Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4013

Pages:84

Published On:December 2025

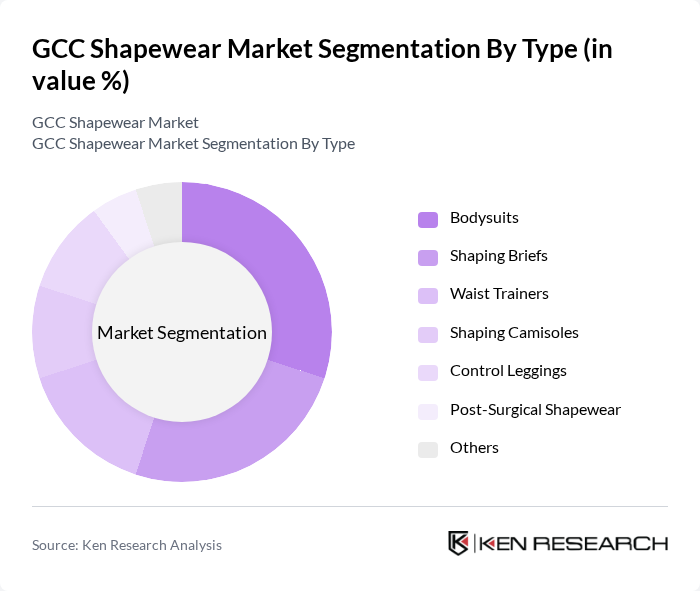

By Type:The shapewear market is segmented into various types, including bodysuits, shaping briefs, waist trainers, shaping camisoles, control leggings, post-surgical shapewear, and others. Among these, bodysuits and shaping briefs are particularly popular due to their versatility and comfort, making them the preferred choice for everyday wear. The demand for waist trainers has also seen a rise, especially among fitness enthusiasts looking for additional support during workouts.

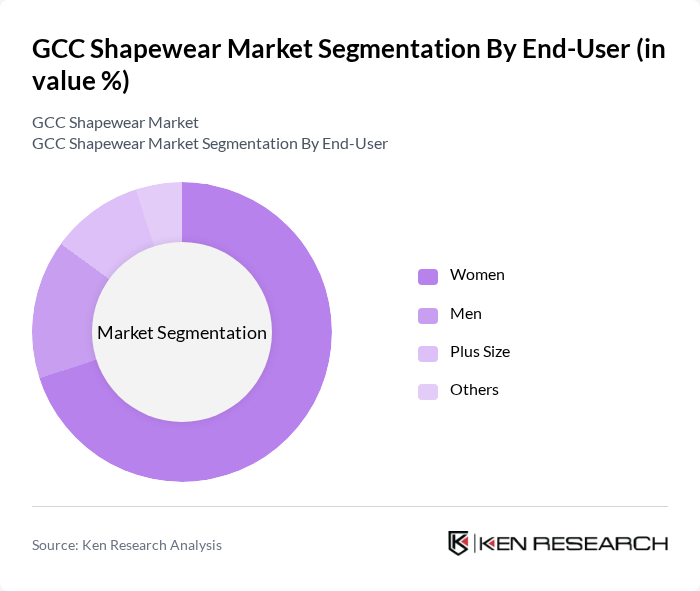

By End-User:The end-user segmentation includes women, men, plus size, and others. Women represent the largest segment, driven by the increasing popularity of shapewear as a fashion staple. The men's segment is also growing, albeit at a slower pace, as more brands introduce shapewear designed specifically for men. The plus-size segment is gaining traction as brands expand their offerings to cater to diverse body types, reflecting a shift towards inclusivity in the fashion industry.

The GCC Shapewear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Spanx, Maidenform, Yummie, Commando, Skims, Bali, Warner's, Ann Chery, Leonisa, Aerie, Livia Corsetti, Playtex, Jockey, Victoria's Secret, ThirdLove contribute to innovation, geographic expansion, and service delivery in this space.

The GCC shapewear market is poised for continued growth, driven by evolving consumer preferences towards body positivity and inclusivity. As brands increasingly adopt sustainable practices and innovative technologies in fabric production, the market is likely to see a rise in eco-friendly and technologically advanced shapewear. Additionally, the integration of personalized shopping experiences through AI and data analytics will enhance customer engagement, further propelling market expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Bodysuits Shaping Briefs Waist Trainers Shaping Camisoles Control Leggings Post-Surgical Shapewear Others |

| By End-User | Women Men Plus Size Others |

| By Distribution Channel | Online Retail Offline Retail Specialty Stores Others |

| By Material | Nylon Spandex Cotton Polyester Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Occasion | Everyday Wear Special Occasions Sports and Fitness Others |

| By Region | UAE Saudi Arabia Qatar Kuwait Oman Bahrain Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Insights on Shapewear | 140 | Female Consumers aged 18-45, Fashion Enthusiasts |

| Retailer Perspectives on Shapewear Sales | 90 | Store Managers, Buyers from Apparel Retail Chains |

| Manufacturers' Views on Market Trends | 70 | Product Development Managers, Marketing Executives |

| Online Shopping Behavior for Shapewear | 110 | eCommerce Shoppers, Digital Marketing Specialists |

| Influencer Impact on Shapewear Purchases | 50 | Social Media Influencers, Fashion Bloggers |

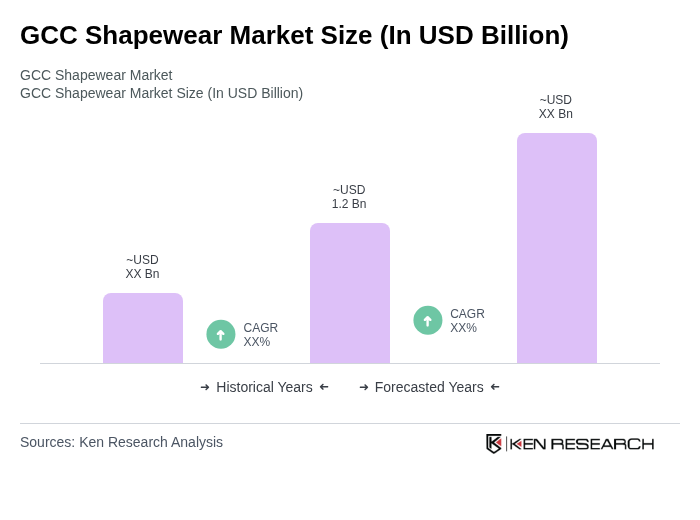

The GCC Shapewear Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing consumer awareness of body positivity and the popularity of athleisure wear.