Region:Middle East

Author(s):Rebecca

Product Code:KRAB7384

Pages:84

Published On:October 2025

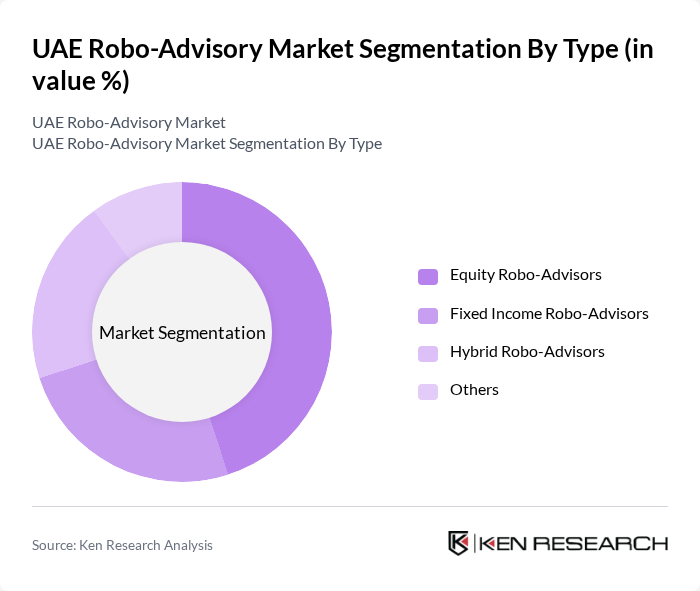

By Type:The market is segmented into various types, including Equity Robo-Advisors, Fixed Income Robo-Advisors, Hybrid Robo-Advisors, and Others. Among these, Equity Robo-Advisors are currently leading the market due to their appeal to younger investors who are more inclined towards stock market investments. The trend of investing in equities, driven by the potential for higher returns, has made this sub-segment particularly popular.

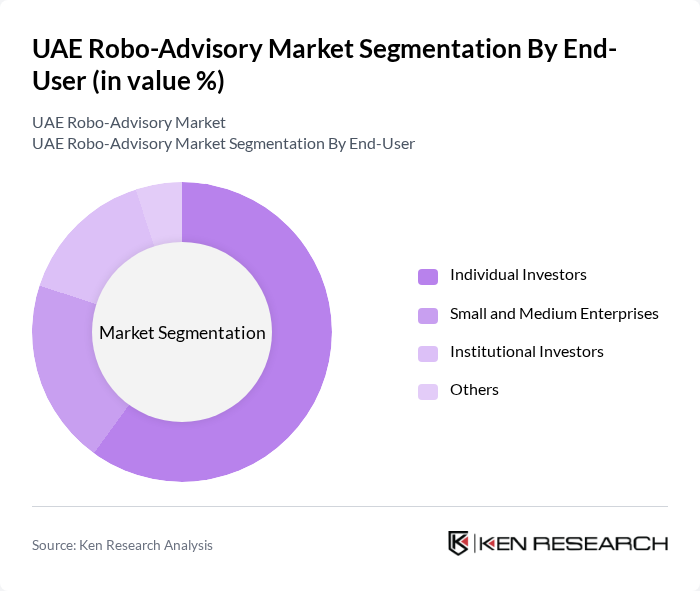

By End-User:The end-user segmentation includes Individual Investors, Small and Medium Enterprises, Institutional Investors, and Others. Individual Investors dominate this segment, driven by the increasing number of retail investors seeking accessible and affordable investment options. The rise of mobile applications and user-friendly platforms has made it easier for individuals to manage their investments, contributing to their significant market share.

The UAE Robo-Advisory Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sarwa, Wahed Invest, StashAway, YAPILI, InvestSky, Mena Financial, Al Mal Capital, Emirates NBD Asset Management, Abu Dhabi Investment Authority, Dubai Investments, Noor Bank, First Abu Dhabi Bank, RAK Bank, HSBC UAE, Standard Chartered UAE contribute to innovation, geographic expansion, and service delivery in this space.

The UAE robo-advisory market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As the demand for personalized investment solutions grows, firms are likely to enhance their offerings through AI-driven analytics and tailored portfolio management. Additionally, the increasing focus on sustainable investing will shape product development, with more robo-advisors integrating ESG criteria into their algorithms. This evolution will create a more competitive landscape, fostering innovation and attracting a diverse range of investors.

| Segment | Sub-Segments |

|---|---|

| By Type | Equity Robo-Advisors Fixed Income Robo-Advisors Hybrid Robo-Advisors Others |

| By End-User | Individual Investors Small and Medium Enterprises Institutional Investors Others |

| By Investment Strategy | Passive Investment Strategies Active Investment Strategies Tactical Asset Allocation Others |

| By Service Model | Full-Service Robo-Advisors Self-Service Robo-Advisors Hybrid Service Models Others |

| By Customer Segment | Millennials Gen X Baby Boomers Others |

| By Geographic Focus | UAE Nationals Expatriates Regional Investors Others |

| By Pricing Model | Flat Fee Model Percentage of Assets Under Management Performance-Based Fees Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Investors | 150 | Individual Investors, Financial Planners |

| Institutional Investors | 100 | Portfolio Managers, Investment Analysts |

| Fintech Startups | 80 | Founders, Product Managers |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| Potential Users of Robo-Advisory Services | 120 | Millennials, Gen Z Investors |

The UAE Robo-Advisory Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by the increasing adoption of digital financial services and a tech-savvy population seeking low-cost investment solutions.