Region:Middle East

Author(s):Dev

Product Code:KRAC3591

Pages:81

Published On:January 2026

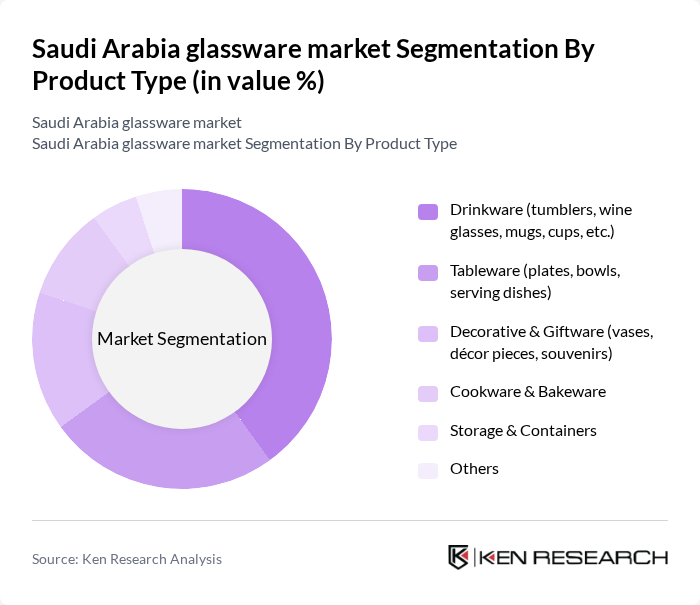

By Product Type:The glassware market can be segmented into various product types, including drinkware, tableware, decorative & giftware, cookware & bakeware, storage & containers, and others. This structure is consistent with the way international and regional reports classify household and foodservice glass products, often grouping tumblers, mugs, cups, and stemware under drinkware and plates, bowls, and serving dishes under tableware. Among these, drinkware is the most dominant segment, driven by consumer preferences for stylish and functional glass products for everyday use and special occasions, supported by rising café culture and premium hotels and restaurants. The increasing trend of home entertaining, modern wedding and gifting practices, and the penetration of organized retail further boosts the demand for high-quality drinkware and coordinated tableware sets in the Saudi market.

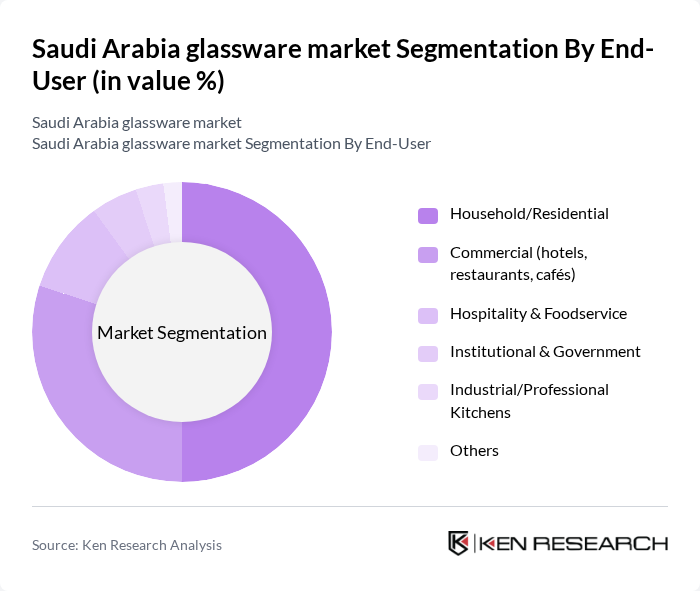

By End-User:The end-user segmentation includes household/residential, commercial (hotels, restaurants, cafés), hospitality & foodservice, institutional & government, industrial/professional kitchens, and others. This segmentation is aligned with the way drinkware and tableware demand is tracked in Saudi Arabia, where household and foodservice channels represent the primary consumption bases. The household/residential segment is the largest, driven by increasing consumer spending on home décor, dining experiences, and replacement purchases of branded glassware through supermarkets, hypermarkets, and e-commerce platforms. The rise in the number of restaurants and cafés, along with expansion of hotel and quick-service restaurant chains, also contributes significantly to the commercial and broader hospitality segment's growth, as operators standardize glassware for branding and service-quality purposes.

