Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8263

Pages:93

Published On:November 2025

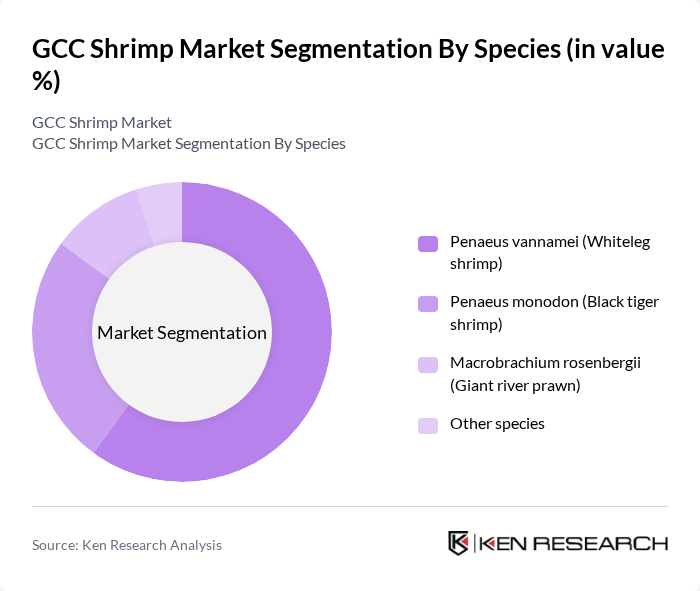

By Species:The shrimp market is segmented into four primary species: Penaeus vannamei (Whiteleg shrimp), Penaeus monodon (Black tiger shrimp), Macrobrachium rosenbergii (Giant river prawn), and other species. Among these, Penaeus vannamei is the most dominant due to its fast growth rate, adaptability to various farming conditions, and high consumer preference. This species is widely cultivated in the region, contributing significantly to the overall shrimp production and meeting the increasing demand from both local and export markets.

By Shrimp Size:The shrimp market is categorized by size into small, medium, and large shrimp. Medium-sized shrimp are currently leading the market due to their versatility in culinary applications and consumer preference for portion sizes that are easy to cook and serve. The demand for medium shrimp is particularly high in the food service industry, where they are commonly used in various dishes, enhancing their market presence.

The GCC Shrimp Market is characterized by a dynamic mix of regional and international players. Leading participants such as National Aquaculture Group (NAQUA), Saudi Fisheries Company, Asmak (International Fish Farming Holding Co.), Al Jaraf Fisheries, Al Qudra Holding, Emirates AquaTech, Al Watania Agriculture, Al Kabeer Group, Al Falah Fisheries, Al Mufeed Seafood, Al Zain Fisheries, Al Noor Fisheries, Al Ahlia Seafood, National Fish Company (Oman), Gulf Shrimp Company contribute to innovation, geographic expansion, and service delivery in this space.

The GCC shrimp market is poised for continued growth, driven by increasing consumer preferences for sustainable and healthy seafood options. As aquaculture practices evolve, technological advancements will likely enhance production efficiency and sustainability. Additionally, the rising trend of online sales channels is expected to reshape distribution strategies, making shrimp products more accessible. The focus on traceability and transparency in sourcing will further align with consumer demands for ethically produced seafood, fostering market resilience and expansion.

| Segment | Sub-Segments |

|---|---|

| By Species | Penaeus vannamei (Whiteleg shrimp) Penaeus monodon (Black tiger shrimp) Macrobrachium rosenbergii (Giant river prawn) Other species |

| By Shrimp Size | Small Medium Large |

| By Product Form | Fresh/Chilled Shrimp Frozen Shrimp Cooked Shrimp Canned/Processed Shrimp |

| By End-User | Retail Consumers Food Service Industry Export Markets |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Specialty Stores Direct Sales |

| By Country/Region | Saudi Arabia United Arab Emirates Oman Qatar Kuwait Bahrain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| GCC Shrimp Farm Operators | 75 | Aquaculture Managers, Farm Owners |

| Seafood Distributors and Wholesalers | 65 | Distribution Managers, Sales Executives |

| Retail Seafood Outlets | 55 | Store Managers, Seafood Buyers |

| Food Service Providers | 50 | Restaurant Owners, Executive Chefs |

| Regulatory Bodies and Industry Associations | 40 | Policy Makers, Industry Analysts |

The GCC Shrimp Market is valued at approximately USD 825 million, reflecting a robust growth driven by increasing consumer demand for seafood, health consciousness, and advancements in aquaculture technology that enhance production efficiency and sustainability.