Region:Middle East

Author(s):Shubham

Product Code:KRAE0401

Pages:95

Published On:December 2025

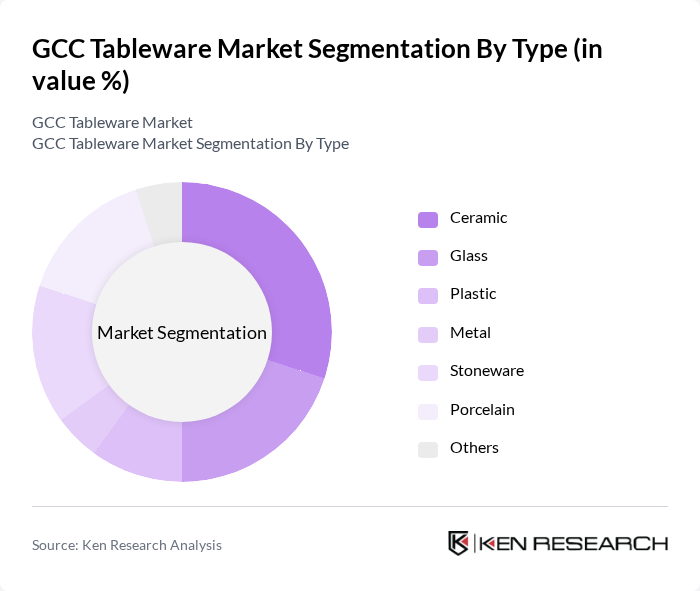

By Type:The tableware market is segmented into various types, including ceramic, glass, plastic, metal, stoneware, porcelain, and others. Among these, ceramic and porcelain are the most popular due to their durability and aesthetic appeal. The demand for eco-friendly materials is also rising, reflecting consumer preferences for sustainable options. The market is characterized by a diverse range of products catering to different consumer needs and preferences.

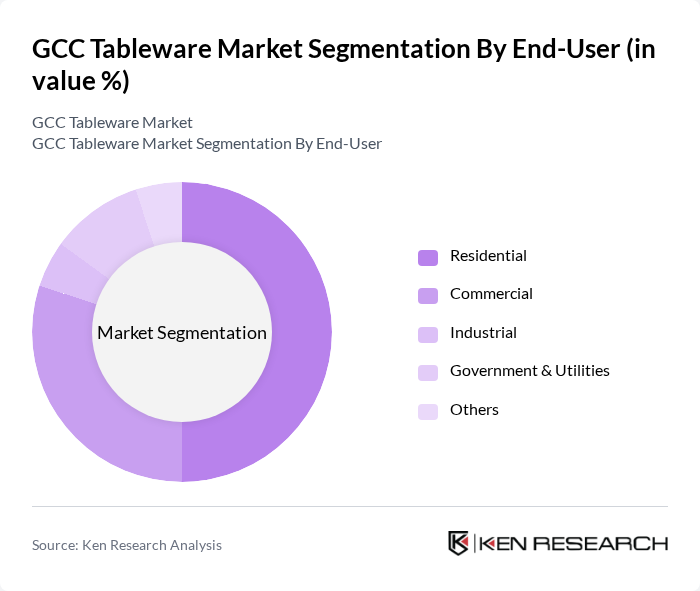

By End-User:The end-user segmentation includes residential, commercial, industrial, government & utilities, and others. The residential segment is the largest, driven by increasing household consumption and the trend of home dining. The commercial segment, particularly in the hospitality industry, is also significant, as restaurants and hotels seek high-quality tableware to enhance customer experience.

The GCC Tableware Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Alessi, Corelle Brands LLC, Royal Doulton, Lenox Corporation, Villeroy & Boch, Noritake, Mikasa, Tupperware Brands Corporation, Bormioli Rocco, Libbey Inc., Tablecraft, Anchor Hocking, Fiesta Tableware Company, Cuisinart contribute to innovation, geographic expansion, and service delivery in this space.

The GCC tableware market is poised for dynamic growth, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, manufacturers are increasingly adopting eco-friendly materials, which is expected to reshape product offerings. Additionally, the integration of smart technology in tableware design is anticipated to enhance user experience. The rise of online shopping platforms will further facilitate market access, allowing brands to reach a broader audience and adapt to changing consumer behaviors effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Ceramic Glass Plastic Metal Stoneware Porcelain Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Material | Eco-friendly materials Traditional materials Composite materials Others |

| By Design | Modern Traditional Customized Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Others |

| By Price Range | Budget Mid-range Premium Others |

| By Occasion | Everyday use Special occasions Events and gatherings Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Tableware Sales | 150 | Store Managers, Category Buyers |

| Manufacturing Insights | 100 | Production Managers, Quality Control Supervisors |

| Consumer Preferences | 200 | Household Decision Makers, Young Professionals |

| Distribution Channels | 80 | Logistics Coordinators, Supply Chain Analysts |

| Market Trends Analysis | 120 | Market Analysts, Retail Strategists |

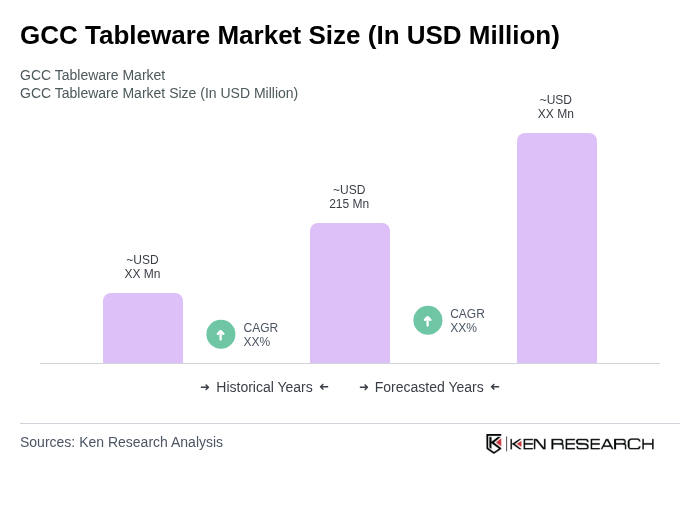

The GCC Tableware Market is valued at approximately USD 215 million, reflecting a five-year historical analysis. This growth is driven by increased consumption in key markets, particularly in Saudi Arabia, and rising demand from urban households and the hospitality sector.