The Saudi Arabia glassware market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Jazeera Factory for Glass Products, Saudi Glass Industries, Al-Qassim Factory for Glass, Al-Muhaidib Glass, Saudi International Glass Company, Al-Watania Glass, Zamil Glass Industries, Crystal Arc Factory, ARC International (Saudi Arabia), Libbey (Saudi Distributor), Bormioli Rocco (Saudi Distributor), Middle East Glass Manufacturing Company, Al-Suwaidi Industrial Services, Al-Rajhi Group (glass & tableware distribution), and other emerging local glassware manufacturers contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia glassware market is poised for significant growth, driven by increasing consumer demand for luxury and eco-friendly products. As the hospitality sector expands, the need for high-quality glassware will rise, particularly in urban areas. Additionally, the shift towards online shopping is expected to reshape distribution channels, making glassware more accessible. Local manufacturers are likely to focus on innovation and sustainability to meet evolving consumer preferences, positioning themselves favorably in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Drinkware (tumblers, wine glasses, mugs, cups, etc.) Tableware (plates, bowls, serving dishes) Decorative & Giftware (vases, décor pieces, souvenirs) Cookware & Bakeware Storage & Containers Others |

| By End-User | Household/Residential Commercial (hotels, restaurants, cafés) Hospitality & Foodservice Institutional & Government Industrial/Professional Kitchens Others |

| By Distribution Channel | Online Retail/e-Commerce Supermarkets/Hypermarkets Specialty Stores & Homeware Stores Wholesale/B2B Direct Sales Others |

| By Material | Soda-lime Glass Borosilicate/Heat-resistant Glass Crystal & Lead Glass Tempered/Safety Glass Others |

| By Design & Styling | Classic/Traditional Contemporary/Modern Artistic/Decorative Custom/Personalized Designs Others |

| By Price Range | Budget/Value Mid-Range Premium Luxury Others |

| By Occasion & Usage | Everyday Use Special Events & Banqueting Gifting & Corporate Gifting Promotional/Branding Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Glassware Sales | 120 | Store Managers, Retail Buyers |

| Manufacturing Insights | 90 | Production Managers, Quality Control Supervisors |

| Consumer Preferences | 140 | Household Decision Makers, Interior Designers |

| Export Market Dynamics | 80 | Export Managers, Trade Compliance Officers |

| Market Trends Analysis | 100 | Market Analysts, Industry Experts |

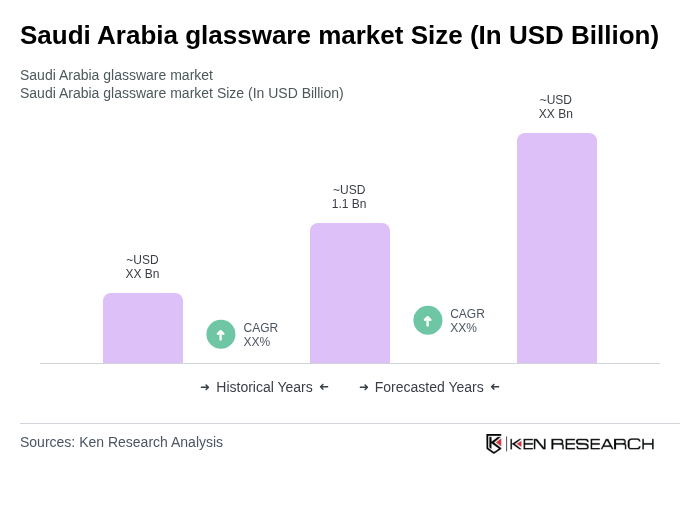

The Saudi Arabia glassware market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by increasing consumer demand for high-quality glass products and the expansion of the hospitality and foodservice sectors.