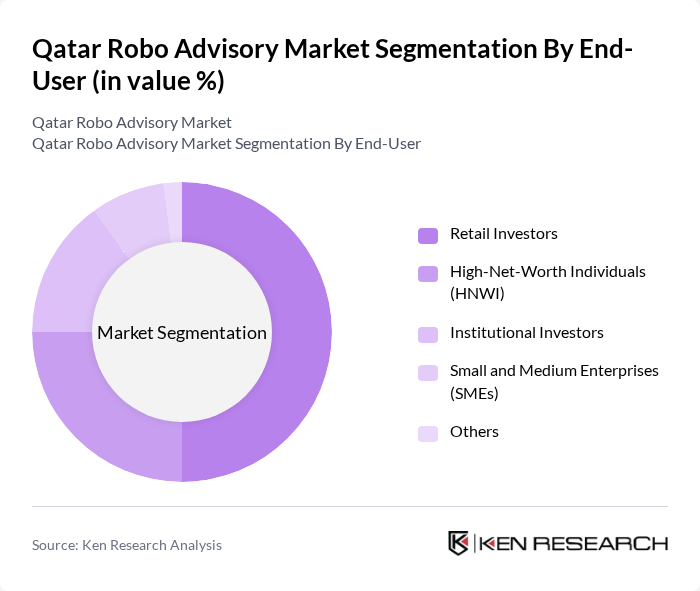

By End-User:The end-user segmentation includes Retail Investors, High-Net-Worth Individuals (HNWI), Institutional Investors, Small and Medium Enterprises (SMEs), and Others. Retail Investors represent a significant portion of the market, driven by the increasing accessibility of investment platforms. HNWIs and institutional investors seek tailored solutions, while SMEs are increasingly recognizing the benefits of automated investment strategies to manage their financial assets effectively.

The Qatar Robo Advisory Market is characterized by a dynamic mix of regional and international players. Leading participants such as QInvest, Qatar National Bank (QNB), Doha Bank, Al Rayan Investment, Qatar Islamic Bank (QIB), Masraf Al Rayan, Amwal, Qatari Investors Group, Barwa Bank, Qatar Financial Centre (QFC), Qatar Development Bank, Dlala Brokerage and Investment Holding Company, Al Khalij Commercial Bank (al khaliji), Qatar Insurance Company (QIC), Qatar Stock Exchange, CBQ Investment Services (Commercial Bank of Qatar), Kamco Invest Qatar, Aventicum Capital Management (Qatar), MEEZA, QNB Capital contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar robo advisory market appears promising, driven by technological advancements and increasing consumer acceptance. As financial literacy continues to rise, more individuals are likely to seek automated investment solutions. Additionally, the integration of ESG factors into investment strategies is expected to attract socially conscious investors. The collaboration between robo advisory firms and traditional financial institutions will further enhance service offerings, creating a more competitive landscape that benefits consumers and drives market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Pure Robo Advisors Hybrid Robo Advisors Equity Robo Advisors Fixed Income Robo Advisors Others |

| By End-User | Retail Investors High-Net-Worth Individuals (HNWI) Institutional Investors Small and Medium Enterprises (SMEs) Others |

| By Investment Strategy | Passive Investment Strategies Active Investment Strategies Tactical Asset Allocation Goal-Based Investment Others |

| By Risk Profile | Conservative Moderate Aggressive Others |

| By Customer Segment | Millennials Gen X Baby Boomers Expatriate Communities Others |

| By Service Model | Fully Automated Services Human-AI Collaboration Services Advisory Services Portfolio Management Retirement Planning Tax-Loss Harvesting Others |

| By Geographic Focus | Urban Areas Rural Areas Expatriate Communities Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Investor Insights | 100 | Individual Investors, Financial Planners |

| High-Net-Worth Individuals | 60 | Wealth Managers, Investment Advisors |

| Fintech Adoption Trends | 50 | Tech Entrepreneurs, Financial Analysts |

| Regulatory Impact Assessment | 40 | Compliance Officers, Legal Advisors |

| Market Readiness Evaluation | 40 | Investment Consultants, Market Researchers |

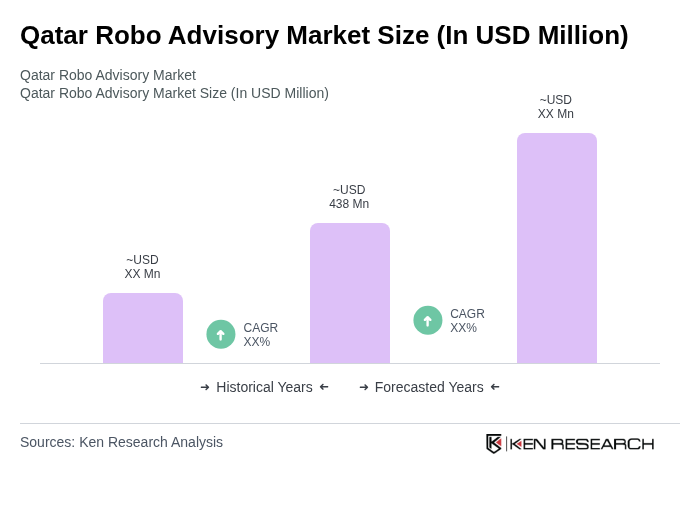

The Qatar Robo Advisory Market is valued at approximately USD 438 million, reflecting significant growth driven by the increasing adoption of digital financial services and a tech-savvy population seeking personalized investment solutions.