Region:Asia

Author(s):Shubham

Product Code:KRAC3682

Pages:91

Published On:January 2026

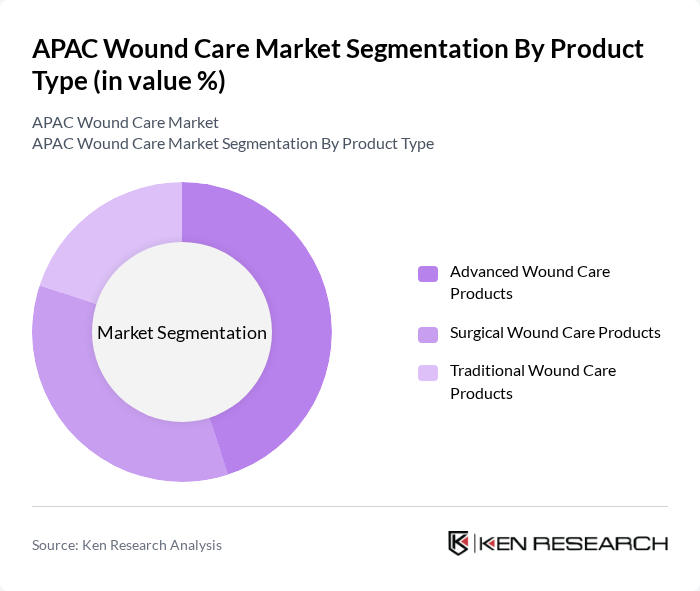

By Product Type:The product type segmentation includes Advanced Wound Care Products, Surgical Wound Care Products, and Traditional Wound Care Products. Advanced wound care products are gaining strong traction due to their proven effectiveness in managing complex and chronic wounds, supporting faster healing and reduced infection risk through technologies such as moist wound dressings, foam and alginate dressings, hydrocolloids, negative pressure wound therapy, and cellular and tissue-based products. Surgical wound care products are essential in post-operative care, driven by rising volumes of surgeries and trauma cases across APAC, while traditional wound care products (gauze, tapes, basic bandages) remain widely used due to their cost-effectiveness and broad availability in primary care and resource-constrained settings.

By Wound Type:The wound type segmentation includes Chronic Wounds and Acute Wounds. Chronic wounds, such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers, are becoming increasingly prevalent in APAC due to the rise in diabetes, vascular diseases, cancer, and aging-related frailty, which collectively extend healing times and increase the need for long-term, advanced wound care solutions. Acute wounds, including surgical wounds, traumatic injuries, and burns, while typically of shorter duration, require immediate and effective treatment with both surgical and advanced wound care products, and their growing incidence alongside higher surgical volumes in the region further supports demand across hospital and outpatient settings.

The APAC Wound Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Smith & Nephew plc, 3M Company, Johnson & Johnson (Ethicon), Coloplast A/S, Mölnlycke Health Care AB, ConvaTec Group plc, B. Braun Melsungen AG, Paul Hartmann AG, Medline Industries, LP, Integra LifeSciences Holdings Corporation, Smith+Nephew (Advanced Wound Management), BSN medical GmbH (An Essity Company), Acelity L.P. Inc. (KCI – a 3M Company), Derma Sciences, Inc. (a Integra LifeSciences Company), and other emerging APAC players contribute to innovation, geographic expansion, and service delivery in this space through portfolios spanning advanced dressings, negative pressure wound therapy, and related wound management solutions.

The APAC wound care market is poised for significant transformation, driven by technological advancements and demographic shifts. The integration of digital health technologies, such as telehealth and mobile health applications, is expected to enhance patient engagement and improve treatment adherence. Additionally, the focus on personalized wound care solutions will cater to the unique needs of patients, fostering better healing outcomes. As healthcare systems adapt to these trends, the market will likely see increased investment and innovation, paving the way for sustainable growth.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Advanced Wound Care Products Surgical Wound Care Products Traditional Wound Care Products |

| By Wound Type | Chronic Wounds Acute Wounds |

| By Application | Diabetic Foot Ulcers Pressure Ulcers Venous Leg Ulcers Surgical & Traumatic Wounds Burns Other Wounds |

| By End-User | Hospitals & Clinics Home Care Settings Long-term Care Facilities Other End Users |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies & Drug Stores E-commerce / Online Platforms Direct Tenders Others |

| By Product Category (Advanced Dressings) | Foam Dressings Hydrocolloid Dressings Film Dressings Alginate Dressings Hydrogel Dressings Collagen Dressings Antimicrobial Dressings Other Advanced Dressings |

| By Region | China Japan India Australia & New Zealand South Korea Southeast Asia Rest of APAC |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Wound Care Departments | 120 | Wound Care Specialists, Nurses, Hospital Administrators |

| Home Healthcare Providers | 90 | Home Health Aides, Care Coordinators, Patient Care Managers |

| Medical Supply Distributors | 60 | Sales Representatives, Distribution Managers, Product Managers |

| Patient Experience Surveys | 100 | Chronic Wound Patients, Caregivers, Rehabilitation Specialists |

| Clinical Research Institutions | 50 | Clinical Researchers, Medical Directors, Trial Coordinators |

The APAC Wound Care Market is valued at approximately USD 5.1 billion, driven by the increasing prevalence of chronic wounds, a growing geriatric population, and advancements in wound care technologies.