Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8264

Pages:93

Published On:November 2025

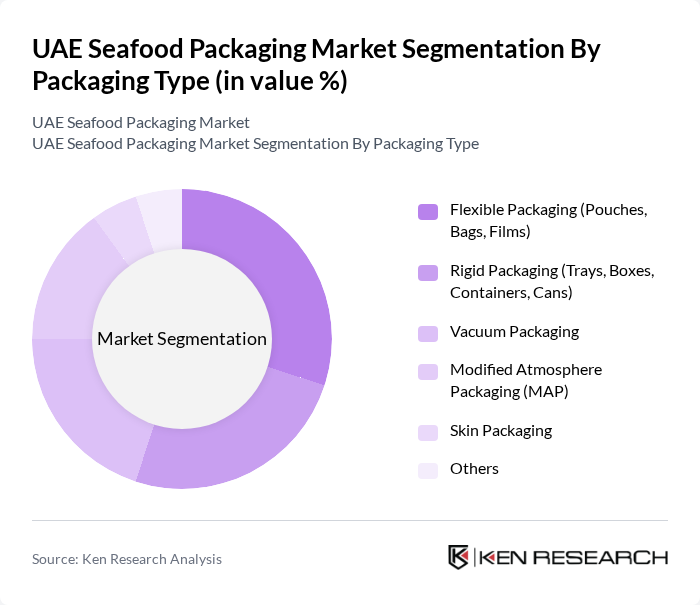

By Packaging Type:The packaging type segment includes various forms of packaging solutions tailored for seafood products. The subsegments are Flexible Packaging (Pouches, Bags, Films), Rigid Packaging (Trays, Boxes, Containers, Cans), Vacuum Packaging, Modified Atmosphere Packaging (MAP), Skin Packaging, and Others. Each of these subsegments plays a crucial role in preserving the freshness and quality of seafood, catering to different consumer preferences and market demands. Flexible packaging remains the most popular due to its lightweight, cost-effective, and versatile nature, while vacuum and MAP technologies are increasingly adopted for premium and export-oriented seafood products .

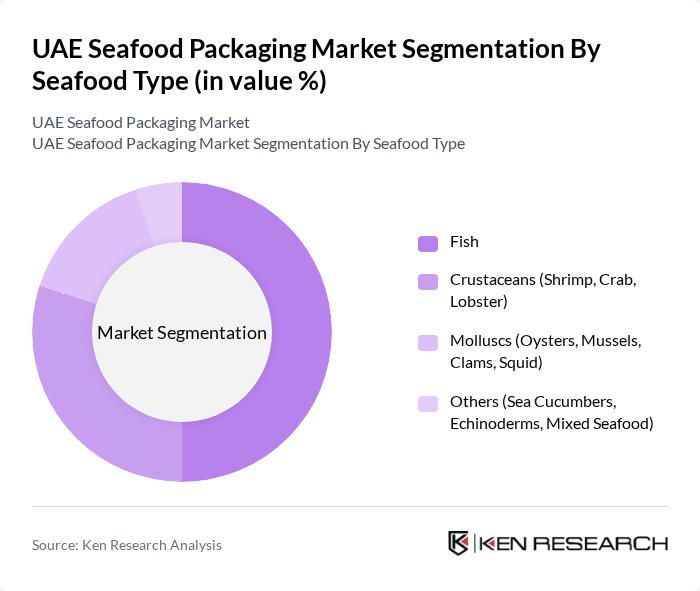

By Seafood Type:This segment categorizes seafood products into various types, including Fish, Crustaceans (Shrimp, Crab, Lobster), Molluscs (Oysters, Mussels, Clams, Squid), and Others (Sea Cucumbers, Echinoderms, Mixed Seafood). Each type has distinct packaging requirements based on its perishability and consumer preferences, influencing the choice of packaging materials and technologies. Fish remains the largest segment due to its high consumption and export volumes, while crustaceans and molluscs are seeing increased demand for specialized packaging to maintain freshness and quality .

The UAE Seafood Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Bayader International, Gulf Packaging Industries Limited (GPI), National Plastic & Building Material Industries, Emirates Packaging Industries LLC, Amber Packaging Industries LLC, ENPI Group, Swiss Pac UAE, DS Smith, TecPak Industries LLC, Shuaiba Industrial Co. (UAE), Al Jazeera International Catering LLC (Packaging Division), ULMA Packaging Middle East, Sealed Air (UAE), Amcor Flexibles UAE, PLASTOPIL (Middle East) contribute to innovation, geographic expansion, and service delivery in this space.

The UAE seafood packaging market is poised for significant transformation, driven by increasing consumer demand for sustainable and innovative packaging solutions. As the government continues to enforce regulations promoting eco-friendly practices, companies will need to adapt quickly. The rise of e-commerce in seafood distribution will further necessitate advancements in packaging technology, ensuring product freshness and safety during transit. Overall, the market is expected to evolve, focusing on sustainability and technological integration to meet consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Packaging Type | Flexible Packaging (Pouches, Bags, Films) Rigid Packaging (Trays, Boxes, Containers, Cans) Vacuum Packaging Modified Atmosphere Packaging (MAP) Skin Packaging Others |

| By Seafood Type | Fish Crustaceans (Shrimp, Crab, Lobster) Molluscs (Oysters, Mussels, Clams, Squid) Others (Sea Cucumbers, Echinoderms, Mixed Seafood) |

| By Material | Plastic Paper & Paperboard Metal Glass Others (Biodegradable, Compostable, Laminates) |

| By Application | Fresh Seafood Frozen Seafood Processed Seafood Dried Seafood Others |

| By End-User | Retail (Supermarkets, Hypermarkets, Specialty Stores) Food Service (Hotels, Restaurants, Catering) Wholesale/Export Others |

| By Packaging Technology | Modified Atmosphere Packaging (MAP) Vacuum Packaging Active Packaging Intelligent Packaging Traditional Packaging Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Seafood Retail Packaging | 100 | Retail Managers, Packaging Buyers |

| Food Service Packaging Solutions | 80 | Restaurant Owners, Catering Managers |

| Seafood Processing Operations | 70 | Operations Managers, Quality Control Supervisors |

| Packaging Material Suppliers | 50 | Sales Representatives, Product Development Managers |

| Regulatory Compliance in Packaging | 40 | Compliance Officers, Environmental Managers |

The UAE Seafood Packaging Market is valued at approximately USD 110 million, reflecting a significant growth trend driven by increasing seafood demand and consumer awareness regarding food safety and sustainability.